5 Points to Consider Before Shifting Your Strategy

This is the question that founders, CEOs, entrepreneurs, owners or anyone responsible for a business is asking all the time: “Do we have the right strategy?”

This is the question that founders, CEOs, entrepreneurs, owners or anyone responsible for a business is asking all the time: “Do we have the right strategy?”

We have changed our name to Standout Capital, and just wanted to write a short blog post to explain why, in case anyone is wondering.

Investments to maximize short-term return on capital will not create long-term growth and jobs – and not even return on capital. This is a dilemma, but today’s super-dynamic tech industry might offer the unique combination of both fast capital returns, and simultaneous rapid new market creations from innovations.

Ben Horowitz’ book The Hard Thing About Hard Things is about being a CEO in struggling tech companies, and what he learnt the hard way. Here are our top 10 insights from this amazing story.

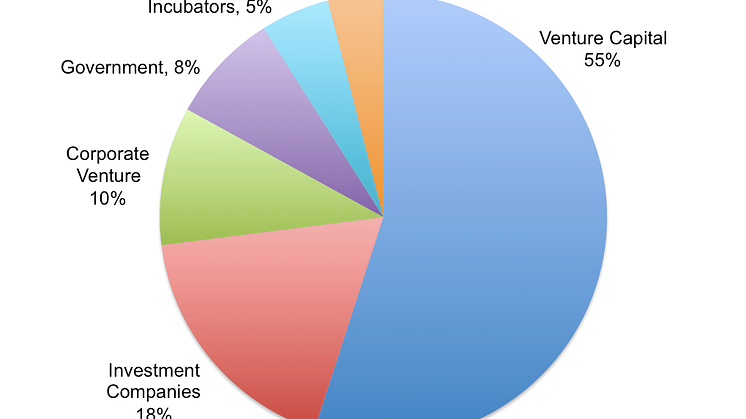

There are at least 120 tech investors active in the Nordics. What does this diverse landscape really look like? Here are some of the findings.

In 2014 we wrote a series of blog posts about the startup boom and changing face of VC in Stockholm and the Nordics. But who are actually the players investing in the Nordic tech boom? Venture Capital firms, investment companies, incubators, angel networks, corporate venture and government agencies. Our team made some research and created the Nordic 100 Tech Investor list.

Maybe it’s not a Stockholm syndrome, but a European dilemma. According to a recent article in The Economist about venture capital in Europe, “the rule of thumb is that young American firms raise twice as much money in each round of financing as European ones – and twice as fast.

At the beginning of 2000, venture capital skyrocketed in Sweden and all over the Western world, then dropped in the first years of the new decade. Most VC markets then stabilized although they keep on struggling.

Around Stockholm, startup hubs, activities, spaces and incubators are now emerging, driven by need for access to office space, networks and getting together with other talents to build amazing new things.

There is a Silicon Alley in New York, a Silicon Beach in Los Angeles and a Silicon Roundabout in London. There is no Silicon Archipelago here, but a hashtag and a movement that has grown from the grassroots of Stockholm’s startup community: #sthlmtech.

Venture Capital is a new software industry. I do not only mean that it’s a new market for smart tools like Visible for running VC funds, but that VC companies themselves are becoming tech startups. Please let me highlight five points why.