Press release -

Find ‘inner peace’ – do your tax return now

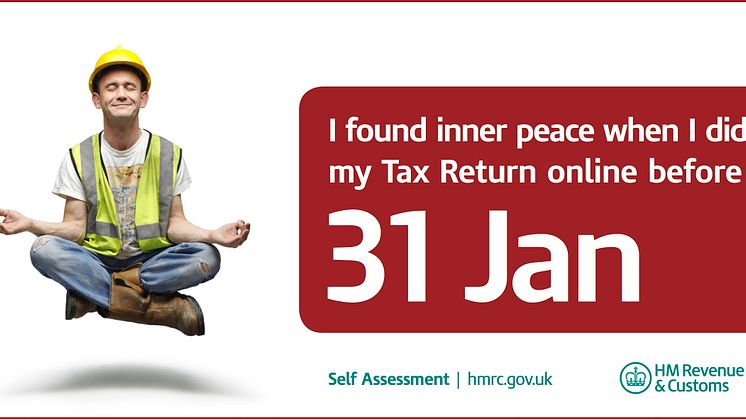

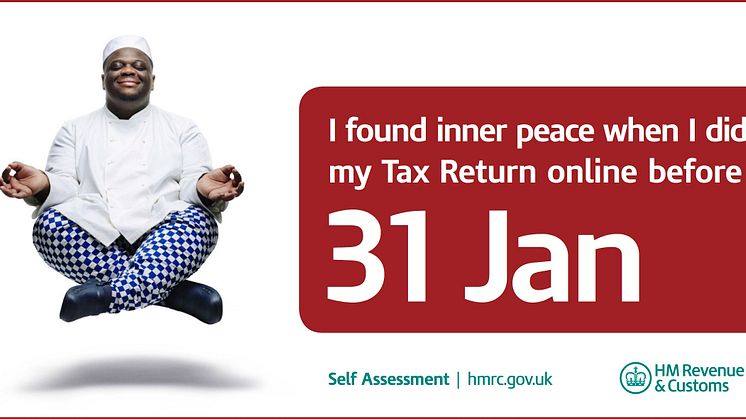

A new HM Revenue & Customs (HMRC) advertising campaign is urging anyone who hasn’t sent in their 2011-12 tax return to do it now – and find “inner peace”.

The new ads, launching later this month, highlight the imminent 31 January deadline for online returns, and the £100 penalty for missing the deadline. They encourage people who still haven’t sent their return to “do it today, pay what you owe and take a load off your mind”, so they can experience “inner peace”.

The campaign has been developed to touch on the emotions that HMRC found people typically experience after they have filled in their tax return, often described as a real sense of relief or peace of mind – like a weight being lifted from their shoulders. The new ads feature people from different professions experiencing this feeling of post-return well-being.

As well as traditional posters, radio and newspaper ads, the campaign will use cutting-edge interactive digital advertising, which will give internet surfers the chance to see people experiencing inner peace floating around their computer screens.

The ads form part of HMRC’s efforts to encourage all 10.6 million people who have to submit a Self Assessment return for the 2011-12 tax year to file online, and pay the tax they owe, by the 31 January deadline.

For help and advice on completing a return, visit www.hmrc.gov.uk/sa or call the Self Assessment helpline on 0845 9000 444.

Notes for editors

1. Images of the press and outdoor ads are available from HMRC’s Flikr channel at www.flickr.com/hmrcgovuk

2. The penalties for late Self Assessment returns are:

· an initial £100 fixed penalty, which applies even if there is no tax to pay, or if the tax due is paid on time;

· after three months, additional daily penalties of £10 per day, up to a maximum of £900;

· after six months, a further penalty of 5 per cent of the tax due or £300, whichever is greater; and

· after 12 months, another 5 per cent or £300 charge, whichever is greater.

There are also additional penalties for paying late of 5 per cent of the tax unpaid at: 30 days; six months; and 12 months.

3. Follow HMRC on Twitter @HMRCgovuk

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.