News -

Post Offices see highest ever amount of cash deposited and withdrawn in one month

- Post Office branches saw cash deposits and withdrawals total £3.48 billion in April, the highest amount on record

- Recent partnership with Monzo contributed positively to total cash deposits & withdrawal value for April 2024

- In total, Post Offices handled £2.62bn in personal and business cash deposits in April compared with £2.26bn last April

- Personal cash withdrawals from Post Office’s 11,500 branches totalled £864.9m in April, up over +20.4% YOY

New figures today reveal a significant increase in cash transactions at Post Office branches in April, with cash deposits and withdrawals across the counter totalling £3.48 billion across 11,500 branches, their highest levels ever.

In the UK, total cash deposits (business and personal) stood at £2.62 billion in April, marking an increase of 4.7% month-on-month and a significant 26.5% increase year-on-year.

Total withdrawals amounted to £864.9 million, despite a slight month-on-month decrease of 0.77%. However, year-on-year, withdrawals saw an increase of 20.4%.

Cash deposits in England totalled £2.18 billion, up 5.1% month-on-month and 16.6% year-on-year. Withdrawals were £679.2 million, showing a modest month-on-month decrease of 0.35% but an 11.17% increase year-on-year.

Welsh branches experienced a substantial increase in deposits at £135.9 million, up 8.68% month-on-month and 18.6% year-on-year. Withdrawals totalled £68.3 million.

The Post Office has recently partnered with Monzo to expand its Everyday Banking services, offering cash deposit facilities for Monzo customers at all branches nationwide. This has contributed positively to the total value of cash deposits & withdrawal value for April 2024

Jeet Jadeja, Postmaster for Staple Hill in Bristol and Quedgeley in Gloucestershire, said: “Having Monzo on board for cash deposits is fantastic and will make a huge difference for banking customers. Monzo has over 9 million retail customers as well as 400,000 business customers so this will widen Post Office’s appeal in both of my branches and across the network.”

Ross Borkett, Banking Director at Post Office said:"Post Office is delighted to welcome Monzo as another partner in our Banking Framework, helping us ensure more UK banking customers than ever before can access essential cash services in any Post Office branch.

“It is positive to see the continued growth in customers using their local Post Office, and accessing essential cash services through our extensive partnership with banks. The fact that we are seeing the highest ever levels of cash withdrawals and deposits demonstrates the growing importance of our services in providing access to cash for customers and businesses across the UK.”

Post Office Cash tracker data – April 2024

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for April 2024 | |

UK[1] | £2.62bn | +4.7% | +26.5% | £864.9m | -0.77% | +20.4% | £3.48bn |

England | £2.18bn | +5.1% | +16.6% | £679.2m | -0.35% | +11.17% | £2.85bn |

Scotland | 174.5m | +5.31% | +11.35% | £59.1m | -3.59% | 5.57% | 233.6m |

Wales | 135.9m | +8.68% | +18.60% | £68.3m | -0.58% | 9.88% | 204.2m |

Northern Ireland | 127.6m | +3.99% | +7.69% | £58.2m | -3% | 1.57% | 204.2m |

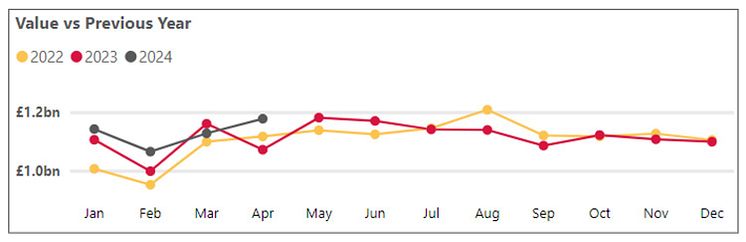

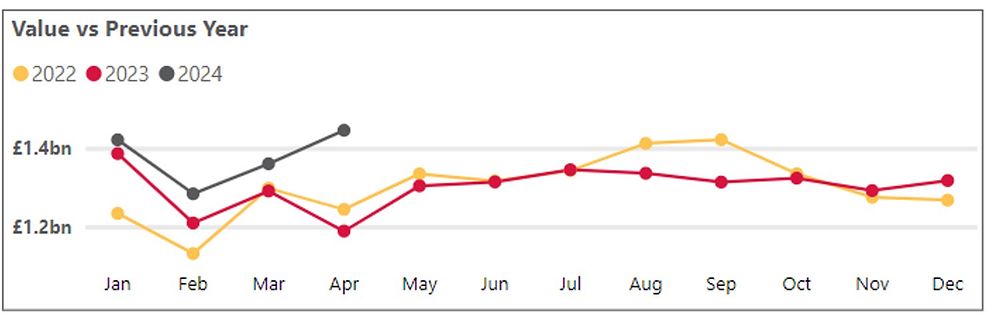

Business cash deposits

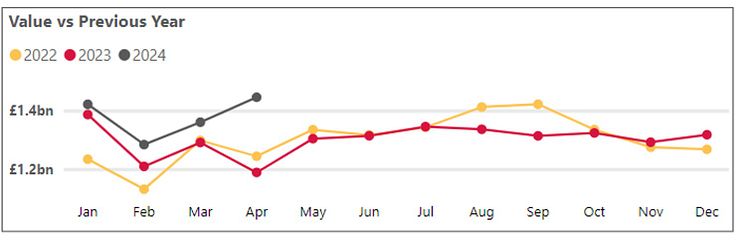

Personal cash deposits

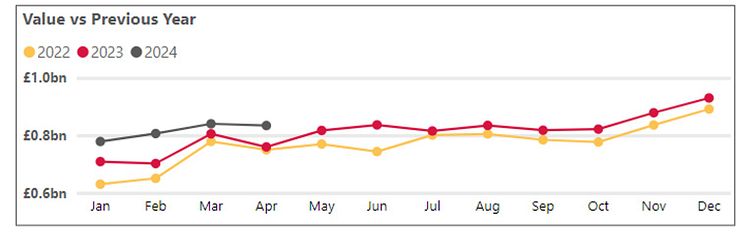

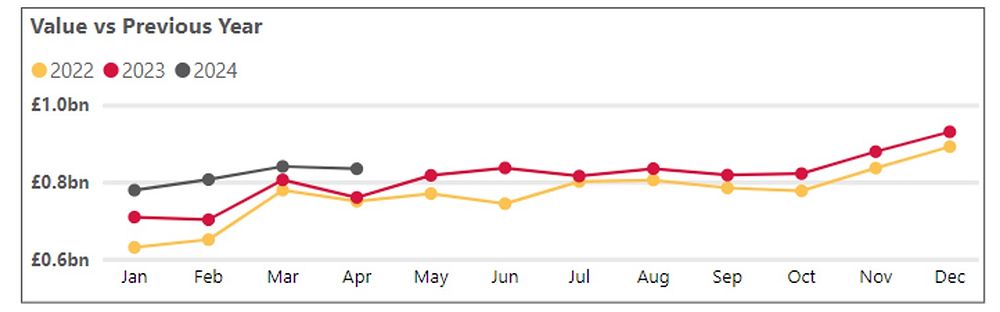

Personal cash withdrawals

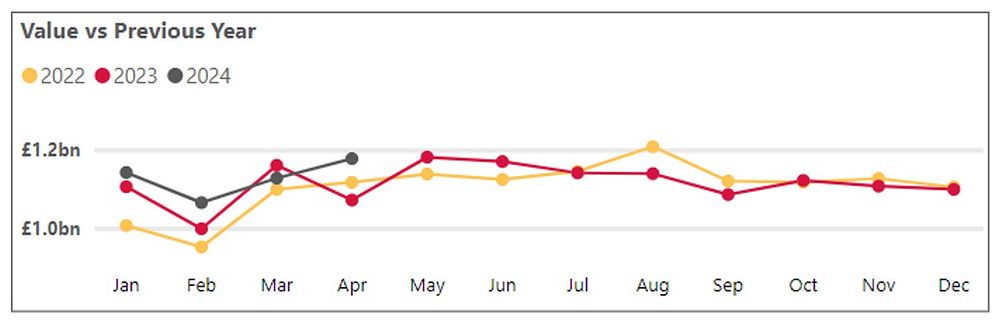

Banking Hubs

As of 7th May, 50 hubs have been opened in partnership between Cash Access UK and the Post Office. 121 Banking Hubs have now been announced by LINK with further openings planned for later this year.

For further data and analysis, visit https://corporate.postoffice.co.uk/cashtracker

How Banking Hubs operate

Banking Hubs feature a counter service operated by the Post Office, allowing customers of any bank to withdraw and deposit cash, settle bills, and conduct routine banking transactions. Furthermore, each Hub has a private area where customers can consult with community bankers from their respective banks for more complex matters that necessitate specialized knowledge or confidentiality. The banks participating in each Hub operate on a rotational basis, ensuring the presence of staff from different banks on varying days.

Banking Hubs were originally trialled as part of the Community Access to Cash Pilots when two Banking Hubs were established in Cambuslang (South Lanarkshire) and Rochford (Essex). This was part of a wider initiative to help local communities, often where the local branch had closed, to be able to spend cash as well as making it easier for small businesses to bank cash too. Following the successful pilots, in December 2021, the banking industry committed to maintaining basic access to cash in communities following the closure of the final bank branch in that location.

How the Hubs are recommended

The Hubs are recommended by LINK, the UK’s cash access and ATM network, who independently review a community based on criteria including number of shops, transport links and deprivation. LINK will assess an area following confirmation of a bank closure or through a community request.

Recommendations are then delivered by Cash Access UK, a not-for-profit organisation, who were established at the beginning of 2023, and is owned and funded by nine major banks. From the day a Hub is recommended it typically takes around 12 months to open. In locations where it proves difficult to find a suitable property, Cash Access UK can open Temporary Hubs, providing all the same services and by the same team. This gives more time to secure a permanent home for the Hub and crucially gives that community access to important services without a need to travel.

The 50th Banking Hub has been established as a temporary hub at Hometown Hub, 11 Exchange Street, Jedburgh following confirmation in June last year that the final bank branch in the town was closing. The temporary Banking Hub will provide locals with basic banking and cash services, while plans for the permanent Hub continue to progress. Customers of all major banks and building societies can carry out regular cash transactions at a counter service operated by the Post Office, Monday-Friday 9am-5pm. Community Bankers are also available, so customers can talk to their bank about more complicated issues on the day their bank is in the Hub.

If you would like to know more about the Banking Hubs please contact: cashaccessuk@cicero-group.com.

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.