Blog post -

The outlook for global insolvencies in 2022

As the Covid-19 pandemic unfolded, governments and central banks all over the world acted swiftly, using massive amounts of monetary and policy support to prevent insolvencies. As a result, bankruptcies declined dramatically in 2020 as compared to 2019.

This was a repeat of the playbook used during the Global Finance Crisis in 2009. However, this time around, the temporary suppression of insolvencies may not last longer as central banks have to make a difficult choice to either encourage growth through expansionary policies or control inflation by gradually withdrawing support.

Want to know more about this topic? Listen to RIABU's Simon Littlewood and Mark Laudi discuss this issue on our podcast, Be First In Line To Get Paid:

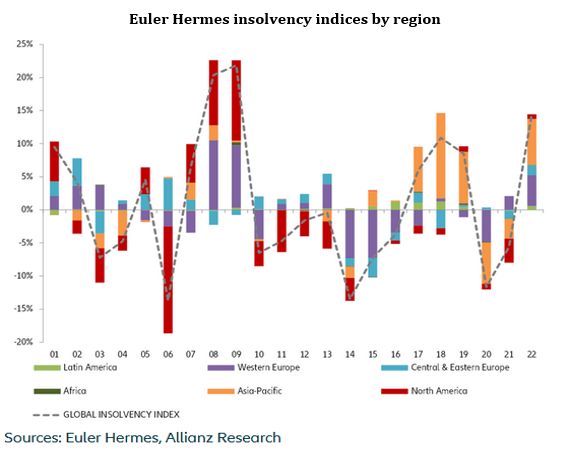

Euler Hermes, in its recently published Global Insolvency report, has projected a double-digit growth in insolvencies by the end of 2022. Its Global Insolvency Index is expected to grow 15% by the end of 2022, when compared with 2021.

Just before the onset of the pandemic, Euler Hermes’ regional insolvency indices had highlighted the shift of bankruptcy trends from North America and Europe to the Asia-Pacific region.

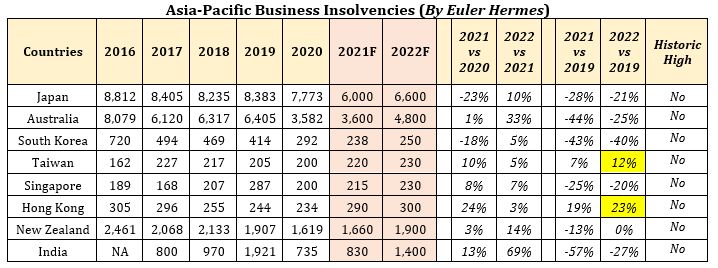

How have the past two years changed the landscape? Currently, Euler Hermes’ index for country-wise insolvencies shows an uneven outlook.

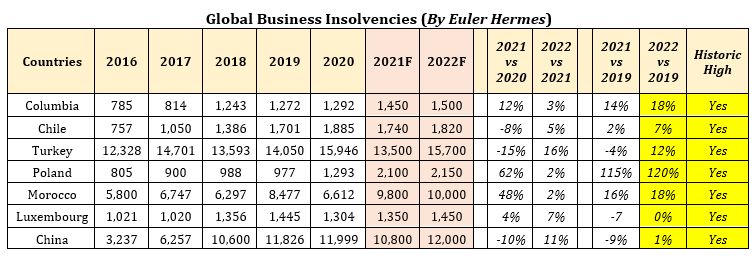

In countries including Colombia, Chile, Turkey, Poland, and Morocco, insolvencies are expected to exceed pre-pandemic levels and reach historically high levels in 2022. China is also in this list.

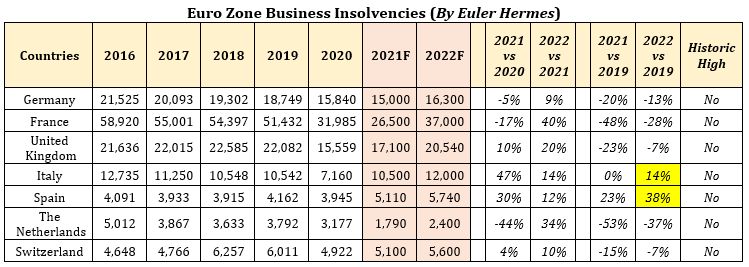

The Eurozone is expected to post a mixed trend. Spain and Italy are likely to see a large recovery of insolvencies by 2022. In contrast, France, Germany, and the Netherlands will take longer to return to pre-crisis levels.

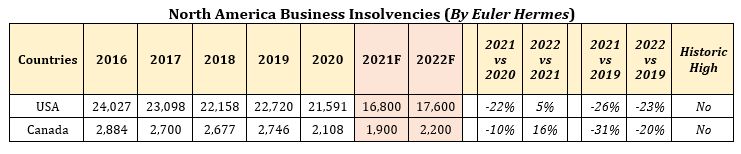

Notably, the United States has a low number of insolvencies likely both in 2021 and 2022, mainly due to the combination of massive support and quicker economic rebound.

Asia will also record less insolvencies in 2022, thanks to its faster exit from the pandemic and its economic recovery. But Hong Kong and Taiwan are expected to exceed 2019 insolvency levels.

Euler Hermes cites several factors in play that could lead to differing trends in insolvencies. Firstly, the global momentum of the economic rebound may lead to the removal of support measures, and in turn, impact the pace of business insolvency.

Many fragile companies will still be at high risk of default, notably the pre-Covid-19 ‘zombies’ kept afloat by emergency measures and the companies weakened by extra indebtedness from the crisis. The deterioration of companies’ financials will also be adding to debt sustainability issues. As companies prepare to greet a new year with more uncertainties, it is more important than ever to get their cash flow processes in order so that their businesses can stay standing.

Get more tips on effective cash flow management from our book, Let The Cash Flow. To find out more about how RIABU helps small businesses get paid on time, visit RIABU.com

Topics

- Business enterprise, General