More than 11 million cigarettes seized

Four men have been arrested after the seizure of more than 11 million cigarettes in South Armagh.

Four men have been arrested after the seizure of more than 11 million cigarettes in South Armagh.

This Talk Money Week (4 – 8 November), taxpayers are being urged to “Do One Thing” and get on the HMRC app to save time and simplify managing their money and tax. More than 1.7m people are already using the HMRC app every month, which enables users to access services such as making a Child Benefit claim, finding your National Insurance number and a tax calculator to estimate your take-home pay.

Here are some top tips for tax agents ahead of the Self Assessment (SA) deadline on 31 January 2025.

People have 100 days until 31 January deadline to file their Self Assessment tax return and pay tax owed

Self Assessment customers urged to prepare and file their tax return early

The countdown clock has begun as HM Revenue and Customs (HMRC) reminds customers they have 100 days to file and pay their Self Assessment tax return before the 31 January deadline.

Anyone who is yet to start

HM Revenue and Customs (HMRC) reveals the top 5 reasons why people are calling the Self Assessment helpline and reminds them that they can self-serve to quickly access the information online.

More than 10,000 payments worth £12.5 million have been made through the new digital service to boost people’s State Pension since it launched in April 2024, HM Revenue and Customs (HMRC) has revealed.

With around 2,000 babies born on 26 September each year, more than any other day, HM Revenue and Customs (HMRC) is urging parents to claim their Child Benefit entitlement.

Claiming online means families could receive their first payment within just a week of their baby’s birth.

Child Benefit is worth up to £1,331 a year for the first child and £881 for each additional child.

Claims ca

More than 670,000 18-22 year olds yet to claim their Child Trust Fund are reminded to cash in their stash as HM Revenue and Customs (HMRC) reveals the average savings pot is worth £2,212.

A new report published today shows HM Revenue and Customs (HMRC) has slashed the tax gap on illicit cigarettes and tobacco by more than half since 2005. Between April 2023 and March 2024 HMRC also secured prison sentences totalling 148 years against 107 cigarette and tobacco fraudsters.

During Pensions Awareness week, HM Revenue and Customs (HMRC) is urging tens of thousands of people to check if they are eligible to boost their State Pension.

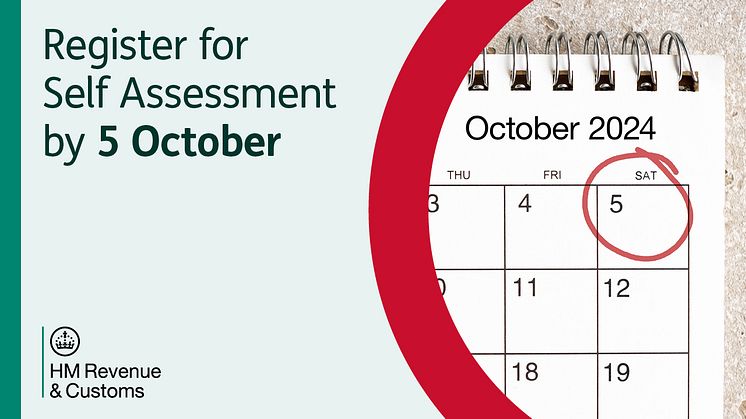

Anyone who needs to complete a Self Assessment tax return for the first time to cover the 2023 to 2024 tax year, should tell HM Revenue and Customs (HMRC) by 5 October 2024. There’s plenty of myths about who needs to file a Self Assessment return before the 31 January 2025 deadline and HMRC today debunks some of the most common ones. Myth 1: “HMRC hasn’t been in touch, so I don’t need to file"

Parents have less than two weeks to tell HM Revenue and Customs (HMRC) their 16-19 year-old is continuing education or training, or their Child Benefit payments will stop. Hundreds of thousands of teenagers will decide on their future this week as they receive their GCSE results on Thursday (22 August 2024).

No.1 The Goodsyard, part of a new development on Station Street, Portsmouth, is set to become the new location for HM Revenue and Customs (HMRC).

The state-of-the-art Portsmouth office will be a government hub and HMRC’s 14th regional centre. It will accommodate approximately 1,250 HMRC and Marine Management Organisation (MMO) employees in the city, an increase of more than 350 full time roles

Two brothers, Stephen and Michael Hirst, have been sentenced for a 3.2 million offshore tax scam. The brothers used offshore companies to hide money from the sale of land in Wakefield, to evade tax. They were given the chance to pay what was owed through a Contractual Disclosure Facility but failed to do so.

HM Revenue and Customs (HMRC) has launched a digital tool to help businesses estimate what registering for VAT may mean for them.

The VAT Registration Estimator has been developed after feedback from small businesses suggested an online tool would be helpful to show when their turnover could require businesses to register for VAT and its effect on profits.

A business must register for VAT i

More than a million parents will receive reminders from this week to extend Child Benefit for their teenagers if they are continuing their education or training after their GCSEs or Scottish Nationals.

The directors of a Leicester clothing company that supplied well known high street and online retailers have been jailed for a £1.3 million tax fraud.

A gang that set up 90 bogus companies in a bid to steal more than £800,000 in a VAT and car finance fraud have been sentenced to more than 10 years.

Almost 300,000 Self Assessment customers filed their tax return in the first week of the new tax year, almost 10 months ahead of the deadline, HM Revenue and Customs (HMRC) has revealed.

Customers can file their Self Assessment returns for the 2023 to 2024 tax year between 6 April 2024 and 31 January 2025.

Almost 70,000 people filed their return on the opening day this year (6 April) and HM

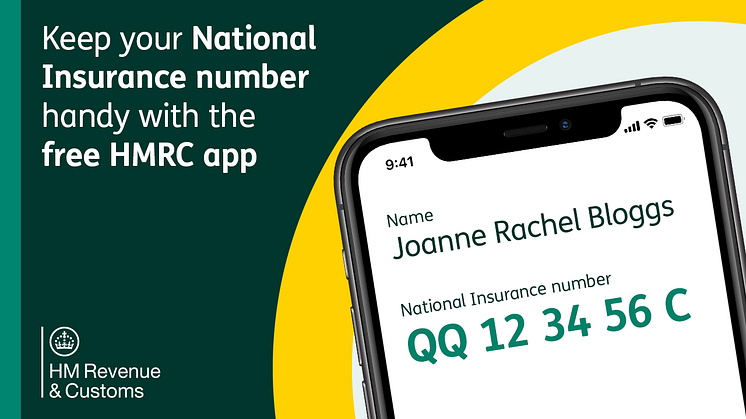

With many A level students planning their next steps in life, those starting university in September can ‘tap the app’ to get National Insurance and tax information they need to complete their student finance applications, HM Revenue and Customs (HMRC) has said.

Anyone applying for a student loan for the 2024/25 academic year is encouraged to start their application now and to get the essential

100 Parliament St

SW1A 2BQ London