One week left to settle past tax bills

Taxpayers who have failed to submit tax returns for past years have one week left to come forward and take advantage of an HM Revenue and Customs (HMRC) campaign.

Taxpayers who have failed to submit tax returns for past years have one week left to come forward and take advantage of an HM Revenue and Customs (HMRC) campaign.

People who have sold properties that are not their main homes without paying the tax due have one week left to pay HM Revenue and Customs (HMRC).

Taxpayers who have failed to submit tax returns are being offered the chance to come forward and pay up under a new HM Revenue and Customs (HMRC) campaign.

People selling directly to customers and who haven’t paid all the tax they owe have one month to come forward and pay up under an HM Revenue and Customs (HMRC) campaign.

As many as 50,000 businesses that have failed to submit VAT returns will be targeted by HM Revenue and Customs (HMRC) this month with warnings that their tax affairs will be closely scrutinised.

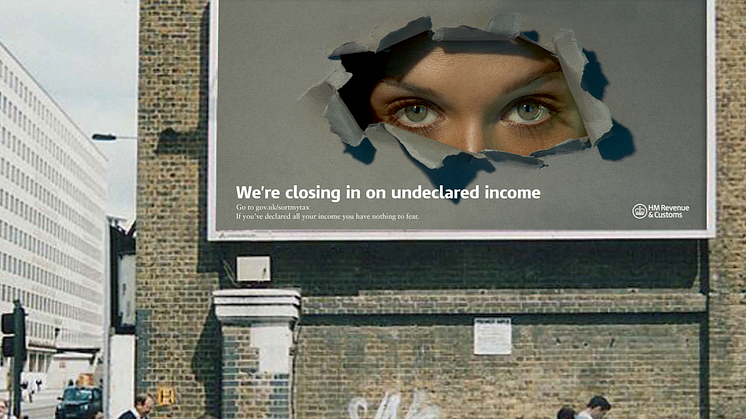

An advertising campaign warning tax cheats to declare all their income before it is too late was launched today by HM Revenue & Customs (HMRC).