Press release -

Cash deposits and withdrawals top £3 billion at Post Offices for first time

- Post Offices handled over £3 billion in cash deposits and withdrawals in a single month for the first time

- Post Offices also saw the biggest month for personal cash withdrawals with £743 million withdrawn over its counters, up 7% month-on-month (£692 million, October 2021) and up 32% year-on-year (£562 million, November 2020)

- The continuation of bank branch closures sees thousands of their customers directed to Post Offices for their cash needs and they’re staying with Post Office where many branches are open long hours and at weekends

- Post Offices handled £1.04 billion in business cash deposits in November, up over 4% month-on-month (£1 billion, October 2021) and up over 45% on a year ago (£719 million, November 2020)

- Post Office recently launched a new charity partnership with Trussell Trust donating 1p for any cash withdrawal done over the counter and hopes to raise £250,000 for the charity

Post Offices in November handled over £3 billion in cash deposits and withdrawals, the highest amount for a single month in its 360-year history.

Crossing the £3 billion threshold for the first time comes as the Chair of the Access to Cash Action Group is expected to announce this week solutions for communities where there are difficulties accessing cash.

As banks continue to close branches or announce forthcoming closures, Post Offices also saw the biggest month for personal cash withdrawals with £743 million withdrawn over its counters. The previous highest month was December 2019 when £707 million was withdrawn.

In total, £3.01 billion was deposited and withdrawn by personal and business customers in November. The figure was £2.92 billion in October 2021 and £2.99 billion in September 2021.

Martin Kearsley, Banking Director at Post Office, said:

“Each month comes news of further bank branch closures and in many communities across the country, Post Office is already the last counter in town. Business and personal cash deposits, as well as personal cash withdrawals, are all significantly up on last year and Postmasters are now routinely handling around £3 billion worth of cash every month. Post Offices services ensure the millions of people who rely on cash everyday can access their cash in a quick, convenient and secure manner and we’re working closely with the banks to develop shared branches and offer wider services.”

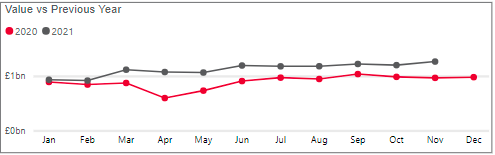

Personal cash deposits

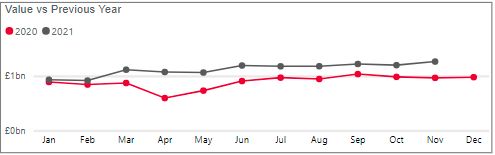

Personal cash deposits totalled £1.26 billion in November. This was up 5.5% month-on-month (£1.2 billion, October 2021) and up 31% year-on-year (£966 million, November 2020). Personal cash deposits have exceeded a billion pounds every month since March 2021.

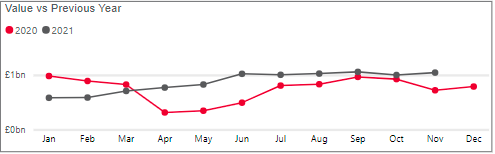

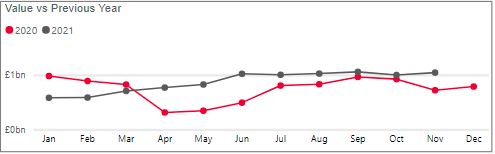

Business cash deposits

Business cash deposits totalled £1.04 billion in November. This was up over 4% month-on-month (£1 billion, October 2021) and up over 45% on a year ago (£719 million, November 2020). A recent Post Office survey found nearly half (44%) of small hospitality and leisure businesses in the UK rely on cash daily. A third (34%) of hospitality and leisure business owners said they would fear for the security of their business if they didn’t have the ability to deposit cash at the end of each day. Business cash deposits have exceeded a billion pounds every month since June 2021.

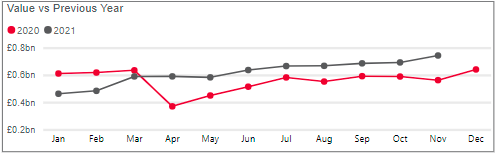

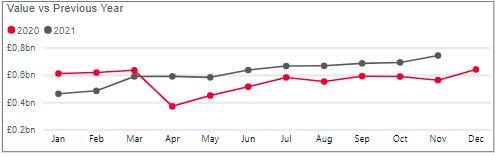

Personal cash withdrawals

Personal cash withdrawals totalled £743 million in November 2021. The highest amount ever withdrawn over the Post Office’s 11,500 counters. The figure was up 7.3% month-on-month (£692 million, October 2021) and up 32.2% year-on-year (£562 million, November 2021).

On 30 November, the Post Office announced a new charity partnership with the Trussell Trust and is donating 1p for every cash withdrawal done over the counter. Post Office hopes to raise £250,000 for the charity between now and the end of February.

More than 14m people in the UK live in poverty, including 4.5m children and for many of these people, the cost of living is unaffordable. At a time when energy prices are rising and supply chains are under increased pressure, for some, an unexpected illness or job loss can turn a bad situation into a financial crisis. The Trussell Trust supports a nationwide network of over 1,300 food bank centres and together they provide emergency food parcels to people locked into poverty and campaign for change to end the need for food banks in the UK.

Post Office Cash tracker data – November 2021

Cash deposits value (business & personal) | MOM% | YOY% | Cash withdrawals value (business & personal) | MOM% | YOY% | Total cash deposits & withdrawal value for November 2021 | |

UK[1] | £2.31bn | +5.0% | +37.0% | £769m | +7.2% | +31.9% | £3.01bn |

England | £1.89bn | +4.6% | +40.7% | £600.4m | +7.3% | +31.8% | £2.50bn |

Scotland | £170.7m | +5.1% | +20.4% | £57.4m | +4.7% | +22.1% | £228.1m |

Wales | £119.2m | +6.2% | +31.8% | £61.9m | +5.7% | +25.1% | £181.0m |

Northern Ireland | £124.5m | +9.2% | +16.3% | £49.6m | +10.4% | +58.8% | £174.1m |

Business cash deposits

Personal cash deposits

Personal cash withdrawals

For further data and analysis, visit www.corporate.postoffice.co.uk/cashtracker

[1] Figures for cash deposits value and cash withdrawals value by country have been rounded to the nearest million. This is why value figures per country will not add up exactly to the total for the UK.

Categories

About the Post Office

- With over 11,500 branches, Post Office has the biggest retail network in the UK, with more branches than all the banks and building societies combined.

- Post Office is helping anyone who wants cash to get it whichever way is most convenient. Partnership with over 30 banks, building societies and credit unions means that 99% of UK bank customers can access their accounts at their Post Office.

- Cash withdrawals, deposits and balance enquiries can be made securely and conveniently over the counter at any Post Office; and the biggest investment by any organisation or company in the last decade is being made to safeguard 1,400 free-to-use ATMs across the UK.

- Post Office is simplifying its proposition for Postmasters with a focus on itscash and banking; mails and parcels; foreign exchange; andbill paymentsservices.

- Researchhas found that visits to the Post Office help drive another 400 million visitors to other shops, restaurants and local businesses equating to an estimated £1.1 billion in additional revenue for High Street businesses.

- 99.7% of the population live within three miles of a Post Office; and 4,000 branches are open seven days a week.