News -

6.44 million cash deposits at Post Office branches in June, up over 10% on last year’s figures

New figures released today (16 July) show that the number of cash transactions at Post Office branches is up again against 2024 numbers.

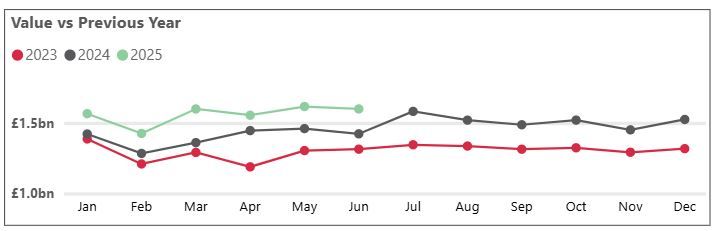

6.44 million cash deposits were made in June 2025, by both businesses and personal customers. This figure was strongly up (10.5%) year-on-year (5.83 million, June 2024) but down 0.4% month-on-month (6.47 million, May 2025).

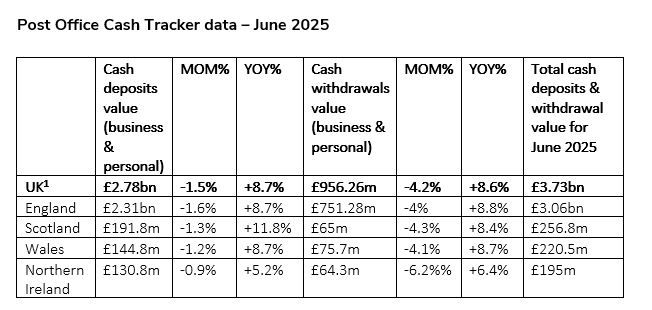

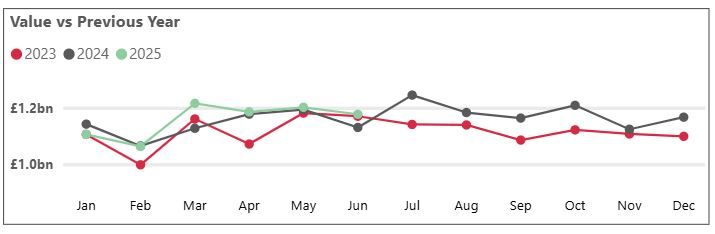

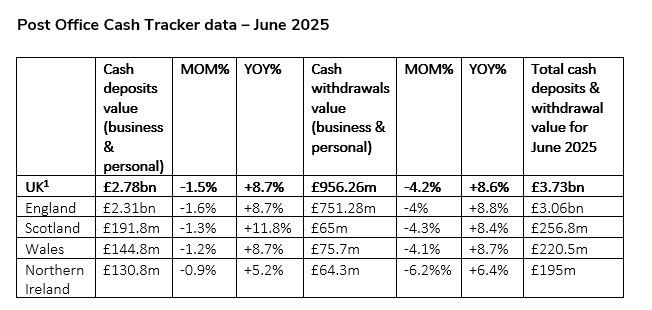

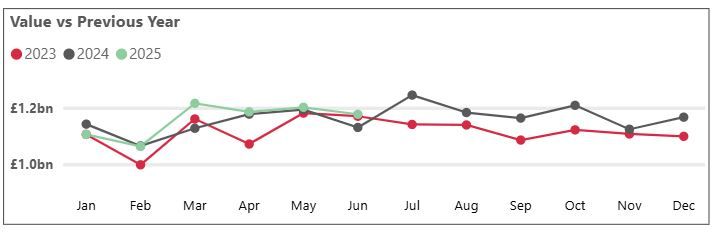

This trend was mirrored in the total value of cash deposits too, which were up 8.7% year-on-year to £2.78 billion in June 2025 (£2.55 billion, June 2024) but down slightly (1.5%) month-on-month (£2.82 billion, May 2025).

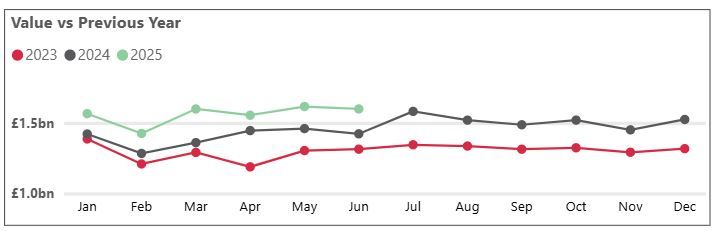

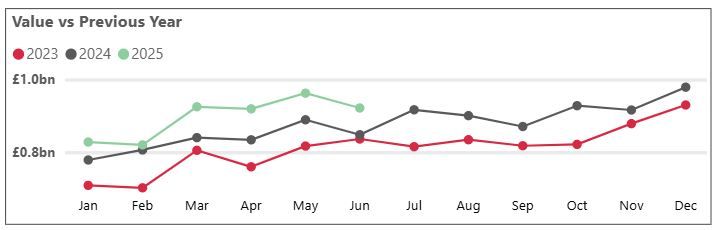

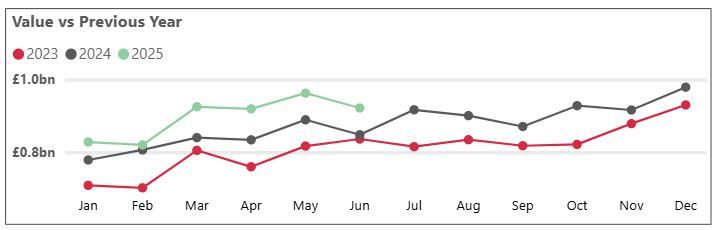

6.97 million personal cash withdrawals were made at Post Office branches in June, which was down 4.4% month-on-month (7.3 million, May 2025) but up 0.3% year-on-year (6.95 million, June 2024). These withdrawals by personal customers totalled £921.63 million, down 4.2% month-on-month (£962.46 million, May 2025) but significantly up by 8.7% year-on-year (£848.01 million, June 2024) as customers withdrew on average £10.20 more cash this month compared to June last year.

Overall, personal and business cash deposits and withdrawals at Post Office totalled £3.73 billion in June.

Ross Borkett, Banking Director at Post Office, said: “We continue to see a significant year-on-year increase in the number of cash deposits and withdrawals at our Post Office branches. We know that the cash banking services our postmasters provide to customers and businesses are incredibly valued by the community, and these numbers show that customers are increasingly choosing their local Post Office branch as a convenient and safe location to deposit and withdraw their money.”

Business cash deposits

Personal cash deposits

Personal cash withdrawals

Banking Hubs

As of 9 June 2025, 176 hubs have been opened in partnership between Cash Access UK and the Post Office. 226 Banking Hubs have now been announced by LINK with further openings planned for later this year.

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

About Post Office Cash Tracker and access to cash

Data included in this press release reflects cash services used under the Banking Framework. Over 30 banks and building societies are part of the Banking Framework which enables their customers to withdraw or deposit cash at any of the Post Office’s 11,500 branches. On 30 April 2025, Post Office announced that the Banking Framework agreement had been extended until the end of 2030.

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.