Blog post -

Non-recurring business is compounding woes for USA SMEs

Small businesses routinely face late payments from customers. In the United States, around 4.4 million operational small and medium enterprises (SMEs) received at least one late payment in 2020. Many SMEs saw delayed payments from non-recurring customers — those they do business once or just a few times every year, also known as ad-hoc business. Even worse, these SMEs are paying to get these invoices paid quickly.

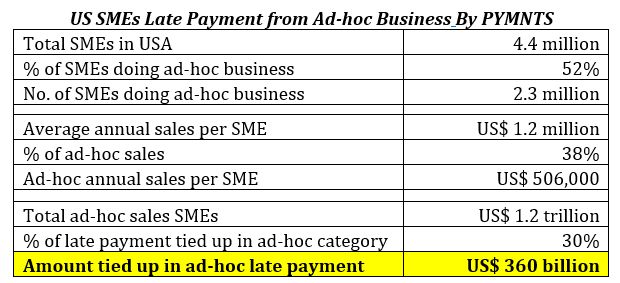

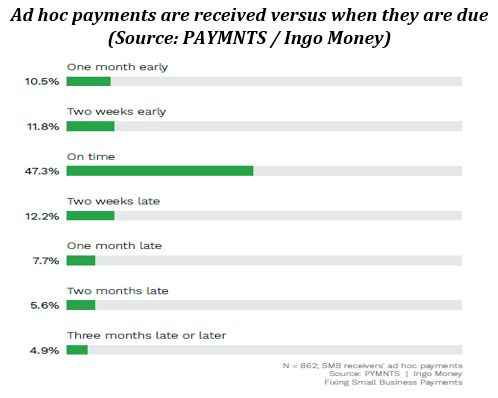

A study by PYMNTS.com and Ingo Money reveals that half of US SMEs have conducted ad-hoc business, which contributes about 38% to their annual sales. Such ad-hoc business adds up to an estimated US$1.2 trillion, of which 30% or USS$360 billion is paid late by customers. To get these payments, SMEs are willing to offer discounts to these late-paying customers that are as high as 4.5%.

Too much dependency on ad-hoc payments is a double-edged sword. It may increase SMEs’ turnover but can also impact cash flows if these invoices are paid late. SMEs have less bargaining power when it comes to persuading these customers to make payments according to terms, due to the irregular nature of such business. In other words, such customers may find it easier to default, since they have less long-term reliance on these SMEs. And because SMEs have limited contact with such customers, they also may not have enough knowledge of whether these customers are likely to pay on time.

In such cases, RIABU can help. We aim to give small businesses more tools when dealing with known and unknown customers, with the goal of getting paid on time.

RIABU’s registered users give their customers ratings and share their past payment track record on our platform. By aggregating this data anonymously, RIABU can assess when a customer is likely to settle their invoices.

When a new registered user logs onto RIABU, he/she can thus access insights into the past payment conduct of prospective and existing customers, and how long they are likely to take to pay their invoices, based on the experiences of other suppliers. This can help you in managing your working capital cycle.

RIABU also helps you to get paid on time in the future, by giving you access to the RIABU Academy. There you can find expert advice, best practice guides and peer forums to improve your policies and processes and ensure you get paid faster.

Get more tips on effective cash flow management from our book, Let the Cash Flow. To find out more about how RIABU helps small businesses get paid on time, visit RIABU.com

Topics

- Business enterprise, General

Categories

- prompt payment code

- accounts receivable

- simon littlewood

- riabu

- sme

- mark laudi

- risk

- cash flow

- late payments