Image -

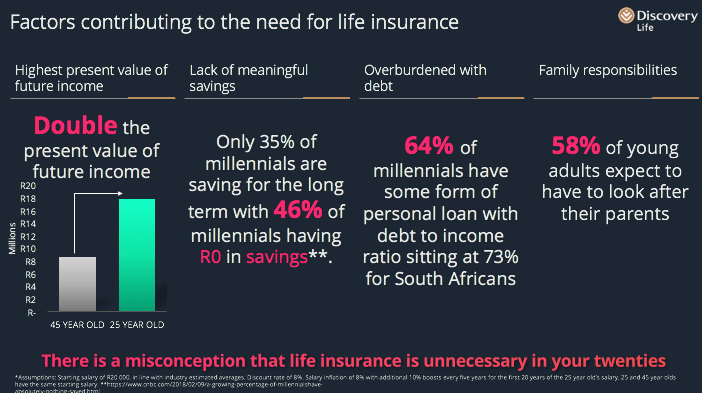

Factors contributing to the need for life insurance

Highest present value: Internal discovery life research. Assumptions on slide

Lack of meaningful savings: 46% stat is from a Bank of America survey of millennials. https://www.cnbc.com/2018/02/09/a-growing-percentage-of-millennials-have-absolutely-nothing-saved.html The 35% is from a 10x survey done in South Africa around savings habits of South Africans

Overburdened with debt: the Household savings ratio is from statsSa and the 64% is from the South African Savings and Investment survey

Family responsibilities: South African Savings and investment survey

Discovery Life

- License:

- Media Use

The content may be downloaded by journalists, bloggers, columnists, creators of public opinion, etc. It can be used and shared in different media channels to convey, narrate, and comment on your press releases, posts, or information, provided that the content is unmodified. The author or creator shall be attributed to the extent and in the manner required by good practice (this means, for example, that photographers should be attributed).

- By:

- Discovery Life

- File format:

- .png

- Size:

- 702 x 393, 132 KB