Press release -

Market For Corrosion Inhibitors (Organic and Inorganic) Market: Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2013 - 2019

Executive summary chapter of this report includes global market volume (kilo tons) and revenue (USD million).

This part of the report also provides market snapshot with segmentation into various products, application and geography. This report gives a detailed analysis and forecast of the corrosion inhibitors market on a global as well as regional level. On a global level, the market has been analyzed and forecast for a time period ranging from 2013 to 2019, on the basis of volume (kilo tons) and revenue (USD million). For an insightful understanding of the market on the regional level, the demand has been forecasted based on volume (kilo tons) and revenue (USD million). The study includes drivers and restraints and their impact on the growth of the corrosion inhibitors market over the forecast period. In addition, the report includes opportunities available for the growth of the market within the forecast period, on a global as well as regional level.

Download Detail Report http://www.marketresearchreports.biz/sample/sample/174034

For a comprehensive understanding of the market, we have given a thorough analysis of the value chain. This analysis provides insights into the gross value added at each stage of the value chain. In addition, industry analysis section of the report analyses market dynamics and trends such as market drivers, restraints and opportunities with their impact over the forecast period. Furthermore, we have included Porter’s five forces model which provides a detailed understanding of the degree of competition present in the market. This model also include understanding of other acting forces that include bargaining power of suppliers, bargaining power of buyers, threat from substitutes and threat from new entrants. Moreover, the study consists of a market attractiveness analysis, where the applications are benchmarked based on their market size, growth rate and general attractiveness. This analysis provides the most lucrative application segment during the forecast period in the market.

The corrosion inhibitors market has been segmented based on product, application and end-use. All the segments have been analyzed and forecast based on volume (kilo tons) and revenue (USD million) for a time period ranging from 2013 to 2019. In addition, the segments have been analyzed and forecast based on current trends on a global as well as regional level, for the given time period. Geographically, the market has been segmented into North America, Europe, Asia Pacific and Rest of the World (RoW), and the demand has been analyzed and forecast based on current trends for a period of six years, ranging from 2013 to 2019.

Profiles of certain leading companies have been covered in this report along with a detailed analysis of their market share. The study has profiled companies such as Ashland Inc., AkzoNobel, BASF SE, Cortec, Champion Technologies, Dow, Dai-Ichi Karkaria, Ecolab, Lubrizol and Solutia among others. The company profiles include attributes such as company overview, financial overview, SWOT analysis, business strategies and recent developments.

To compile this report we have conducted in-depth interviews and discussions with key opinion leaders in the industry. Primary research is supplemented with extensive secondary research. Important secondary sources used to compile this report include various documents and articles published by NACE International – The Corrosion Society, Concrete Corrosion Inhibitors Association, Coatings World Magazine, Oil and Color Chemists Association and BASF Investors presentation. Other secondary resources referred to are national government documents, statistical databases, company websites, annual reports, news articles, press releases, SEC filings and market reports.

The market has been segmented as below:

Corrosion Inhibitors Market: Product Segment Analysis,

- Organic

- Inorganic

- Water based

- Oil/solvent based

- Power generation

- Oil & gas

- Pulp & paper

- Metals processing

- Chemicals processing

- Others

- North America

- Europe

- Asia Pacific

- Rest of the World

Growth of the water treatment market is expected to boost demand for corrosion inhibitors. In addition, increasing use of corrosion inhibitors for various steel and iron equipments which mainly used in the construction industry is expected to contribute to the growth of the market. However, several environmental issues associated with raw materials used in corrosion inhibitors are expected to hamper the growth of the market. Advanced technology which has resulted in the increasing use of green inhibitors and application of nanotechnology in corrosion inhibitors is expected to open new opportunities for the growth of the market over the next few years.

Organic inhibitors was the largest product segment present within the corrosion inhibitors market and accounted for over 70% of the market in 2012. Absence of metals in organic corrosion inhibitors results in prevention of unwanted chemical reactions. The increasing use of organic inhibitors in oil & gas and construction sector is expected to drive the demand for this product segment. Organic inhibitors are expected to be the fastest growing segment within the forecast period due to the growing preference of consumers. Inorganic inhibitors such as molybdates are widely used in water treatment.

Water-based corrosion inhibitors dominated the market for corrosion inhibitors accounting for over 75% in 2012. Rising awareness regarding the harmful effects of volatile organic compound (VOC) emissions on human life coupled with low or negligible VOC emissions from water-based corrosion inhibitors is expected to the drive the demand for this application segment over the next few years. In addition, the growing demand for water-based corrosion inhibitors in high temperature applications such as oil extraction and refining is expected to be another factor contributing to the growth of the market. Oil/solvent based corrosion inhibitors are used in applications which require constant performance over long durations of time and continuous film thickness which provides uniform protection. They are used in applications such as automobiles and electronics.

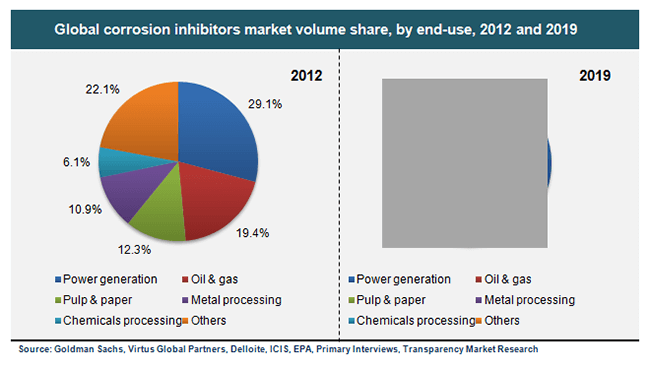

Demand for corrosion inhibitors was highest from power generation sector in 2012 accounting for over 25% of the market in 2012. Oil & gas was the second largest end-use segment of corrosion inhibitors accounting for 19.4% of the market in 2012. Oil & gas is expected to be the fastest growing segment within the market due to the rising awareness of the losses caused due to corrosion. In addition, rise in industrial activities across various developed and developing countries is expected to drive the demand for oil & gas which in turn is expected to boost the corrosion inhibitors market.

Asia Pacific accounted for the highest demand for corrosion inhibitors accounting for over 35% of the market in 2012. Europe and North America together accounted for over 50% of the market in 2012. Increasing industrial activities coupled with rising awareness regarding the adverse impact of corrosion in Asia Pacific is expected to boost their demand over the next few years. Moreover, industrial development in countries such as Brazil and South Africa has led to a growth in construction activities which in turn is expected to contribute significantly to the growth of the market within the forecast period.

The corrosion inhibitors market is fragmented in nature with the top four companies accounting for less than 40% of the market share in 2012. Ecolab was the largest manufacturer of corrosion inhibitors and accounted for over 15% of the market in 2012. GE Water, Ashland and BASF are other leading manufacturers. Some other prominent corrosion inhibitor manufacturers include AkzoNobel, Champion Technologies, Cytec, Cortec, Dow, DuPont and Lubrizol among others. Certain companies such as Dow, DuPont and BASF are integrated across the entire value chain of corrosion inhibitors market.

Topics

- Business enterprise