Image -

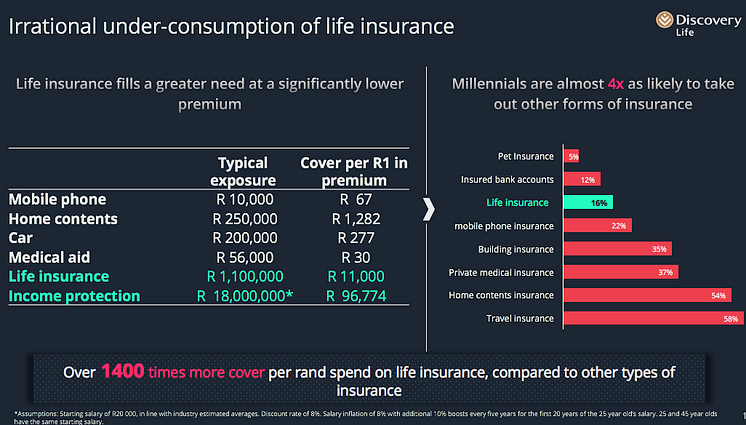

Millennial Insurance Gap - Irrational under-consumption of life insurance

*Assumptions: Starting salary of R20 000, in line with industry, estimated averages. Discount rate of 8%. Salary inflation of 8% with additional 10% boosts every five years for the first 20 years of the 25-year-old’s salary. 25 and 45-year-olds have the same starting salary.

Discovery Life

- License:

- Media Use

The content may be downloaded by journalists, bloggers, columnists, creators of public opinion, etc. It can be used and shared in different media channels to convey, narrate, and comment on your press releases, posts, or information, provided that the content is unmodified. The author or creator shall be attributed to the extent and in the manner required by good practice (this means, for example, that photographers should be attributed).

- By:

- Discovery Life

- File format:

- .png

- Size:

- 1026 x 584, 151 KB