Communiqué de presse -

Mondelēz International Reports Q2 2022 Results

MDLZ Q2 2022 Earnings Release Content

Second Quarter Highlights

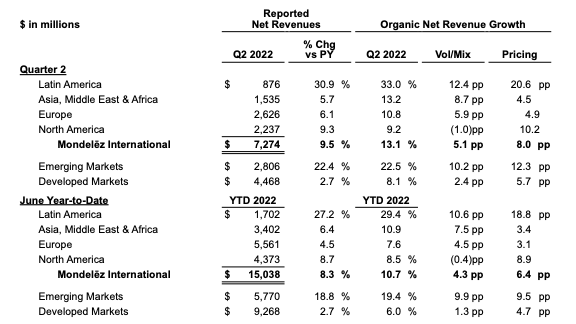

Net revenues increased +9.5% driven by Organic Net Revenue1 growth of +13.1% with underlyingVolume/Mix of +5.1%

Diluted EPS was $0.54, down 28.9%; Adjusted EPS1 was $0.67, up +9.1% on a constant-currency basis

Year-to-date cash provided by operating activities was $2.0 billion, an increase of +$0.2 billionversus prior year; Free Cash Flow1 was $1.6 billion, +$0.2 billion

Return of capital to shareholders was $2.5 billion in the first half of the year

-

Announced agreement to acquire Clif Bar, a leader in high growth, well-being snack bars, creating

a $1+ billion global snack bar business

Announcing +10% increase to quarterly dividend

-

Raising Organic Net Revenue growth outlook for full year to 8%+

CHICAGO, Ill. – July 26, 2022 – Mondelēz International, Inc. (Nasdaq: MDLZ) todayreported its second quarter 2022 results.

"Our second quarter and first half results were marked by strong top and bottom-lineperformance across all regions and categories, supporting the raising of our full-year revenuegrowth outlook," said Dirk Van de Put, Chairman and Chief Executive Officer. "Our chocolateand biscuit businesses continue to demonstrate strong volume growth and pricing resilienceacross both developed and emerging markets. These results combined with ongoing costdiscipline, simplification and revenue growth management are delivering robust profit dollargrowth and strong cash flow, enabling us to increase our dividend by 10 percent.

We also continue to execute against our strategy of accelerating our core business whilereshaping our portfolio, most recently with our agreement to acquire Clif Bar, a leader in highgrowth, well-being snack bars, creating a $1 billion-plus snack bar business. Clif Bar has theleading position in the U.S. protein and nutrition segments with clear opportunities to expand

domestic and international distribution, velocities and profitability to create significant value forour shareholders in the years to come.”

Second Quarter Commentary

Net revenues increased 9.5 percent driven by Organic Net Revenue growth of 13.1 percent, andincremental sales from the company's acquisition of Chipita, partially offset by unfavorablecurrency. Pricing and volume drove Organic Net Revenue growth.

Gross profit increased $10 million, while gross profit margin decreased 330 basis points to 36.3percent primarily driven by the decrease in Adjusted Gross Profit1 margin and lower mark-to-market gains from derivatives. Adjusted Gross Profit increased $257 million at constant currency,while Adjusted Gross Profit margin decreased 210 basis points to 37.9 percent due to higher rawmaterial and transportation costs and unfavorable mix, partially offset by pricing and volumeleverage.

Operating income increased $55 million and operating income margin was 12.7 percent, down40 basis points primarily due to lower mark-to-market gains from derivatives, lower AdjustedOperating Income1 margin and higher acquisition integration costs, partially offset by lowerrestructuring costs and lapping prior-year pension participation changes. Adjusted OperatingIncome increased $91 million at constant currency while Adjusted Operating Income margindecreased 110 basis points to 15.1 percent, with input cost inflation and unfavorable mix, mostlyoffset by pricing and SG&A leverage.

Diluted EPS was $0.54, down 28.9 percent, primarily due to lapping a prior-year net gain onequity method transactions, an unfavorable year-over-year change in mark-to-market impactsfrom derivatives and higher acquisition integration costs, partially offset by lower restructuringcosts, lower negative impacts from enacted tax law changes, lapping a prior-year intangible assetimpairment charge, lapping a prior-year unfavorable impact of pension participation changes andan increase in Adjusted EPS.

Adjusted EPS was $0.67, up 9.1 percent on a constant-currency basis driven by strong operatinggains, lower taxes and fewer shares outstanding, partially offset by higher interest expense andlower income from equity method investments.

Capital Return: The company returned $1.2 billion to shareholders in cash dividends and sharerepurchases. Today, the company’s Board of Directors declared a quarterly cash dividend of$0.385 per share of Class A common stock, an increase of 10 percent. This dividend is payableon October 14, 2022, to shareholders recorded as of September 30, 2022.

2022 Outlook

Mondelēz International provides its outlook on a non-GAAP basis, as the company cannot predictsome elements that are included in reported GAAP results, including the impact of foreign exchange.Refer to the Outlook section in the discussion of non-GAAP financial measures below for more details.

The company is updating its fiscal 2022 outlook to reflect expectations for continued top-linegrowth, higher cost of goods sold inflation, the timing effect of additional pricing actions and the impact ofthe war in Ukraine.

For 2022, the company now expects 8+ percent Organic Net Revenue growth, which reflects thestrength of its first half and higher pricing related to increased input costs. The company's expectation ofmid-to-high single digit Adjusted EPS growth on a constant currency basis remains unchanged. Thecompany's Free Cash Flow outlook remains at $3+ billion. The company estimates currency translationwould decrease 2022 net revenue growth by approximately 5 percent3 with a negative $0.22 impact toAdjusted EPS3.

Outlook is provided in the context of greater than usual volatility as a result of COVID-19 andgeopolitical uncertainty.

Conference Call

Mondelēz International will host a conference call for investors with accompanying slides toreview its results at 5 p.m. ET today. A listen-only webcast will be provided atwww.mondelezinternational.com. An archive of the webcast will be available on the company’s web site.

About Mondelēz International

Mondelēz International, Inc. (Nasdaq: MDLZ) empowers people to snack right in over 150countries around the world. With 2021 net revenues of approximately $29 billion, MDLZ is leading thefuture of snacking with iconic global and local brands such as Oreo, belVita and LU biscuits; CadburyDairy Milk, Milka and Toblerone chocolate; Sour Patch Kids candy and Trident gum. MondelēzInternational is a proud member of the Standard and Poor’s 500, Nasdaq 100 and Dow JonesSustainability Index. Visit www.mondelezinternational.com or follow the company on Twitter atwww.twitter.com/MDLZ.

End Notes

Organic Net Revenue, Adjusted Gross Profit (and Adjusted Gross Profit margin), AdjustedOperating Income (and Adjusted Operating Income margin), Adjusted EPS, Free CashFlow and presentation of amounts in constant currency are non-GAAP financial measures.Please see discussion of non-GAAP financial measures at the end of this press release formore information.

Earnings attributable to Mondelēz International.

Currency estimate is based on published rates from XE.com on April 20, 2022.

Additional Definitions

Emerging markets consist of the Latin America region in its entirety; the Asia, Middle East andAfrica region excluding Australia, New Zealand and Japan; and the following countries from the Europeregion: Russia, Ukraine, Türkiye, Kazakhstan, Georgia, Poland, Czech Republic, Slovak Republic,Hungary, Bulgaria, Romania, the Baltics and the East Adriatic countries.

Developed markets include the entire North America region, the Europe region excluding thecountries included in the emerging markets definition, and Australia, New Zealand and Japan from theAsia, Middle East and Africa region.

Forward-Looking Statements

This press release contains a number of forward-looking statements. Words, and variations ofwords, such as “will,” “may,” “expect,” “would,” “could,” “might,” “intend,” “plan,” “believe,” “likely,”“estimate,” “anticipate,” “objective,” “predict,” “project,” “seek,” “aim,” “potential,” “outlook” and similarexpressions are intended to identify our forward-looking statements, including but not limited tostatements about: the impact on our business of the war in Ukraine and current and future sanctionsimposed by governments or other authorities, including the impact on matters such as costs, markets, theglobal economic environment, availability of commodities, demand, supplying our Ukraine business'scustomers and consumers, impairments, continuation of and our ability to control our operating activitiesand businesses in Russia and Ukraine, and our operating results; the impact of the COVID-19 pandemicand related disruptions on our business including consumer demand, costs, product mix, our strategicinitiatives, our and our partners’ global supply chains, operations, technology and assets, and ourfinancial performance; price volatility, inflation and pricing actions; our future performance, including ourfuture revenue and earnings growth; our strategy to accelerate consumer-centric growth, driveoperational excellence, create a winning growth culture and scale sustainable snacking; plans to reshapeour portfolio and extend our leadership positions in chocolate and biscuits as well as baked snacks; plansto further enable our growth by investing in our strong and inclusive talent, brand portfolio and digitaltechnologies and skills, as well as our sales and marketing capabilities; plans to divest our developedmarket gum and global Halls candy businesses; anticipated closing of planned acquisitions of Clif Barand Ricolino; our leadership position in snacking; volatility in global consumer, commodity, transportation,labor, currency and capital markets; the cost environment, including higher labor, customer service,commodity, operating, transportation and other costs; factors affecting costs and measures we are takingto address increased costs; supply, transportation and labor disruptions and constraints; consumerbehavior, consumption and demand trends and our business in developed and emerging markets, ourchannels, our brands and our categories; our tax rate, tax positions, tax proceedings, tax liabilities,valuation allowances and the impact on us of potential U.S. and global tax reform; advertising andpromotion bans and restrictions in the U.K.; the costs of, timing of expenditures under and completion of

our restructuring program; consumer snacking behaviors; commodity prices, supply and availability; ourinvestments and our ownership interests in those investments, including JDE Peet's and KDP;innovation; political, business and economic conditions and volatility; currency exchange rates, controlsand restrictions, volatility in foreign currencies and the effect of currency translation on our results ofoperations; the application of highly inflationary accounting for our subsidiaries in Argentina and Türkiyeand the potential for and impacts from currency devaluation in other countries; the outcome and effectson us of legal proceedings and government investigations; the estimated value of goodwill and intangibleassets; amortization expense for intangible assets; impairment of goodwill and intangible assets and ourprojections of operating results and other factors that may affect our impairment testing; our accountingestimates and judgments and the impact of new accounting pronouncements; pension expenses,contributions and assumptions; our ability to prevent and respond to cybersecurity breaches anddisruptions; our liquidity, funding sources and uses of funding, including debt issuances and our use ofcommercial paper and international credit lines; our capital structure, credit availability and our ability toraise capital, and the impact of market disruptions on us, our counterparties and our business partners;the planned phase out of London Interbank Offered Rates and transition to other interest ratebenchmarks; our risk management program, including the use of financial instruments and the impactsand effectiveness of our hedging activities; working capital; capital expenditures and funding; funding ofdebt maturities, acquisitions and other obligations; share repurchases; dividends; long-term value for ourshareholders; guarantees; the characterization of 2022 distributions as dividends; compliance with ourdebt covenants; and our contractual and other obligations.

These forward-looking statements involve risks and uncertainties, many of which are beyond ourcontrol, and many of these risks and uncertainties are currently amplified by and may continue to beamplified by the COVID-19 pandemic, including the spread of new variants of COVID-19. Importantfactors that could cause our actual results to differ materially from those described in our forward-lookingstatements include, but are not limited to, the impact of ongoing or new developments in the war inUkraine, related current and future sanctions imposed by governments and other authorities, and relatedimpacts on our business, growth, employees, reputation, prospects, financial condition, operating results(including components of our financial results), cash flows and liquidity; uncertainty about theeffectiveness of efforts by health officials and governments to control the spread of COVID-19 andinoculate and treat populations impacted by COVID-19; uncertainty about the reimposition or lessening ofrestrictions imposed by governments intended to mitigate the spread of COVID-19 and the magnitude,duration, geographic reach and impact on the global economy of COVID-19; the ongoing, and uncertainfuture, impact of the COVID-19 pandemic on our business, growth, employees, reputation, prospects,financial condition, operating results (including components of our financial results), cash flows andliquidity; risks from operating globally including in emerging markets; changes in currency exchangerates, controls and restrictions; volatility of commodity and other input costs and availability of commodities; weakness in economic conditions; weakness in consumer spending; inflation; pricingactions; tax matters including changes in tax laws and rates, disagreements with taxing authorities andimposition of new taxes; use of information technology and third-party service providers; unanticipateddisruptions to our business, such as malware incidents, cyberattacks or other security breaches, and ourcompliance with privacy and data security laws; global or regional health pandemics or epidemics,including COVID-19; competition and our response to channel shifts and pricing and other competitivepressures; promotion and protection of our reputation and brand image; changes in consumerpreferences and demand and our ability to innovate and differentiate our products; the restructuringprogram and our other transformation initiatives not yielding the anticipated benefits; changes in theassumptions on which the restructuring program is based; management of our workforce and shifts inlabor availability; consolidation of retail customers and competition with retailer and other economybrands; changes in our relationships with customers, suppliers or distributors; compliance with legal,regulatory, tax and benefit laws and related changes, claims or actions; the impact of climate change onour supply chain and operations; our ability to complete, manage and realize the full extent of thebenefits, cost savings or synergies presented by strategic transactions, including our plannedacquisitions of Clif Bar and Ricolino and our recently completed acquisitions of Chipita, Gourmet Foodand Grenade; our ability to access the debt capital markets to fund a portion of the consideration to fundthe pending acquisitions of Clif Bar and Ricolino; significant changes in valuation factors that mayadversely affect our impairment testing of goodwill and intangible assets; perceived or actual productquality issues or product recalls; failure to maintain effective internal control over financial reporting ordisclosure controls and procedures; volatility of and access to capital or other markets, the effectivenessof our cash management programs and our liquidity; pension costs; the expected discontinuance ofLondon Interbank Offered Rates and transition to any other interest rate benchmark; our ability to protectour intellectual property and intangible assets; and the risks and uncertainties, as they may be amendedfrom time to time, set forth in our filings with the U.S. Securities and Exchange Commission, including ourmost recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q for the period endedMarch 31, 2022. There may be other factors not presently known to us or which we currently consider tobe immaterial that could cause our actual results to differ materially from those projected in any forward-looking statements we make. We disclaim and do not undertake any obligation to update or revise anyforward-looking statement in this press release except as required by applicable law or regulation.

Tags

A propos de Mondelēz International en France

Mondelēz International est l’un des leaders mondiaux de l’industrie agroalimentaire, et, en France, le numéro 1 sur le marché des biscuits. Le groupe est présent dans 93% des foyers français et sur tous les circuits de distribution grâce à ses marques emblématiques comme LU, Milka, Belin, Côte d’Or et Hollywood et à ses innovations. Avec environ 3000 collaborateurs, répartis sur 12 sites dont 9 sites de production, la France est l’une des plateformes de croissance essentielles du groupe.

Pour plus d’information, consultez les sites www.mondelezinternational.com ou www.mynewsdesk.com/fr/mondelez-france et www.facebook.com/mondelezinternational ou suivez-nous sur Twitter @MDLZ.