Communiqué de presse -

Mondelēz International Reports Q1 2022 Results

MDLZ Q1 2022 Earnings Release Content

Mondelēz International Reports Q1 2022 Results

First Quarter Highlights

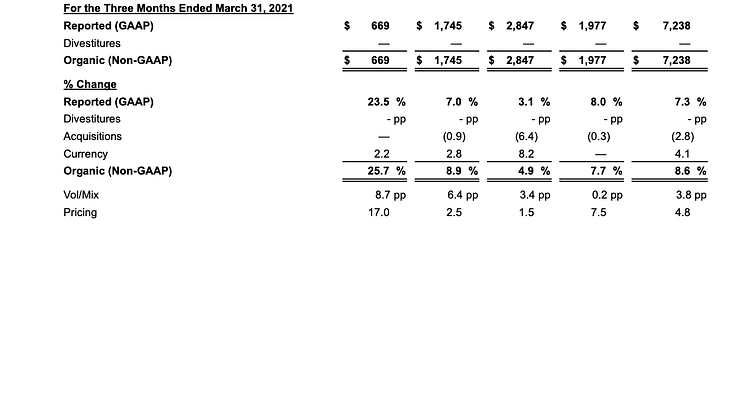

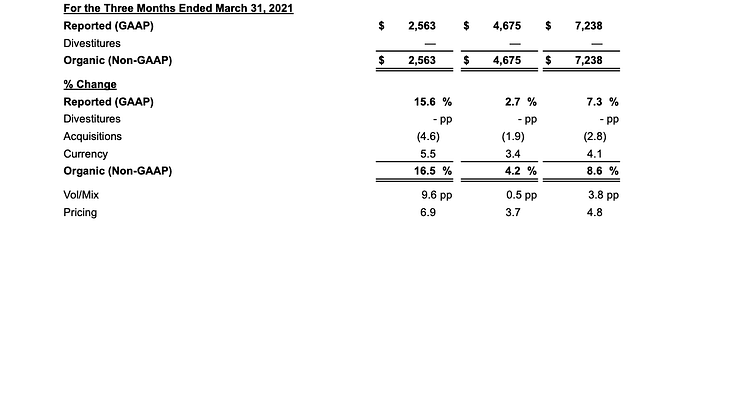

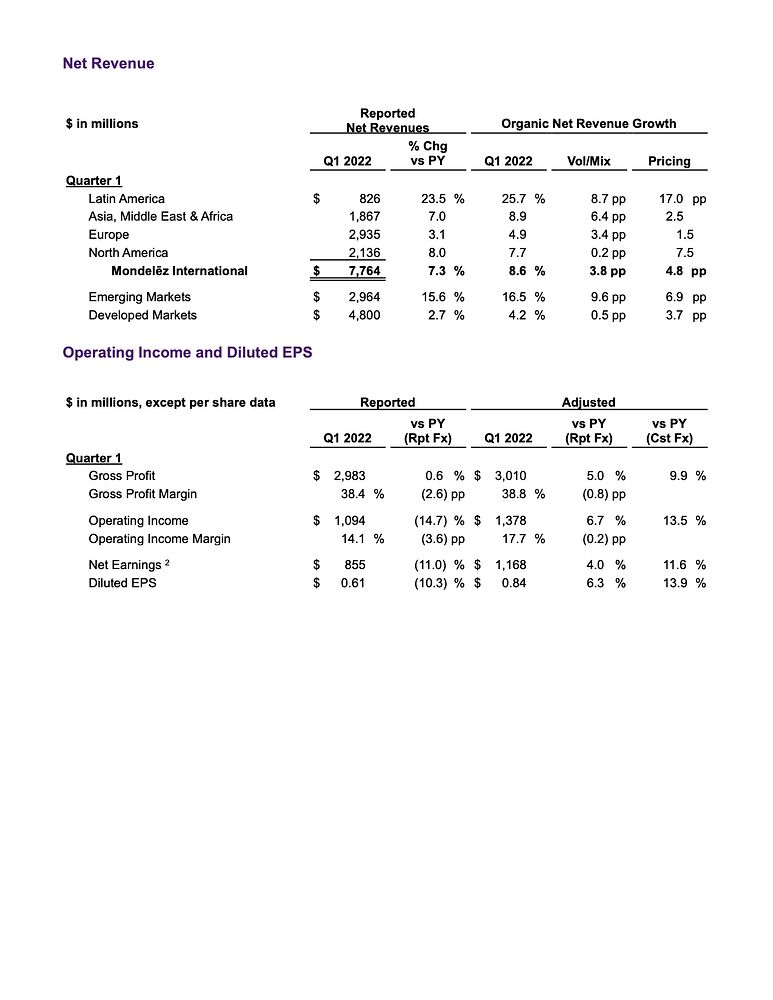

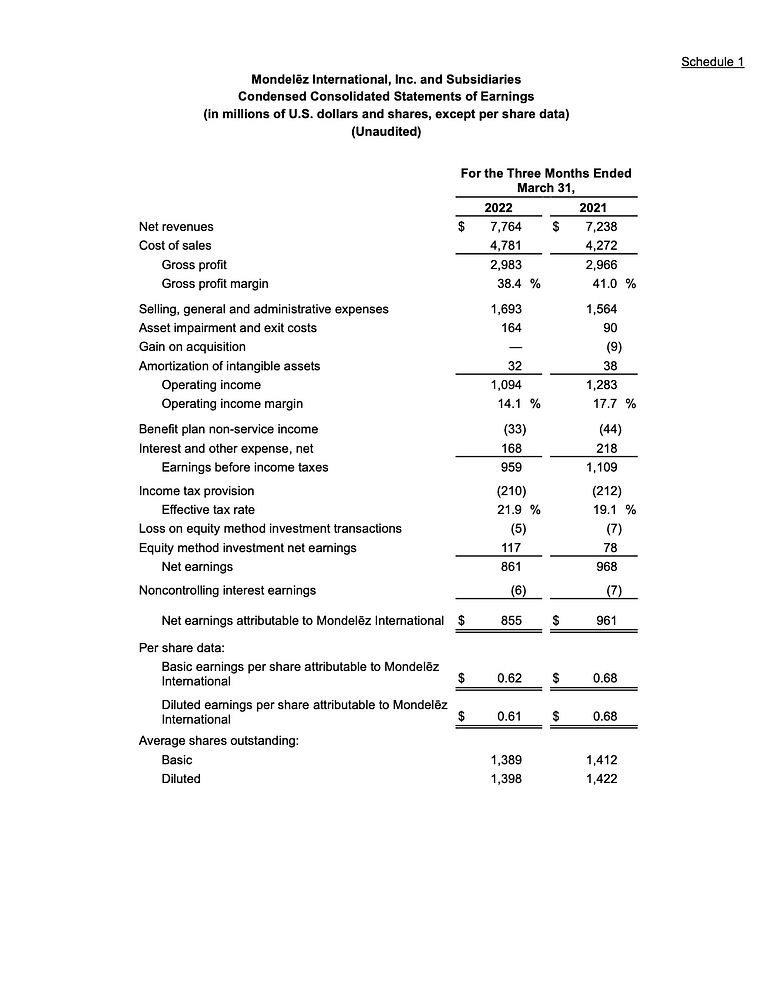

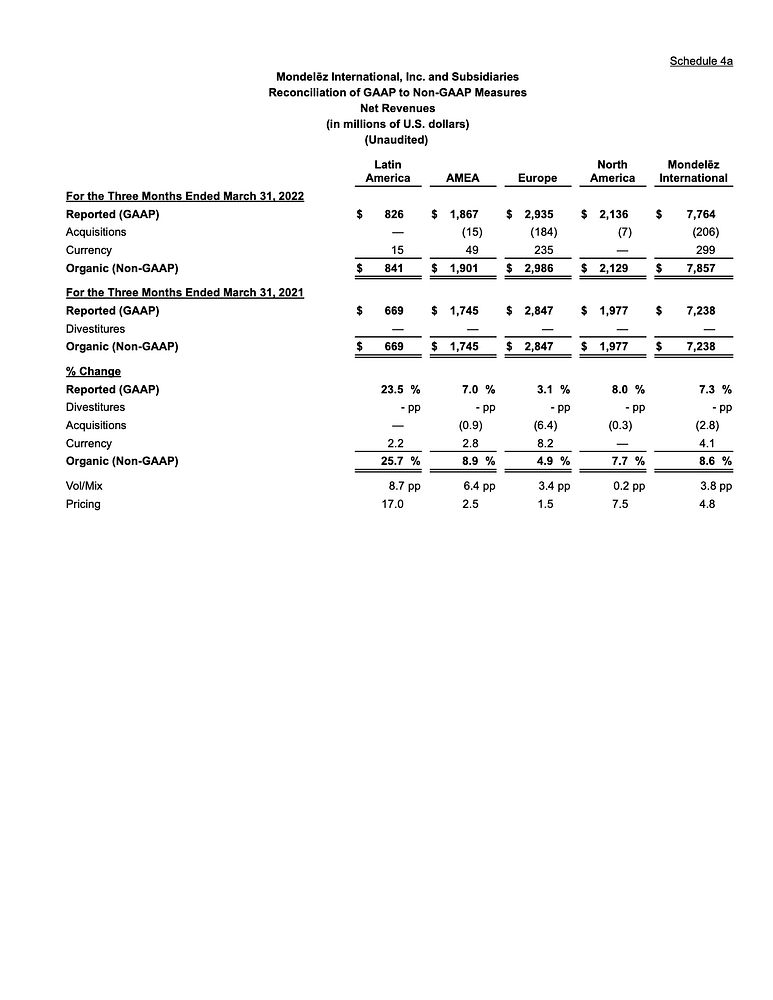

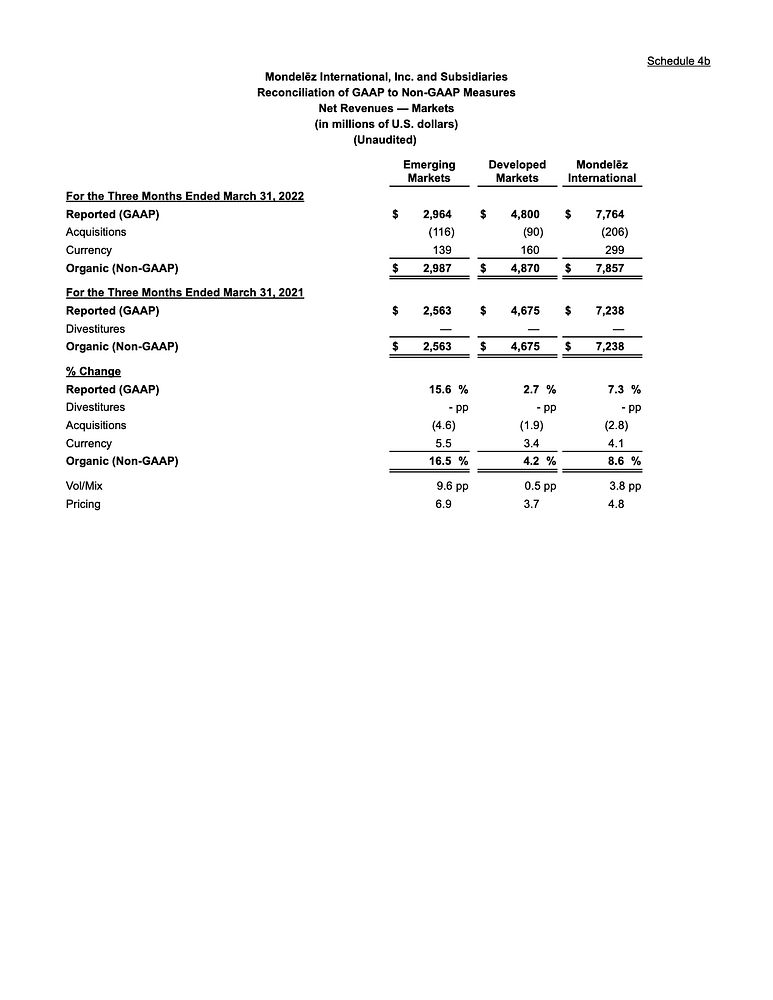

Net revenues increased +7.3% driven by Organic Net Revenue1 growth of +8.6%

-

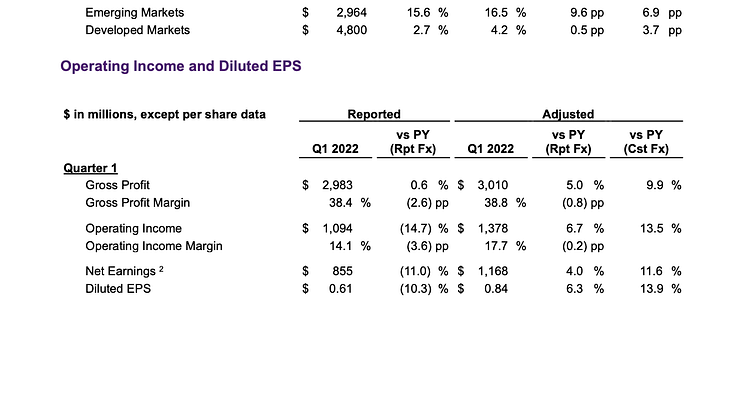

Diluted EPS was $0.61, down -10.3%; Adjusted EPS1 was $0.84, up +13.9% on a constant-

currency basis

-

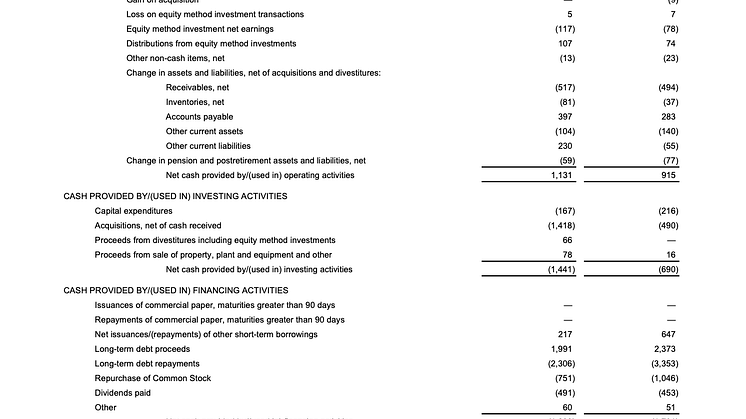

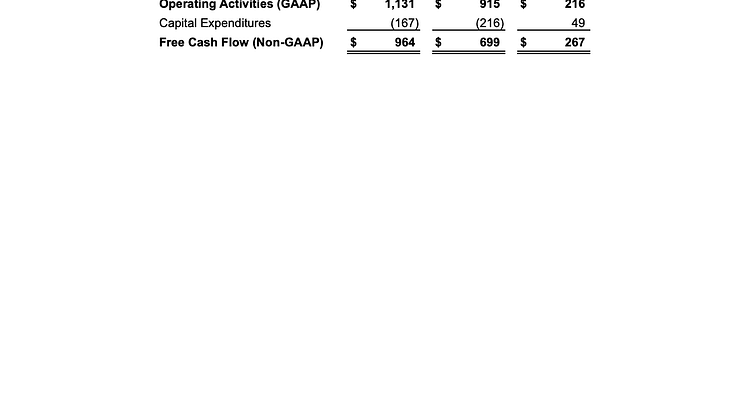

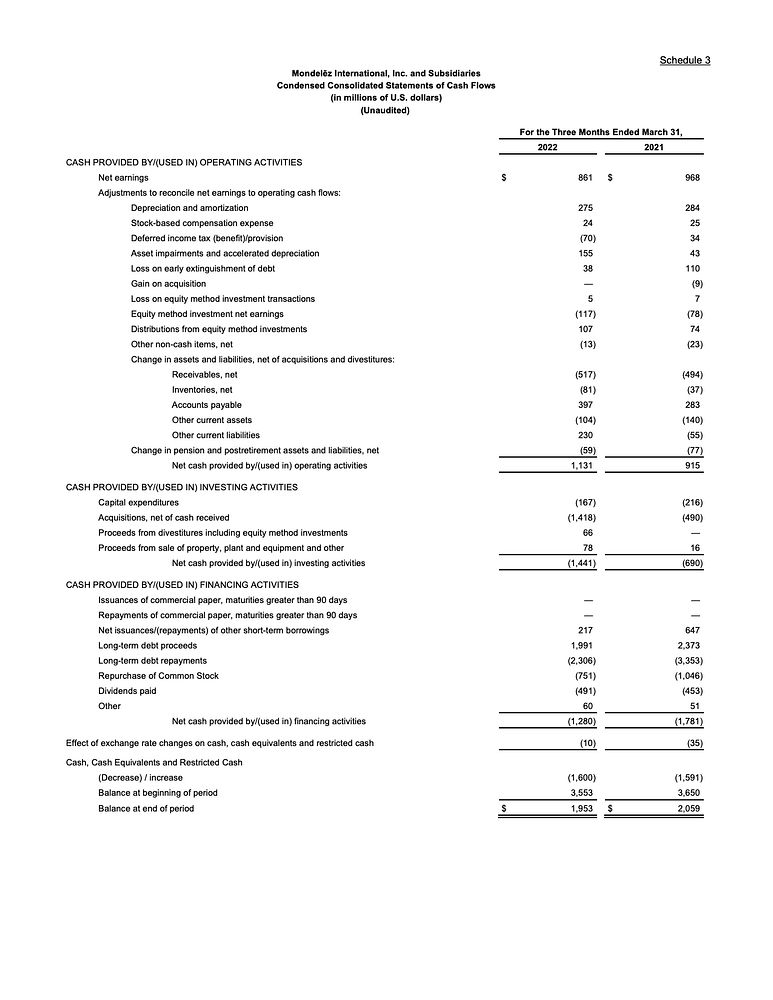

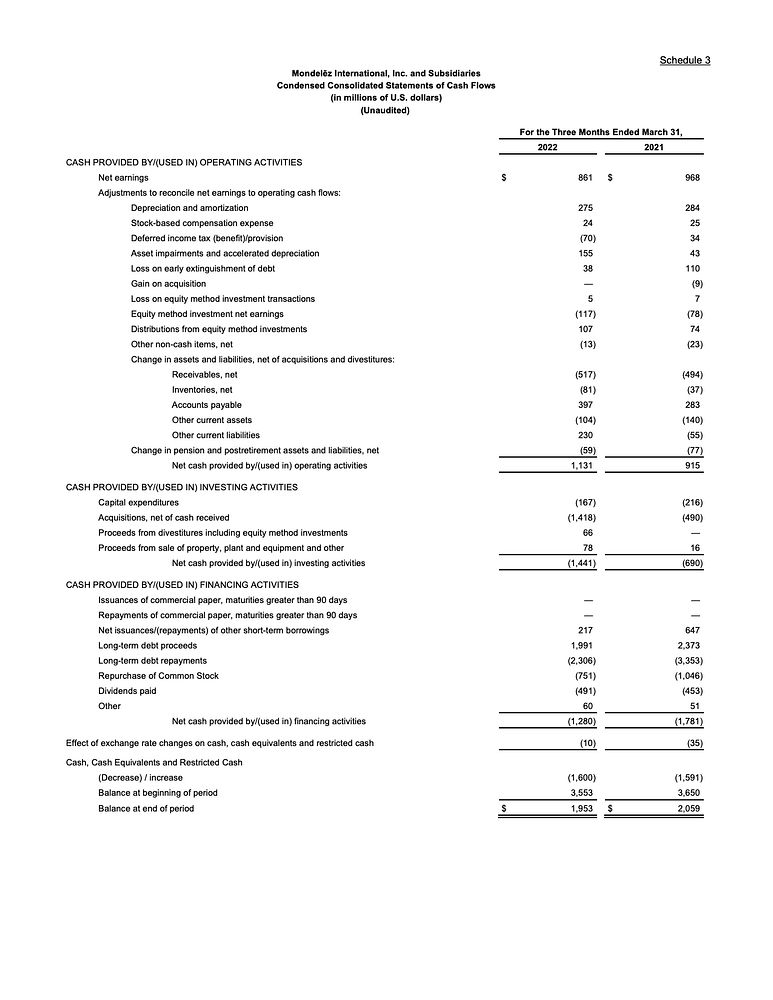

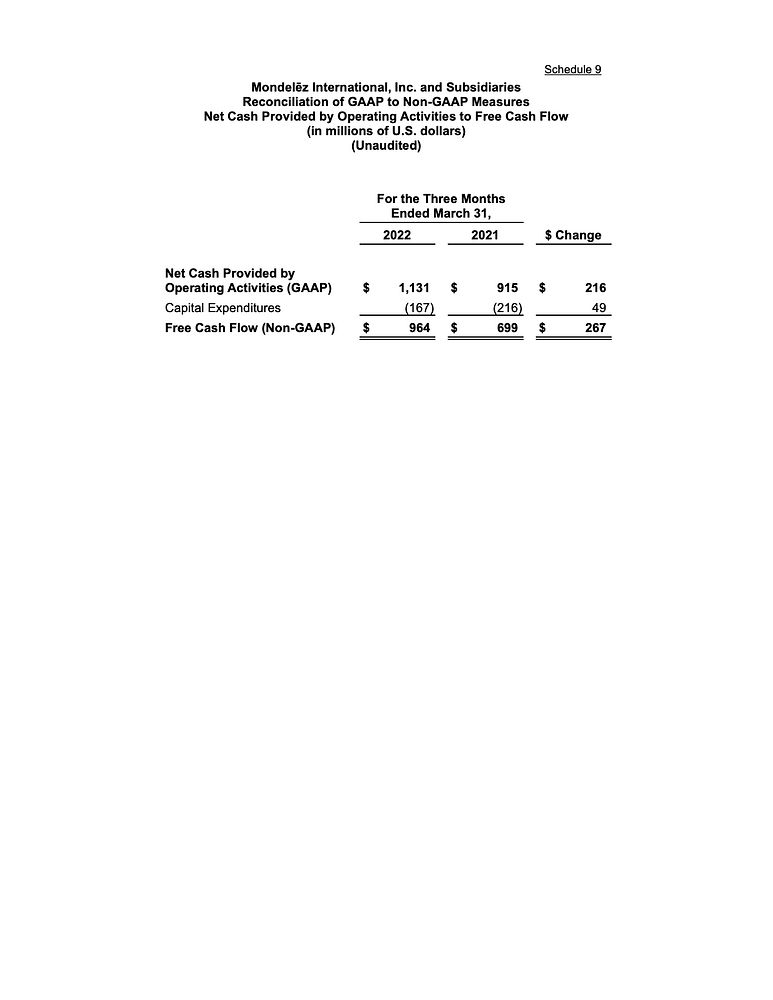

Cash provided by operating activities was $1.1 billion, an increase of +$0.2 billion versus prior

year; Free Cash Flow1 was $1.0 billion, +$0.3 billion

Return of capital to shareholders was $1.2 billion

-

Announced agreement to acquire Ricolino, Mexico's leading confectionery company with iconic

brands and strong distribution capabilities, doubling the size of our Mexico business

-

Appointed Mariano Lozano to the role of EVP and President, Latin America

CHICAGO, Ill. – April 26, 2022 – Mondelēz International, Inc. (Nasdaq: MDLZ) today reported itsfirst quarter 2022 results.

"We delivered strong top-line results in our first quarter, driven by higher pricing and strongvolume growth. Our chocolate and biscuit businesses continue to power our virtuous cycle of attractiverevenue growth, strong profitability and robust cash flow," said Dirk Van de Put, Chairman and ChiefExecutive Officer. "Demand remains strong across both developed and emerging markets, with all ourregions posting growth. We expect elevated levels of input cost inflation to continue through theremainder of the year, and we will continue to take necessary actions to offset this dynamic - including abroader revenue growth management agenda, ongoing cost discipline, and further simplification withinour business. We remain confident in our strategy and ability to create long-term value, while recognizingthe need to stay agile to navigate the dynamic economic and geopolitical environment. We are alsoexcited about our recently announced agreement to acquire Ricolino that will step-change our presencein the priority market of Mexico -- adding to our portfolio some of the country's most beloved chocolateand candy brands, while broadening our distribution footprint with more than 2,100 direct store deliveryroutes reaching 440,000 traditional trade outlets."

MDLZ Q1 2022 Earnings Release Content

First Quarter Commentary

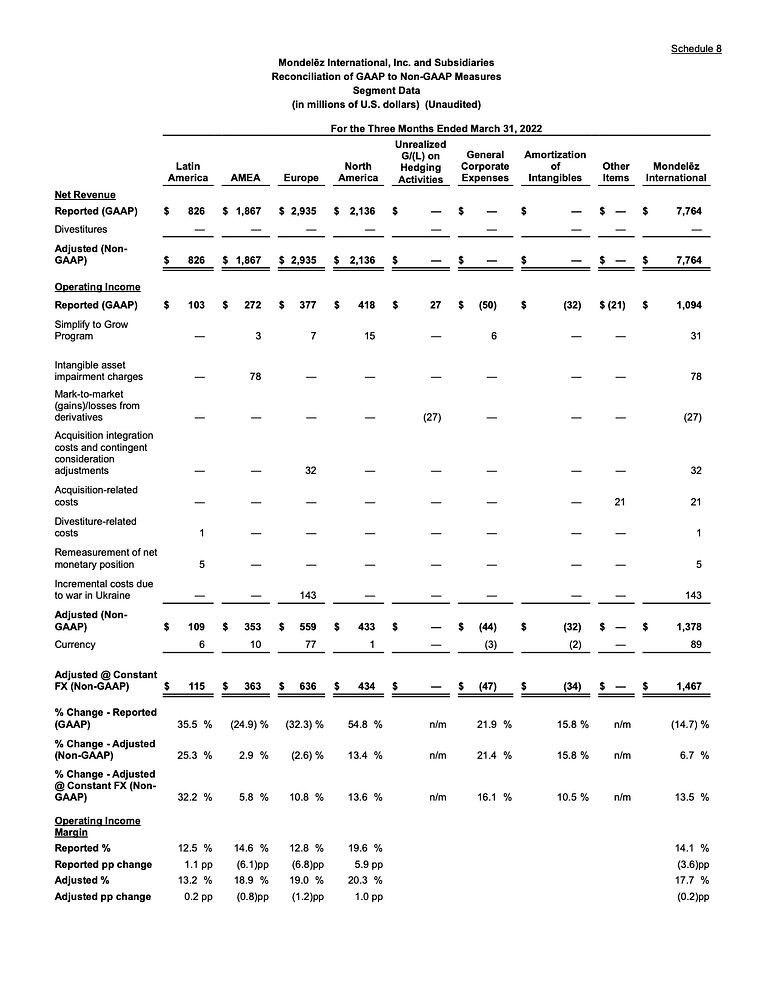

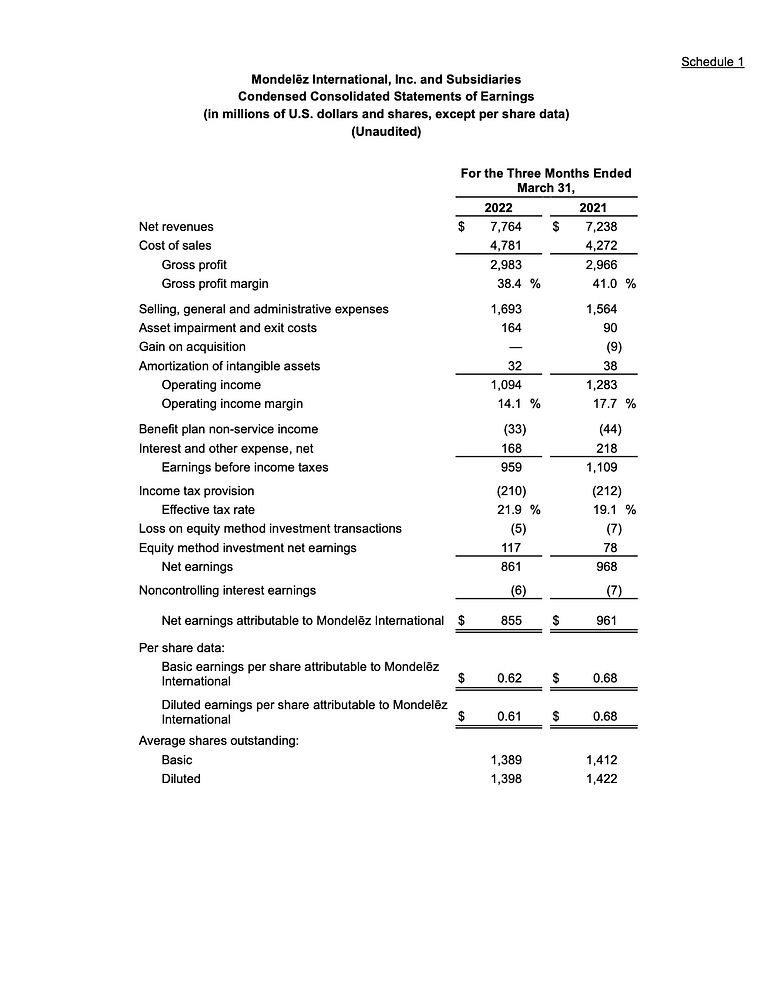

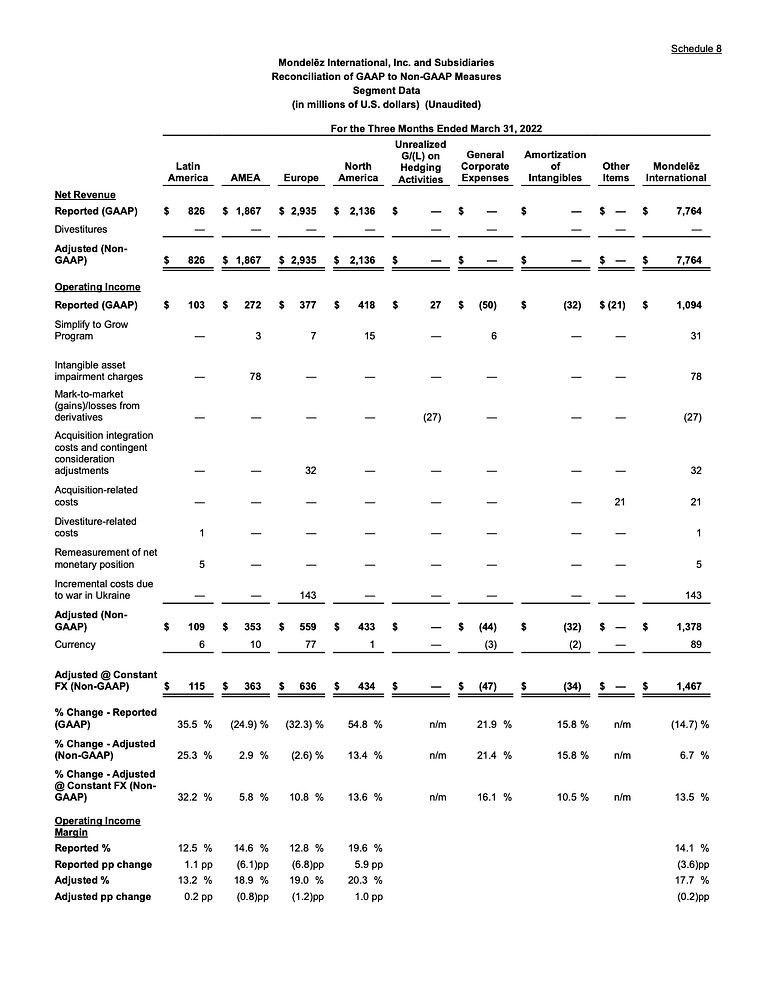

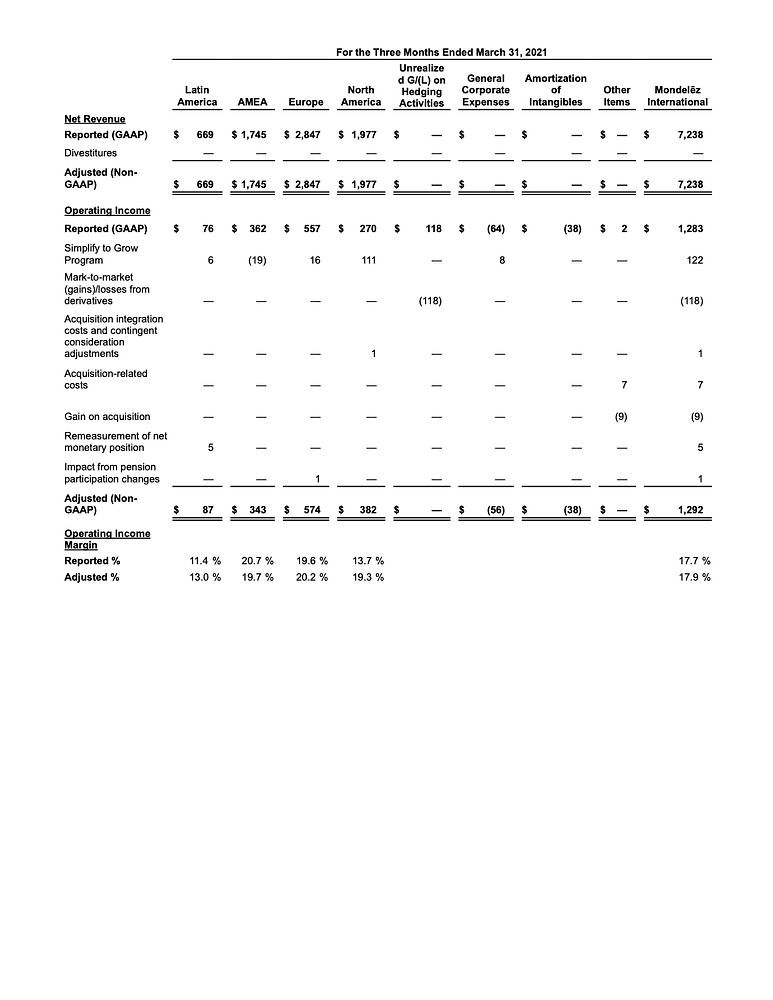

Net revenues increased 7.3 percent driven by Organic Net Revenue growth of 8.6 percent, andincremental sales from the company's acquisitions of Chipita, Grenade and Gourmet Food,partially offset by unfavorable currency. Pricing and volume drove Organic Net Revenue growth.

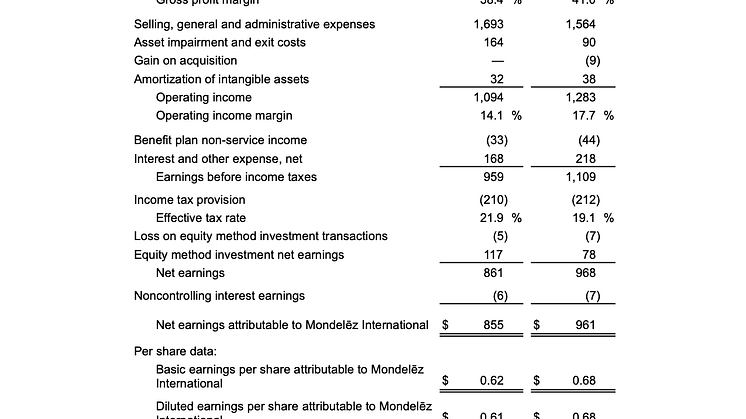

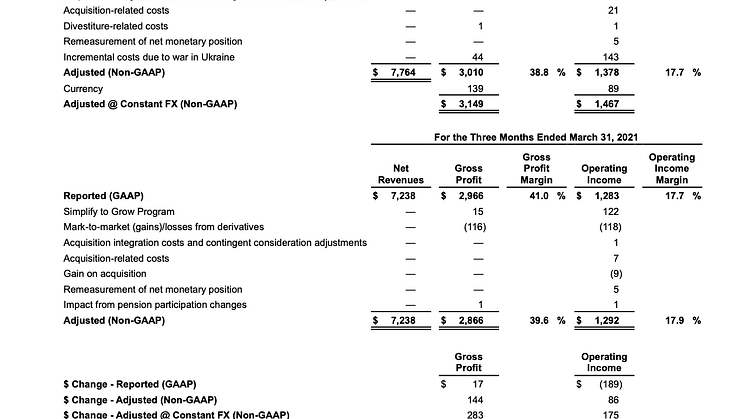

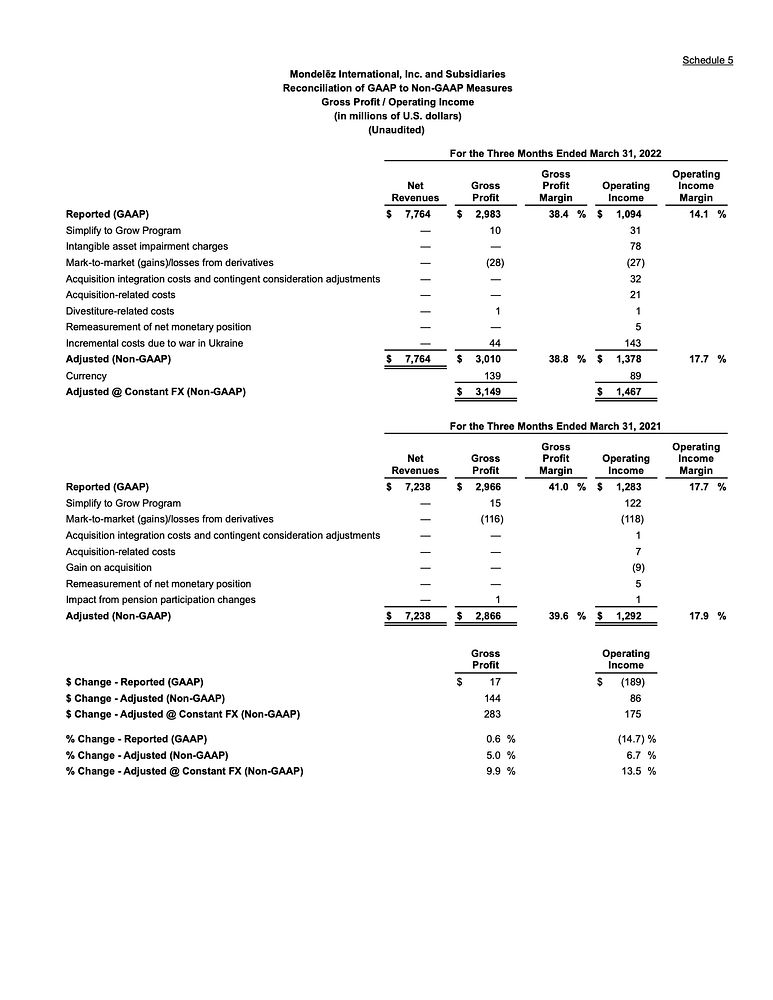

Gross profit increased $17 million, while gross profit margin decreased 260 basis points to 38.4percent primarily driven by lower mark-to-market gains from derivatives, the decrease in AdjustedGross Profit1 margin and incremental costs incurred due to the war in Ukraine. Adjusted GrossProfit increased $283 million at constant currency, while Adjusted Gross Profit margin decreased80 basis points to 38.8 percent due to higher raw material and transportation costs andunfavorable mix, partially offset by pricing, productivity and volume leverage.

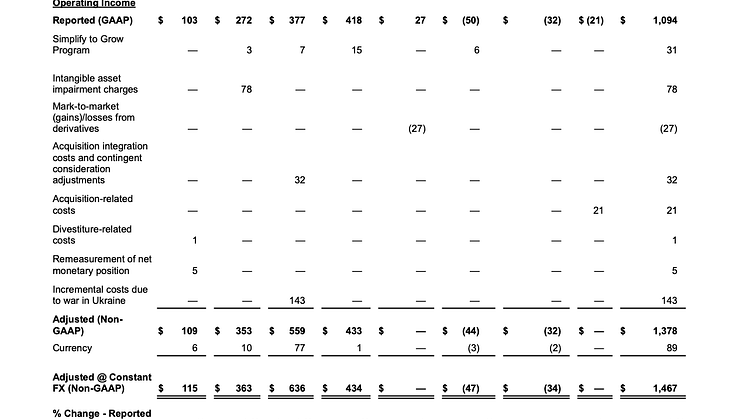

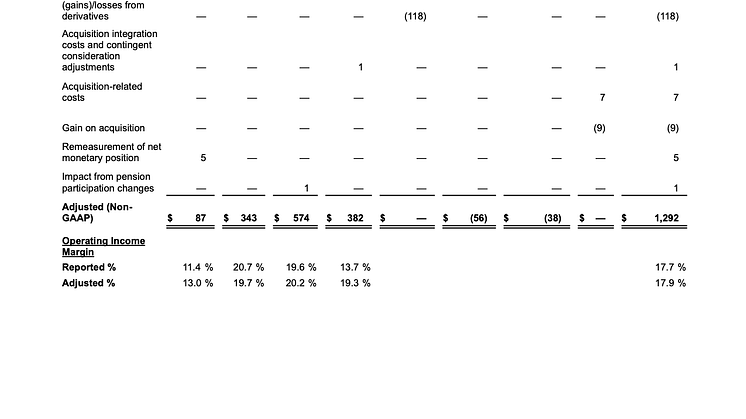

Operating income decreased $189 million and operating income margin was 14.1 percent, down360 basis points primarily due to incremental costs incurred due to the war in Ukraine, lowermark-to-market gains from derivatives, intangible asset impairment charges incurred in 2022,higher acquisition integration costs and lower Adjusted Operating Income1 margin, partially offsetby lower restructuring costs. Adjusted Operating Income increased $175 million at constantcurrency while Adjusted Operating Income margin decreased 20 basis points to 17.7 percent, withinput cost inflation and unfavorable mix, mostly offset by pricing and SG&A leverage.

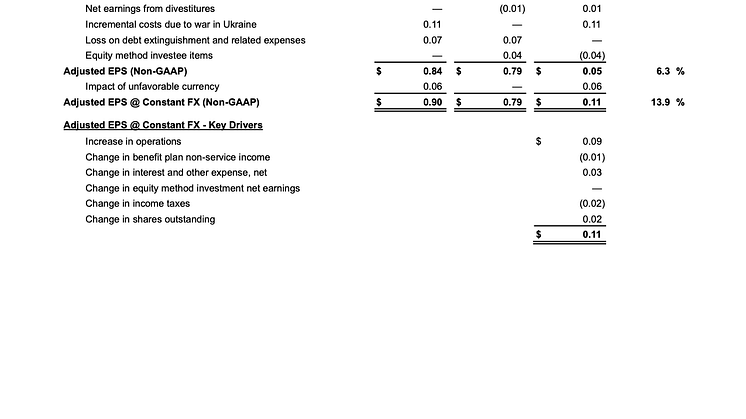

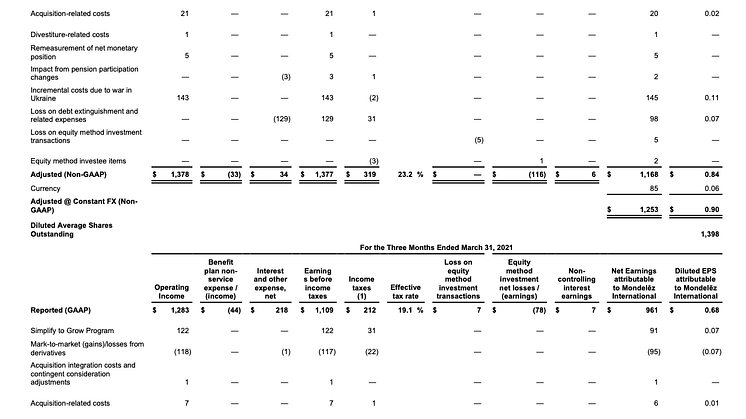

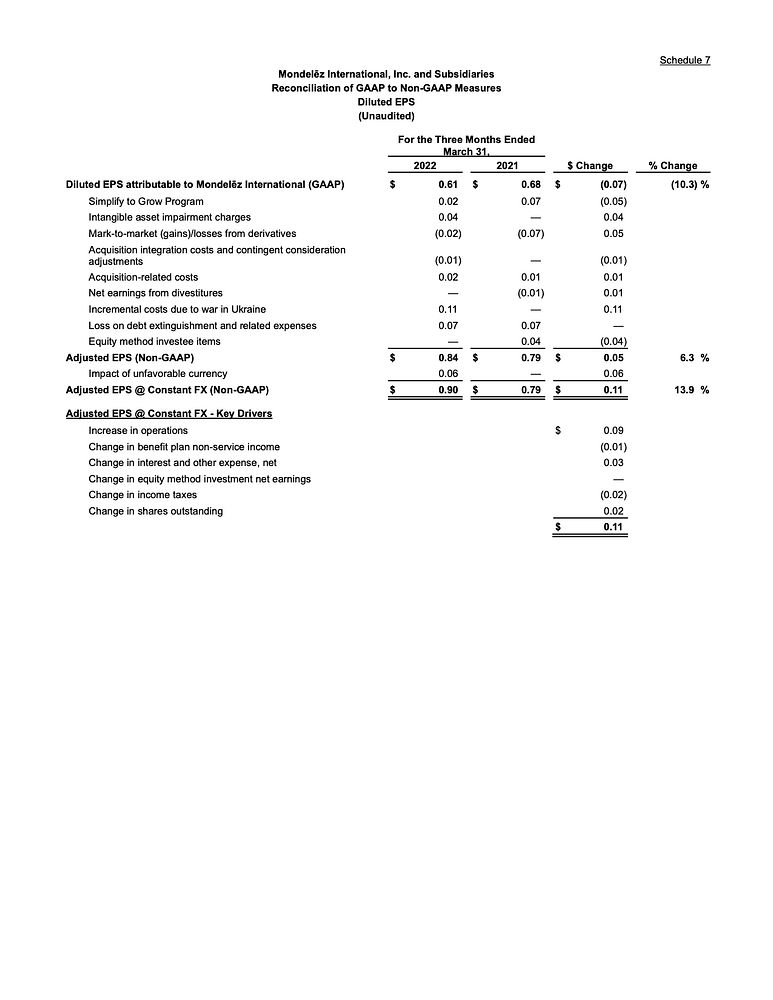

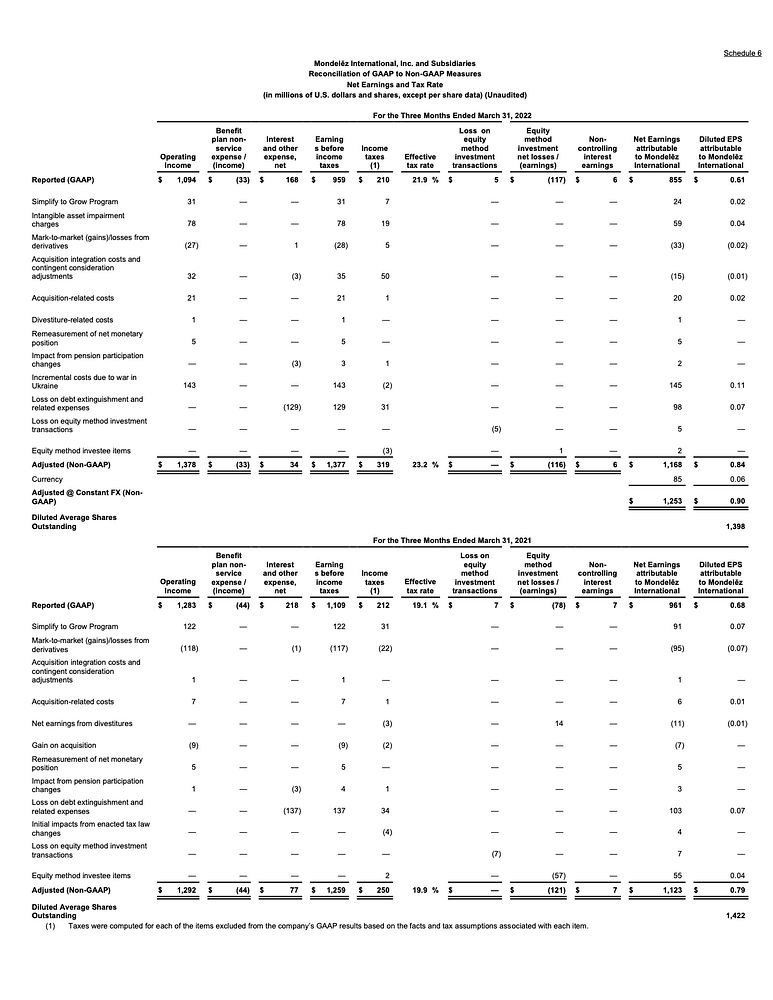

Diluted EPS was $0.61, down 10.3 percent, primarily due to incremental costs incurred due to thewar in Ukraine, lower mark-to-market gains from derivatives, intangible asset impairment chargesincurred in 2022 and higher acquisition-related costs, partially offset by an increase in AdjustedEPS and lower restructuring costs.

Adjusted EPS was $0.84, up 13.9 percent on a constant-currency basis driven by operatinggains, lower interest expense and fewer shares outstanding, partially offset by higher taxesprimarily due to lower net benefits from non-recurring discrete tax items and lower benefit plannon-service income.

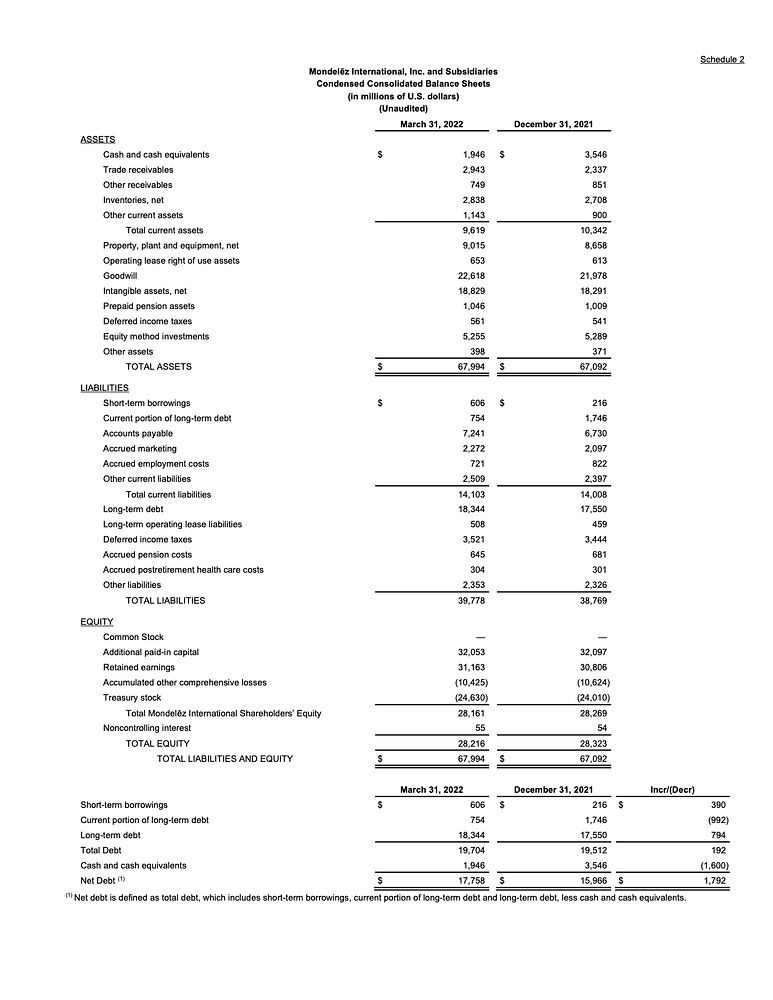

Capital Return: The company returned $1.2 billion to shareholders in cash dividends and sharerepurchases.

2022 Outlook

Mondelēz International provides its outlook on a non-GAAP basis, as the company cannot predictsome elements that are included in reported GAAP results, including the impact of foreign exchange.Refer to the Outlook section in the discussion of non-GAAP financial measures below for more details.

The company is updating its fiscal 2022 outlook to reflect expectations for continued top-linegrowth, higher cost of goods sold inflation, the timing effect of additional pricing actions and the impact ofthe war in Ukraine.

For 2022, the company now expects 4+ percent Organic Net Revenue growth, which reflects the

strength of its first quarter and higher pricing related to increased input costs. The company also now

expects mid-to-high single digit Adjusted EPS growth on a constant currency basis due to the current

estimates of the loss of earnings from the war in Ukraine and material commodity cost increases due

primarily to increases in energy costs. The company's Free Cash Flow outlook remains at $3+ billion. The

company estimates currency translation would decrease 2022 net revenue growth by approximately 3

33percent with a negative $0.17 impact to Adjusted EPS .

Outlook is provided in the context of greater than usual volatility as a result of COVID-19 andgeopolitical uncertainty.

Conference Call

Mondelēz International will host a conference call for investors with accompanying slides toreview its results at 5 p.m. ET today. A listen-only webcast will be provided atwww.mondelezinternational.com. An archive of the webcast will be available on the company’s web site.

About Mondelēz International

Mondelēz International, Inc. (Nasdaq: MDLZ) empowers people to snack right in over 150countries around the world. With 2021 net revenues of approximately $29 billion, MDLZ is leading thefuture of snacking with iconic global and local brands such as Oreo, belVita and LU biscuits; CadburyDairy Milk, Milka and Toblerone chocolate; Sour Patch Kids candy and Trident gum. MondelēzInternational is a proud member of the Standard and Poor’s 500, Nasdaq 100 and Dow JonesSustainability Index. Visit www.mondelezinternational.com or follow the company on Twitter atwww.twitter.com/MDLZ.

End Notes

1. Organic Net Revenue, Adjusted Gross Profit (and Adjusted Gross Profit margin), AdjustedOperating Income (and Adjusted Operating Income margin), Adjusted EPS, Free Cash

Flow and presentation of amounts in constant currency are non-GAAP financial measures.Please see discussion of non-GAAP financial measures at the end of this press release formore information.

Earnings attributable to Mondelēz International.

Currency estimate is based on published rates from XE.com on April 20, 2022.

Additional Definitions

Emerging markets consist of the Latin America region in its entirety; the Asia, Middle East andAfrica region excluding Australia, New Zealand and Japan; and the following countries from the Europeregion: Russia, Ukraine, Türkiye, Kazakhstan, Georgia, Poland, Czech Republic, Slovak Republic,Hungary, Bulgaria, Romania, the Baltics and the East Adriatic countries.

Developed markets include the entire North America region, the Europe region excluding thecountries included in the emerging markets definition, and Australia, New Zealand and Japan from theAsia, Middle East and Africa region.

Forward-Looking Statements

This press release contains a number of forward-looking statements. Words, and variations ofwords, such as “will,” “expect,” “may,” “would,” “could,” “estimate,” “outlook” and similar expressions areintended to identify the company’s forward-looking statements, including, but not limited to, statementsabout: the war in Ukraine; volatility resulting from the COVID-19 pandemic and geopolitical uncertainty;the company’s future performance, including its future revenue growth, earnings per share and cash flow;currency and the effect of currency translation on the company’s results of operations; the company'sstrategy and ability to create long-term value; the economic and geopolitical environment; demand; inputcost inflation and actions the company might take to offset it; strategic transactions, including thecompany's planned acquisition of Ricolino; and the company’s outlook, including 2022 Organic NetRevenue growth, Adjusted EPS growth and Free Cash Flow. These forward-looking statements aresubject to a number of risks and uncertainties, many of which are beyond the company’s control, andmany of these risks and uncertainties are currently amplified by and may continue to be amplified by theCOVID-19 pandemic, including the spread of new variants of COVID-19 such as Omicron. Importantfactors that could cause the company’s actual results to differ materially from those indicated in thecompany’s forward-looking statements include, but are not limited to, the impact of ongoing or newdevelopments in the war in Ukraine, related current and future sanctions imposed by governments and

other authorities, and related impacts on the company’s business, growth, reputation, prospects, financialcondition, operating results (including components of its financial results), cash flows and liquidity;uncertainty about the effectiveness of efforts by health officials and governments to control the spread ofCOVID-19 and inoculate and treat populations impacted by COVID-19; uncertainty about the reimpositionor lessening of restrictions imposed by governments intended to mitigate the spread of COVID-19 andthe magnitude, duration, geographic reach and impact on the global economy of COVID-19; the ongoing,and uncertain future, impact of the COVID-19 pandemic on the company’s business, growth, reputation,prospects, financial condition, operating results (including components of its financial results), cash flowsand liquidity; risks from operating globally including in emerging markets; changes in currency exchangerates, controls and restrictions; volatility of commodity and other input costs and availability ofcommodities; weakness in economic conditions; weakness in consumer spending; pricing actions; taxmatters including changes in tax laws and rates, disagreements with taxing authorities and imposition ofnew taxes; use of information technology and third party service providers; unanticipated disruptions tothe company’s business, such as malware incidents, cyberattacks or other security breaches, and thecompany’s compliance with privacy and data security laws; global or regional health pandemics orepidemics, including COVID-19; competition and the company’s response to channel shifts and pricingand other competitive pressures; promotion and protection of the company’s reputation and brand image;changes in consumer preferences and demand and the company’s ability to innovate and differentiate itsproducts; the restructuring program and the company’s other transformation initiatives not yielding theanticipated benefits; changes in the assumptions on which the restructuring program is based;management of the company’s workforce and shifts in labor availability; consolidation of retail customersand competition with retailer and other economy brands; changes in the company’s relationships withcustomers, suppliers or distributors; compliance with legal, regulatory, tax and benefit laws and relatedchanges, claims or actions; the impact of climate change on the company’s supply chain and operations;strategic transactions; significant changes in valuation factors that may adversely affect the company’simpairment testing of goodwill and intangible assets; perceived or actual product quality issues or productrecalls; failure to maintain effective internal control over financial reporting or disclosure controls andprocedures; volatility of and access to capital or other markets, the effectiveness of the company’s cashmanagement programs and its liquidity; pension costs; the expected discontinuance of London InterbankOffered Rates and transition to any other interest rate benchmark; and the company’s ability to protect itsintellectual property and intangible assets. There may be other factors not presently known to thecompany or which the company currently considers to be immaterial that could cause its actual results to

differ materially from those projected in any forward-looking statements the company makes. Thecompany disclaims and does not undertake any obligation to update or revise any forward-lookingstatement in this report except as required by applicable law or regulation.

MDLZ Q1 2022 Earnings Release Content

Mondelēz International, Inc. and SubsidiariesReconciliation of GAAP and Non-GAAP Financial Measures(Unaudited)

The company reports its financial results in accordance with accounting principles generally accepted in the United States(“GAAP”). However, management believes that also presenting certain non-GAAP financial measures provides additionalinformation to facilitate the comparison of the company’s historical operating results and trends in its underlying operatingresults, and provides additional transparency on how the company evaluates its business. Management uses these non-GAAPfinancial measures in making financial, operating and planning decisions and in evaluating the company’s performance. Thecompany also believes that presenting these measures allows investors to view its performance using the same measures thatthe company uses in evaluating its financial and business performance and trends.

The company considers quantitative and qualitative factors in assessing whether to adjust for the impact of items that may besignificant or that could affect an understanding of its ongoing financial and business performance and trends. The adjustmentsgenerally fall within the following categories: acquisition & divestiture activities, gains and losses on intangible asset sales andnon-cash impairments, major program restructuring activities, constant currency and related adjustments, major programfinancing and hedging activities and other major items affecting comparability of operating results. See below for a descriptionof adjustments to the company’s U.S. GAAP financial measures included herein.

Non-GAAP information should be considered as supplemental in nature and is not meant to be considered in isolation or as asubstitute for the related financial information prepared in accordance with U.S. GAAP. In addition, the company’s non-GAAPfinancial measures may not be the same as or comparable to similar non-GAAP measures presented by other companies.

DEFINITIONS OF THE COMPANY’S NON-GAAP FINANCIAL MEASURES

The company’s non-GAAP financial measures and corresponding metrics reflect how the company evaluates its operatingresults currently and provide improved comparability of operating results. As new events or circumstances arise, thesedefinitions could change. When these definitions change, the company provides the updated definitions and presents the relatednon-GAAP historical results on a comparable basis. When items no longer impact the company’s current or future presentationof non-GAAP operating results, the company removes these items from its non-GAAP definitions. In the first quarter of 2022,the company added to the non-GAAP definitions the exclusion of incremental costs due to the war in Ukraine.

“Organic Net Revenue” is defined as net revenues excluding the impacts of acquisitions, divestitures and currencyrate fluctuations. The company also evaluates Organic Net Revenue growth from emerging markets and developedmarkets.

“Adjusted Gross Profit” is defined as gross profit excluding the impacts of the Simplify to Grow Program;acquisition integration costs; the operating results of divestitures; mark-to-market impacts from commodity, forecastedcurrency and equity method investment transaction derivative contracts; and incremental costs due to the war inUkraine. The company also presents “Adjusted Gross Profit margin,” which is subject to the same adjustments asAdjusted Gross Profit. The company also evaluates growth in the company’s Adjusted Gross Profit on a constantcurrency basis.

“Adjusted Operating Income” and “Adjusted Segment Operating Income” are defined as operating income (orsegment operating income) excluding the impacts of the items listed in the Adjusted Gross Profit definition as well asgains or losses (including non-cash impairment charges) on goodwill and intangible assets; divestiture or acquisitiongains or losses, divestiture-related costs, acquisition-related costs, and acquisition integration costs and contingentconsideration adjustments; remeasurement of net monetary position; impacts from resolution of tax matters; impactfrom pension participation changes; and costs associated with the JDE Peet's transaction. The company also presents“Adjusted Operating Income margin” and “Adjusted Segment Operating Income margin,” which are subject to thesame adjustments as Adjusted Operating Income and Adjusted Segment Operating Income. The company alsoevaluates growth in the company’s Adjusted Operating Income and Adjusted Segment Operating Income on a constantcurrency basis.

“Adjusted EPS” is defined as diluted EPS attributable to Mondelēz International from continuing operationsexcluding the impacts of the items listed in the Adjusted Operating Income definition, as well as losses on debtextinguishment and related expenses; gains or losses on interest rate swaps no longer designated as accounting cashflow hedges due to changed financing and hedging plans; net earnings from divestitures; and initial impacts fromenacted tax law changes; and gains or losses on equity method investment transactions. Similarly, within AdjustedEPS, the company’s equity method investment net earnings exclude its proportionate share of its investees’ significantoperating and non-operating items. The tax impact of each of the items excluded from the company’s GAAP resultswas computed based on the facts and tax assumptions associated with each item, and such impacts have also beenexcluded from Adjusted EPS. The company also evaluates growth in the company’s Adjusted EPS on a constantcurrency basis.

-

“Free Cash Flow” is defined as net cash provided by operating activities less capital expenditures. Free Cash Flow isthe company’s primary measure used to monitor its cash flow performance.

See the attached schedules for supplemental financial data and corresponding reconciliations of the non-GAAP financialmeasures referred to above to the most comparable GAAP financial measures for the three months ended March 31, 2022 andMarch 31, 2021. See Items Impacting Comparability of Operating Results below for more information about the itemsreferenced in these definitions that specifically impacted the company’s results.

SEGMENT OPERATING INCOME

The company uses segment operating income to evaluate segment performance and allocate resources. The company believes itis appropriate to disclose this measure to help investors analyze segment performance and trends. Segment operating incomeexcludes unrealized gains and losses on hedging activities (which are a component of cost of sales), general corporate expenses(which are a component of selling, general and administrative expenses), amortization of intangibles, gains and losses ondivestitures and acquisition-related costs (which are a component of selling, general and administrative expenses) in all periodspresented. The company excludes these items from segment operating income in order to provide better transparency of itssegment operating results. Furthermore, the company centrally manages benefit plan non-service income and interest and otherexpense, net. Accordingly, the company does not present these items by segment because they are excluded from the segmentprofitability measure that management reviews.

ITEMS IMPACTING COMPARABILITY OF OPERATING RESULTS

The following information is provided to give qualitative and quantitative information related to items impacting comparabilityof operating results. The company identifies these based on how management views the company’s business; makes financial,operating and planning decisions; and evaluates the company’s ongoing performance. In addition, the company discloses theimpact of changes in currency exchange rates on the company’s financial results in order to reflect results on a constantcurrency basis.

Divestitures, Divestiture-related costs and Gains/(losses) on divestitures

Divestitures include completed sales of businesses (including the partial or full sale of an equity method investment - discussedseparately below under the gains and losses on equity method investment transactions section) and exits of major product linesupon completion of a sale or licensing agreement. As the company records its share of KDP and JDE Peet’s ongoing earningson a one-quarter lag basis, any KDP or JDE Peet’s ownership reductions are reflected as divestitures within the company's non-GAAP results the following quarter.

• The company's non-GAAP results include the impacts from 2021 partial sales of its equity method investment in KDPas if the sales occurred at the beginning of all periods presented. See the section on gains/losses on equity methodinvestment transactions below for more information.

Acquisitions, Acquisition-related costs and Acquisition integration costs

On January 3, 2022, the company acquired 100% of the equity of Chipita S.A. (“Chipita”), a leading croissants and bakedsnacks company in the Central and Eastern European markets. The acquisition of Chipita offers a strategic complement to thecompany's existing portfolio and advances its strategy to become the global leader in broader snacking. The acquisition addedincremental net revenues of $152 million and operating income of $4 million in the three months ended March 31, 2022. Thecompany incurred acquisition-related costs of $21 million in the three months ended March 31, 2022. The company alsoincurred acquisition integration costs of $35 million in the three months ended March 31, 2022.

On April 1, 2021, the company acquired Gourmet Food Holdings Pty Ltd, a leading Australian food company in the premiumbiscuit and cracker category. The acquisition added incremental net revenues of $14 million and operating income of $1 millionin the three months ended March 31, 2022. The company also incurred acquisition-related costs of $1 million in the threemonths ended March 31, 2021.

On March 25, 2021, the company acquired a majority interest in Lion/Gemstone Topco Ltd ("Grenade"), a performancenutrition leader in the United Kingdom. The acquisition of Grenade expands the company's position into the premium nutritionsegment. The acquisition added incremental net revenues of $21 million and operating income of $2 million in the three monthsended March 31, 2022. The company also incurred acquisition-related costs of $2 million in the three months ended March 31,2021.

On January 4, 2021, the company acquired the remaining 93% of equity of Hu Master Holdings, a category leader in premiumchocolate in the United States, which provides a strategic complement to the company's snacking portfolio in North Americathrough growth opportunities in chocolate and other offerings in the well-being segment. As a result of acquiring the remainingequity interest, the company consolidated the operation and recorded a pre-tax gain of $9 million ($7 million after-tax) relatedto stepping up the company's previously-held $8 million (7%) investment to fair value. The company also incurred acquisition-related costs of $4 million during the three months ended March 31, 2021.

On April 1, 2020, the company acquired a majority interest in Give & Go, a North American leader in fully-finished sweetbaked goods and owner of the famous two-bite® brand of brownies and the Create-A-Treat® brand, known for cookie andgingerbread house decorating kits. The acquisition of Give & Go provides access to the in-store bakery channel and expands thecompany's position in broader snacking. The company incurred $1 million of acquisition-integrations costs in the three monthsended March 31, 2021.

Simplify to Grow Program

The primary objective of the Simplify to Grow Program is to reduce the company’s operating cost structure in both its supplychain and overhead costs. The program covers severance as well as asset disposals and other manufacturing and procurement-related one-time costs.

Restructuring costs

The company recorded restructuring charges of $11 million in the three months ended March 31, 2022 and $88 million in thethree months ended March 31, 2021 within asset impairment and exit costs and benefit plan non-service income. These chargeswere for severance and related costs, non-cash asset write-downs (including accelerated depreciation and asset impairments)and other adjustments, including any gains on sale of restructuring program assets.

Implementation costs

Implementation costs primarily relate to reorganizing the company’s operations and facilities in connection with its supplychain reinvention program and other identified productivity and cost saving initiatives. The costs include incremental expensesrelated to the closure of facilities, costs to terminate certain contracts and the simplification of the company’s informationsystems. The company recorded implementation costs of $20 million in the three months ended March 31, 2022 and $34million in the three months ended March 31, 2021.

Intangible asset impairment charges

During the first quarter of 2022, the company recorded a $78 million intangible asset impairment charge in AMEA due to lowerthan expected growth and profitability of a local biscuit brand sold in select markets in AMEA and Europe.

Mark-to-market impacts from commodity and currency derivative contracts

The company excludes unrealized gains and losses (mark-to-market impacts) from outstanding commodity and forecastedcurrency and equity method investment transaction derivative contracts from its non-GAAP earnings measures. The mark-to-market impacts of commodity and forecasted currency transaction derivatives are excluded until such time that the relatedexposures impact the company's operating results. Since the company purchases commodity and forecasted currencytransaction contracts to mitigate price volatility primarily for inventory requirements in future periods, the company makes thisadjustment to remove the volatility of these future inventory purchases on current operating results to facilitate comparisons ofits underlying operating performance across periods. The company excludes equity method investment derivative contractsettlements as they represent protection of value for future divestitures. The company recorded net unrealized gains oncommodity, forecasted currency and equity method transaction derivatives of $28 million in the three months ended March 31,2022, and recorded net unrealized gains of $117 million in the three months ended March 31, 2021.

Remeasurement of net monetary position

During the second quarter of 2018, primarily based on published estimates which indicated that Argentina's three-yearcumulative inflation rate exceeded 100%, the company concluded that Argentina became a highly inflationary economy foraccounting purposes. As of July 1, 2018, the company began to apply highly inflationary accounting for its Argentineansubsidiaries and changed their functional currency from the Argentinean peso to the U.S. dollar. On July 1, 2018, both monetaryand non-monetary assets and liabilities denominated in Argentinian pesos were remeasured into U.S. dollars. As of eachsubsequent balance sheet date, Argentinean peso denominated monetary assets and liabilities were remeasured into U.S. dollarsusing the exchange rate as of the balance sheet date, with remeasurement and other transaction gains and losses recorded in netearnings. Within selling, general and administrative expenses, the company recorded remeasurement losses of $5 million in thethree months ended March 31, 2022 and $5 million in the three months March 31, 2021 related to the revaluation of theArgentinean peso denominated net monetary position over these periods.

Impact from pension participation changes

The impact from pension participation changes represent the charges incurred when employee groups are withdrawn frommultiemployer pension plans and other changes in employee group pension plan participation. The company excludes thesecharges from its non-GAAP results because those amounts do not reflect the company’s ongoing pension obligations.

On July 11, 2019, the company received an undiscounted withdrawal liability assessment related to the company's completewithdrawal from the Bakery and Confectionery Union and Industry International Pension Fund totaling $526 million andrequiring pro-rata monthly payments over 20 years. The company began making monthly payments during the third quarter of2019. In connection with the discounted long-term liability, the company recorded accreted interest of $3 million in the threemonths ended March 31, 2022 and $3 million in the three months ended March 31, 2021 within interest and other expense, net.As of March 31, 2022, the remaining discounted withdrawal liability was $356 million, with $15 million recorded in othercurrent liabilities and $341 million recorded in long-term other liabilities.

Incremental costs due to the war in Ukraine

In February 2022, Russia began a military invasion of Ukraine and the company closed its operations and facilities in Ukraine.In March 2022, the company's two Ukrainian manufacturing facilities in Trostyanets and Vyshhorod were significantlydamaged. During the first quarter of 2022, the company evaluated and impaired these and other assets. The company recorded$143 million of total expenses ($145 million after-tax) incurred as a direct result of the war, including $75 million recorded inasset impairment and exit costs, $44 million in cost of sales and $24 million in selling, general and administrative expenses.

Loss on debt extinguishment and related expenses

On March 18, 2022, the company completed an early redemption of long-term U.S. dollar ($987 million) denominated notes.The company recorded a $129 million loss on debt extinguishment and related expenses within interest and other expense, net,consisting of $38 million paid in excess of carrying value of the debt and from recognizing unamortized discounts and deferred

financing costs in earnings and $91 million in unamortized forward starting swap losses in earnings at the time of the debtextinguishment.

On March 31, 2021, the company completed an early redemption of euro (€1,200 million) and U.S. dollar ($992 million)denominated notes. The company recorded a $137 million loss on debt extinguishment and related expenses within interest andother expense, net, consisting of $110 million paid in excess of carrying value of the debt and from recognizing unamortizeddiscounts and deferred financing costs in earnings and $27 million foreign currency derivative loss related to the redemptionpayment at the time of the debt extinguishment.

Initial impacts from enacted tax law changes

The company excludes initial impacts from enacted tax law changes from its non-GAAP financial measures as they do notreflect its ongoing tax obligations under the enacted tax law changes. Initial impacts include items such as the remeasurementof deferred tax balances and the transition tax from the 2017 U.S. tax reform. Previously, the company only excluded the initialimpacts from more material tax reforms, specifically the impacts of the 2019 Swiss tax reform and 2017 U.S. tax reform. Tofacilitate comparisons of its underlying operating results, the company has recast all historical non-GAAP earnings measures toexclude the initial impacts from enacted tax law changes.

Gains and losses on equity method investment transactions

Keurig Dr Pepper transactions

On August 2, 2021, the company sold approximately $14.7 million shares of KDP, which reduced its ownership interest by 1%to 5.3% of the total outstanding shares. The company received $500 million of proceeds and recorded a pre-tax gain of $248million (or $189 million after-tax) during the third quarter of 2021.

On June 7, 2021, the company participated in a secondary offering of KDP shares and sold approximately 28.0 million shares,which reduced its ownership interest by 2% to 6.4% of the total outstanding shares. The company received $997 million ofproceeds and recorded a pre-tax gain of $520 million (or $392 million after-tax) during the second quarter of 2021.

The company considers these ownership reductions partial divestitures of its equity method investment in KDP. Therefore, thecompany has removed the equity method investment net earnings related to the divested portion from its non-GAAP financialresults for Adjusted EPS for all historical periods presented to facilitate comparison of results. The company's U.S. GAAPresults, which include its equity method investment net earnings from KDP, did not change from what was previously reported.

Equity method investee items

Within Adjusted EPS, the company’s equity method investment net earnings exclude its proportionate share of its equitymethod investees’ significant operating and non-operating items, such as acquisition and divestiture-related costs andrestructuring program costs.

Constant currency

Management evaluates the operating performance of the company and its international subsidiaries on a constant currencybasis. The company determines its constant currency operating results by dividing or multiplying, as appropriate, the currentperiod local currency operating results by the currency exchange rates used to translate the company’s financial statements inthe comparable prior-year period to determine what the current-period U.S. dollar operating results would have been if thecurrency exchange rate had not changed from the comparable prior-year period.

OUTLOOK

The company’s outlook for 2022 Organic Net Revenue growth, Adjusted EPS growth on a constant currency basis and FreeCash Flow are non-GAAP financial measures that exclude or otherwise adjust for items impacting comparability of financialresults such as the impact of changes in currency exchange rates, restructuring activities, acquisitions and divestitures. Thecompany is not able to reconcile its projected Organic Net Revenue growth to its projected reported net revenue growth for thefull-year 2022 because the company is unable to predict during this period the impact from potential acquisitions ordivestitures, as well as the impact of currency translation due to the unpredictability of future changes in currency exchangerates, which could be material as a significant portion of the company’s operations are outside the U.S. The company is not ableto reconcile its projected Adjusted EPS growth on a constant currency basis to its projected reported diluted EPS growth for thefull-year 2022 because the company is unable to predict during this period the timing of its restructuring program costs, mark-to-market impacts from commodity and forecasted currency transaction derivative contracts and impacts from potentialacquisitions or divestitures as well as the impact of currency translation due to the unpredictability of future changes incurrency exchange rates, which could be material as a significant portion of the company’s operations are outside the U.S. Thecompany is not able to reconcile its projected Free Cash Flow to its projected net cash from operating activities for the full-year2022 because the company is unable to predict during this period the timing and amount of capital expenditures impacting cashflow. Therefore, because of the uncertainty and variability of the nature and amount of future adjustments, which could besignificant, the company is unable to provide a reconciliation of these measures without unreasonable effort.

Tags

A propos de Mondelēz International en France

Mondelēz International est l’un des leaders mondiaux de l’industrie agroalimentaire, et, en France, le numéro 1 sur le marché des biscuits. Le groupe est présent dans 93% des foyers français et sur tous les circuits de distribution grâce à ses marques emblématiques comme LU, Milka, Belin, Côte d’Or et Hollywood et à ses innovations. Avec environ 3000 collaborateurs, répartis sur 12 sites dont 9 sites de production, la France est l’une des plateformes de croissance essentielles du groupe.

Pour plus d’information, consultez les sites www.mondelezinternational.com ou www.mynewsdesk.com/fr/mondelez-france et www.facebook.com/mondelezinternational ou suivez-nous sur Twitter @MDLZ.