Press release -

HMRC warns customers about Self Assessment tricksters

As HM Revenue and Customs (HMRC) prepares to issue emails and SMS to Self Assessment customers, the department is reminding them to be on their guard after nearly 800,000 tax-related scams were reported in the last year.

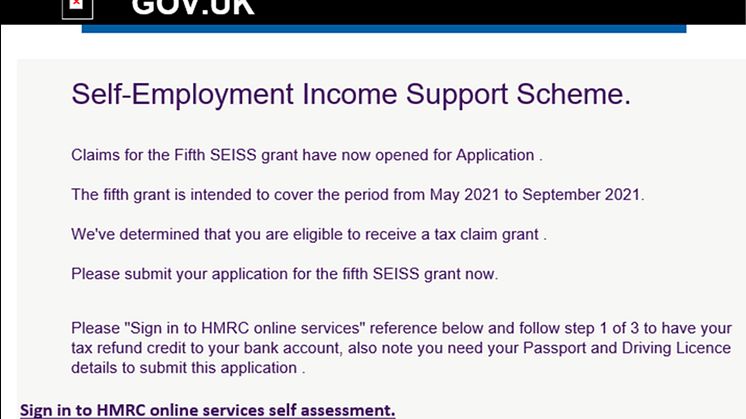

Fraudsters use Self Assessment to try and steal money or personal information from unsuspecting individuals. In the last year alone, HMRC has received nearly 360,000 bogus tax rebate referrals.

The Self Assessment deadline is 31 January 2022 and customers may expect to hear from HMRC at this time of year. More than 4 million emails and SMS will be issued this week to Self Assessment customers pointing them to guidance and support, prompting them to think about how they intend to pay their tax bill, and to seek support if they are unable to pay in full by 31 January.

However, the department is also warning customers to not be taken in by malicious emails, phone calls or texts, thinking that these are genuine HMRC communications referring to their Self Assessment tax return.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said:

“Never let yourself be rushed. If someone contacts you saying they’re from HMRC, wanting you to urgently transfer money or give personal information, be on your guard.

“HMRC will also never ring up threatening arrest. Only criminals do that.

“Scams come in many forms. Some threaten immediate arrest for tax evasion, others offer a tax rebate. Contacts like these should set alarm bells ringing, so if you are in any doubt whether the email, phone call or text is genuine, you can check the ‘HMRC scams’ advice on GOV.UK and find out how to report them to us.”

Criminals use emails, phone calls and text messages to try and dupe individuals, and often mimic government messages to make them appear authentic. They want to trick their victims into handing over money or personal or financial information.

Customers can report suspicious phone calls using a form on GOV.UK; customers can also forward suspicious emails claiming to be from HMRC to phishing@hmrc.gov.uk and texts to 60599.

HMRC has a dedicated team working on cyber and phone crimes. They use innovative technologies to prevent misleading and malicious communications from ever reaching the customer. Since 2017 these technical controls have prevented 500 million emails from reaching HMRC’s customers. More recently, new controls have prevented 90% of the most convincing SMS messages from reaching the public and controls have been applied to prevent spoofing of most HMRC helpline numbers.

HMRC is also reminding Self Assessment customers to double check websites and online forms before using them to complete their 2020/21 tax return. People can be taken in by misleading websites designed to make them pay for help in submitting tax returns or charging to connect them to HMRC phone lines. Customers who are in any doubt about whether a website is genuine should visit GOV.UK for more information about Self Assessment and use the free signposted tax return forms.

Notes to Editors

1. The Self Assessment deadline for 2020/21 tax returns is 31 January 2022.

2. Find out more about how to declare taxable COVID-19 support in your tax return if you are self-employed, in a partnership or run a business.

3. HMRC’s advice to the public:

Stop:

- Take a moment to think before parting with your money or information.

- If a phone call, text or email is unexpected, don’t give out private information or reply, and don’t download attachments or click on links before checking on GOV.UK that the contact is genuine.

- Do not trust caller ID on phones. Numbers can be spoofed.

Challenge:

- It’s ok to reject, refuse or ignore any requests - only criminals will try to rush or panic you.

- Search ‘scams’ on GOV.UK for information on how to recognise genuine HMRC contact and how to avoid and report scams.

Protect:

- Forward suspicious texts claiming to be from HMRC to 60599 and emails to phishing@hmrc.gov.uk. Report tax scam phone calls on GOV.UK.

- Contact your bank immediately if you think you’ve fallen victim to a scam, and report it to Action Fraud (in Scotland, contact the police on 101).

4. In the last 12 months HMRC has:

- responded to 797,010 referrals of suspicious contact from the public. Some 357,567 of these offered bogus tax rebates

- worked with the telecoms industry and Ofcom to remove more than 1,282 phone numbers being used to commit HMRC-related phone scams

- received 327,044 reports of phone scams in total, 21% up on the previous year

- reported 8,561 malicious web pages for takedown.

5. Follow HMRC’s Press Office on Twitter @HMRCpressoffice

Related links

Topics

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.