Press release -

Discovery Bank launches home loans with dynamic interest rate saving of up to 1% – giving South Africans the potential to save R12 billion a year in interest

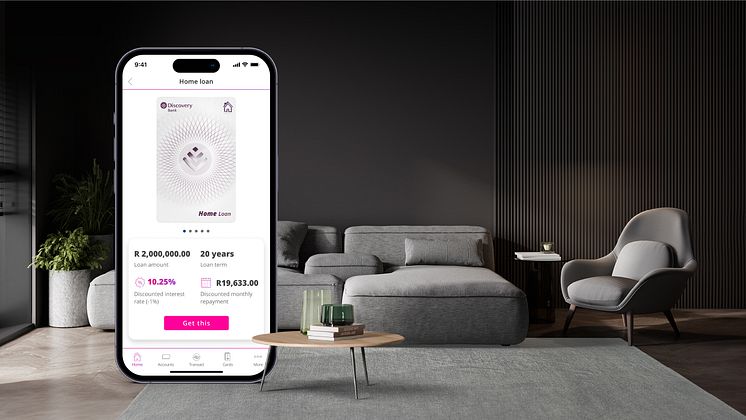

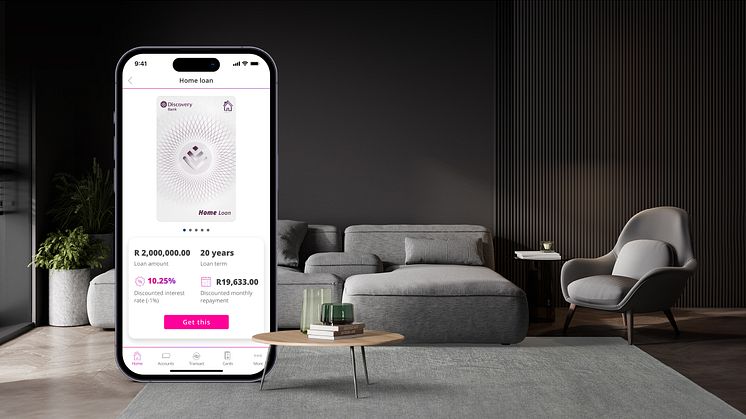

Johannesburg, 27 May 2024 – Discovery Bank has launched its new Home Loan product. The Bank will offer clients competitive, personalised rates based on their individual risk profiles, and use its established Shared-value Banking model to enable clients to further reduce their interest rate by up to 1%. This will be done by managing their money well with Vitality Money and protecting their home loan and home with the relevant insurance products Discovery offers.

Clients can lock in a market-related rate upfront, and dynamically reduce interest repayments by managing their money well to save over the long term. Through this shared-value approach, the current Discovery Bank client base could save up to R2.8 billion in interest repayments on their current loans, and with the same model, South Africans could save up to R12.2 billion a year.*

“This is a highly anticipated milestone for us as we open the virtual doors to our home loans ecosystem. Those looking to buy a new home or wanting to upgrade their home, can enjoy a full ecosystem of benefits and tailor-made services in the Discovery Bank app. Our clients have comprehensive homeowner support alongside our home loans, with protection products for their homes and family, access to additional financing of energy solutions, and various rewards,” said Hylton Kallner, CEO of Discovery Bank.

Home Loans meets Shared-value Banking

As clients manage their money well, they create less risk and more value for Discovery Bank. The behaviours that are rewarded, include saving, being adequately insured, investing for retirements, and paying off home loans faster. The Bank shares the value from these financial behaviours back with clients in the form of better interest rates and other rewards linked to the Vitality Money programme. The better clients manage their money, the higher their Vitality Money status and the better their rewards. Through the combination of Vitality Money, the Home Loan Protector and Building and Contents Cover, Discovery Bank home loan clients with can lower their interest rates by up to 1%.

All clients who take out new home loans, switch home loans or refinance their homes with Discovery Bank can qualify for the Shared-value Interest Rate discount.

Discovery Bank offers home loans up to 100% of the value of properties, with personalised interest rates over a range of repayment terms up to 30 years. In addition to financing for new home purchases, Discovery Bank clients can also switch their existing home loans, or refinance their homes with this new offer. With both switching to Discovery Bank and refinancing unbonded homes, clients can unlock equity in cash based on the value of their homes.

Buying a home requires significant long-term financing, resulting in it being the largest source of debt for many South Africans. However, it is also the biggest asset class and offers long-term hedging against inflation.

Kallner says, “We feel motivated to change the landscape of homeownership. The unique nature of home loans means client and asset risk typically reduce over time. With high costs negatively impacting repricing or switching to a different bank, the result is that an estimated 60% of our clients are overpaying on their existing home loans today. The solution is not only a once-off credit reassessment, but a client controlled dynamic interest rate that adjusts based on real-time changes in financial behaviour. With Discovery Bank home loans, clients can be certain they will get accurate risk-based interest. This ecosystem will give Discovery Bank clients a personalised home-loan preliminary offer in under 5 minutes, and a completely digital application process on our award-winning Discovery Bank app. Our clients will get all the support they need in the home ecosystem – all to make the process of buying and owning a home as seamless and stress-free as possible.”

With the new Discovery Bank Home Partner Network, clients will also get up to 30% back in Điscovery Miles on Discovery Bank purchases at select partner stores, including Coricraft, Dial-a-Bed, Nespresso, Patio Warehouse and Volpes, in the first six months of the Discovery Bank Home Loan.

The Discovery Bank Home Loan offering is administered by a dedicated team from SA Home Loans, following the initial in-app application. SA Home Loans has over 24 years specialist mortgage experience. A dedicated SA Home Loans consultant will assist clients through the necessary administrative and regulatory requirements to complete a home loan switch, refinancing or to purchase a new home.

Notes to Editor

*Based on all reported home loans balances held by South African banking institutions. This would be the saving if all South Africans with home loans were to capitalise on the dynamic interest rate saving of up to 1%.

Topics

Categories

Discovery information

About Discovery Bank

Discovery Bank is part of Discovery Limited, a financial services organisation that operates in healthcare, life assurance, short-term insurance, investments, banking, and wellness industries, in over 40 markets globally. Built on a shared-value model, Discovery Bank is fundamentally designed to create unique shared value for clients, differentiating the Bank from traditional banking models. Clients are encouraged to manage their money well, monetising healthy financial behaviours that lower their financial risk and realises long-term default and risk savings for the Bank. Discovery Bank shares this value with clients in the form of better interest rates, deep discounts and significant rewards from an exclusive retail, lifestyle and wellness partner network. The model has an overall positive impact on clients, society and Discovery Bank - clients experience greater financial wellbeing, the risk of defaults for Discovery Bank is lowered making the business more sustainable; while improved financial behaviours such as increased savings, higher retirement savings and lower debt levels, benefit society as a whole. Behaviour change and rewards are enabled through Vitality Money, an AI-powered programme on the Discovery Bank app that gives clients an understanding of the behaviours that influence their financial wellbeing, while giving them the tools to improve their financial behaviours. The more clients improve their financial behaviour, the higher their Vitality Money status and the greater the value they receive.

Follow us on X @Discovery_SA