Blog post -

Discover Why 678 Global Companies Chose Osaka: Your Strategic Hub in Asia

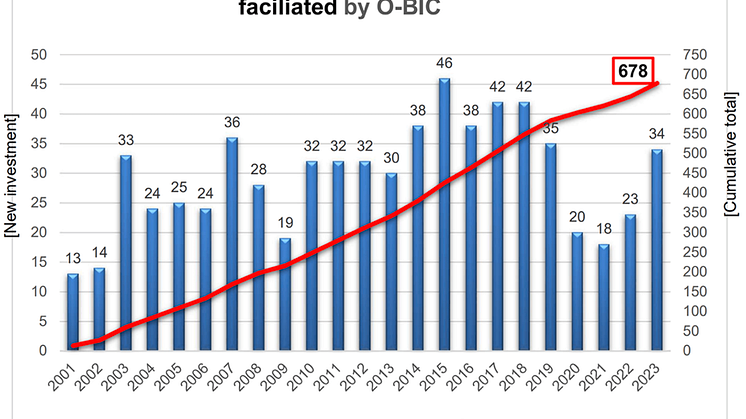

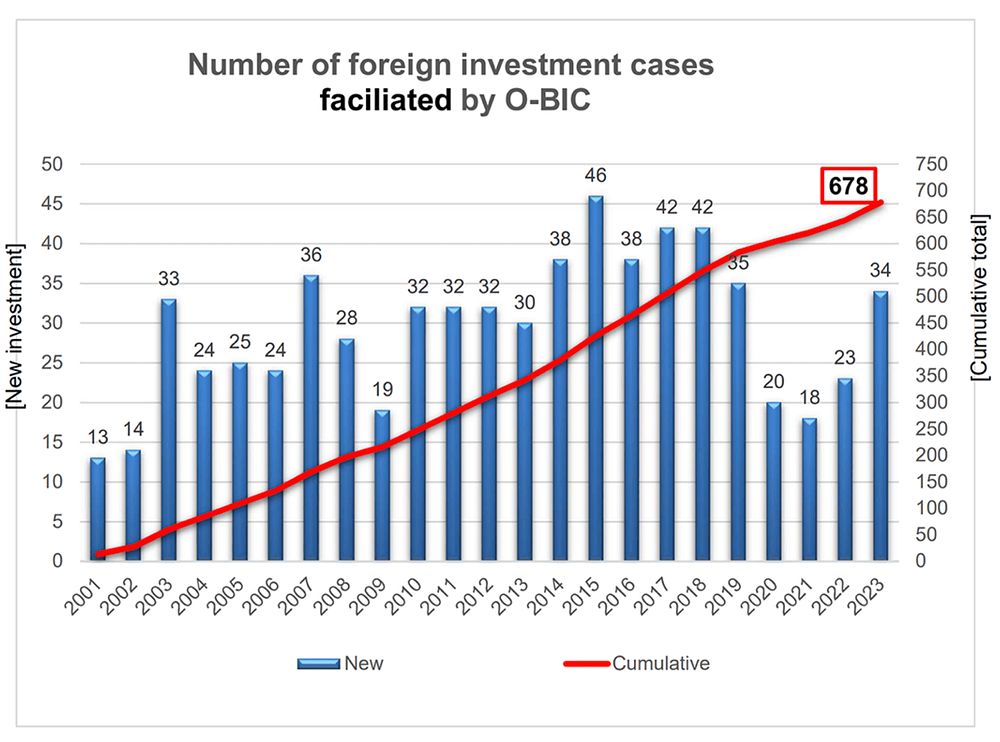

At the crossroads of Asian commerce, Osaka continues to attract global businesses seeking strategic advantages in the Japanese market. Since 2001, 678 international companies have discovered what makes our city unique: a perfect blend of innovation, support, and opportunity. Here's why leading companies are making Osaka their home in Asia.

Your Partner in Business Success, O-BIC

The journey of establishing a business in a new country requires more than just capital—it demands reliable partnerships and expert guidance. This understanding led to the creation of the Osaka Business and Investment Center (O-BIC) in 2001, a unique collaboration between the Osaka Prefectural Government, Osaka City Government, and the Osaka Chamber of Commerce and Industry.

"As a comprehensive investment service center, O-BIC offers detailed support to potential foreign investors. International corporations, foreign government offices, economic organizations, and Japan-based foreign companies can use our center for vital advice and accurate information on entering the Osaka market."

Why Osaka? Strategic Advantages That Matter

Gateway to Innovation

- Strong research and development ecosystem

- Vibrant startup community

- Access to skilled workforce and technical expertise

- Strategic location in the heart of Japan

Comprehensive Support System

- Business Setup Assistance

- One-stop consultation services

- Expert guidance through registration process

- Connection to local business networks

- Support in finding ideal business locations

- Long-term Growth Support

- Industry-specific expertise and guidance

- Access to local business partnerships

- Research and development collaboration opportunities

- Regular business matching events

Practical Support for Your Business

To ensure a smooth entry into the Osaka market, we offer various support programs tailored to your needs:

- Initial Setup Support: Through O-BIC's support program, companies with one-third or more foreign capital can receive assistance for corporate registration expenses

- Location Support: Subsidies available for both building acquisition and leasing, helping you find the perfect base for your operations

- R&D Investment: Special support for companies establishing research facilities, encouraging innovation and development

- Tax Benefits: Various tax reduction programs available for qualifying businesses, especially in emerging sectors like new energy and life sciences

Future-Focused Infrastructure

- Advanced telecommunications networks

- World-class transportation systems

- Modern office facilities and research centers

- Sustainable urban development initiatives

Special Focus: Emerging Industries

As we look toward Expo 2025 Osaka, Kansai, we're particularly focused on supporting companies in:

- New Energy Solutions

- Life Sciences

- Financial Innovation

- Digital Technology

- Sustainable Development

Breaking Down the Benefits: Your Investment Advantage

Immediate Support for New Establishments

- Quick-Start Grant: Up to ¥100,000 for corporate registration costs

- Eligibility: Foreign capital ratio of one-third or more

- Timeline: Simple 60-day application process from registration

Osaka Prefecture Subsidy:

(i) Foreign-affiliated company establishing a business with headquarter functions in Osaka Prefecture.

- Acquiring a Building : 5% of the cost of the house or depreciable assets is subsidized (up to 100 million yen).

- Leasing a Building: one-third of the rent and other costs (24 months worth) is subsidized (up to 60 million yen)

(ii)Small or medium-sized companies newly building or expanding factories or research and development facilities.

- 5% of the cost for building and machinery equipment is subsidized (10% in the case of companies having their head office, factory, or research and development facility in Osaka Prefecture) (up to 30 million yen).

Tax incentives in Osaka Prefecture and Osaka City

Companies engaged in pioneering projects related to new energy and life sciences

Prefecture Level:

Real estate acquisition tax will be reduced by up to 100%. Prefectural inhabitant tax for corporations and corporate business tax will be reduced by up to 100% for the first 5 years and will be reduced by up to 50% for the subsequent 5 years.

City Level:

City inhabitant tax for corporations, business office tax, fixed asset tax and city planning tax be reduced by up to 100% for the first 5 years and will be reduced by up to 50% for the subsequent 5 years.

Learn more about the latest Subsidy Programs:

https://o-bic.net/e/incentive/

Support for the financial sector will be introduced in the coming article.

Success Through Partnership

Our track record speaks for itself: from 2001 to 2023, O-BIC helped 678 companies establish and grow their presence in Osaka. Each success story represents a unique journey, supported by our comprehensive understanding of both international business needs and local market dynamics.

Your Next Steps

Ready to explore your investment potential in Osaka? Our dedicated team at O-BIC is prepared to guide you through every step of your journey, from initial consultation to successful establishment and beyond.

Whether you're considering your first step into the Japanese market or expanding your existing operations, Osaka offers the perfect blend of opportunity, support, and growth potential. Connect with O-BIC today to begin your success story in Japan's most business-friendly city.