Press release -

Online RTI week

Employers are being offered interactive support on Real Time Information (RTI) in a week-long Twitter Q&A from HM Revenue and Customs (HMRC).

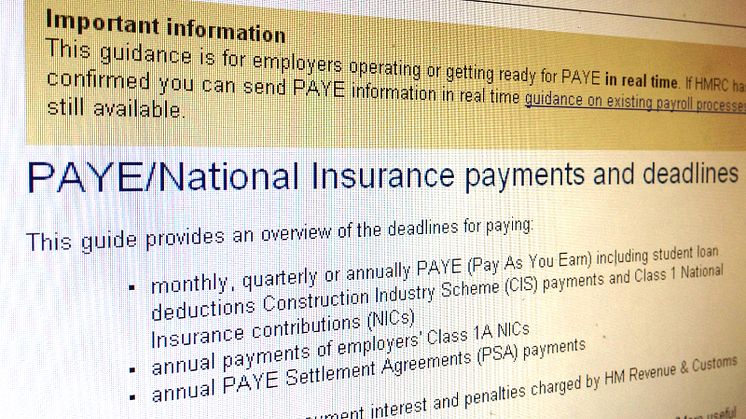

From April, employers will be required to move to a new way of reporting in real time, sometimes called Real Time Information (RTI). Employers will report each time they pay their employees, rather than annually.

HMRC experts will be on hand to offer help and support between 11 March and15 March. To take part or ask a question, follow @HMRCgovuk on Twitter and use hashtag #RTIqa.

Ruth Owen, HMRC’s Director General Personal Tax, said:

“Employers need to act now to get ready for RTI. If you need some help and advice, visit our website. This interactive week will offer support and help to any employer looking for help.”

For further information about RTI go to hmrc.gov.uk/rti

Notes for editor

1. Follow HMRC on Twitter @HMRCgovuk

2. HMRC’s flickr channel www.flickr.com/hmrcgovuk

Related links

Topics

Categories

Issued by HM Revenue & Customs Press Office

HM Revenue & Customs (HMRC) is the UK’s tax authority.

HMRC is responsible for making sure that the money is available to fund the UK’s public services and for helping families and individuals with targeted financial support.