Blog post -

Singapore vs Hong Kong: Which city's SMEs are better at getting paid on time?

Singapore and Hong Kong have economies of roughly the same size, but Singapore is way behind when it comes to paying SMEs on time.

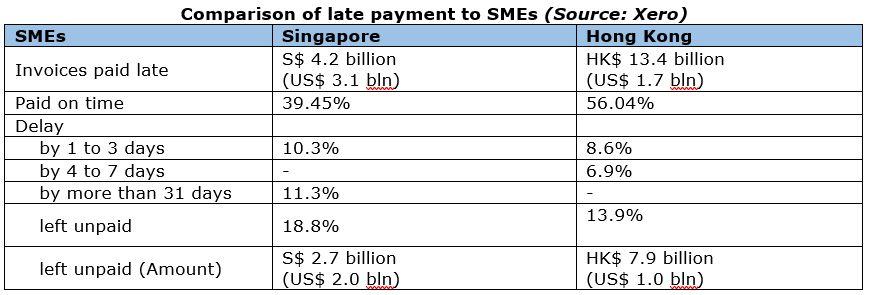

Xero, an accounting software company, revealed that US$3 billion worth of bills were unpaid to SMEs in Singapore, compared to Hong Kong's US$1.7 billion. Only 39.45% of payments to Singapore SMEs are made on time, while 56.04% of payments to Hong Kong SMEs are made on time.

Want to know more about this topic? Listen to RIABU's Simon Littlewood and Mark Laudi discuss this issue on our podcast, Be First In Line To Get Paid:

In Hong Kong, payments are most often late by one to three days (8.63%) or four to seven days (6.93%). But Singapore SMEs faces higher instances of payments that are late by one to three days (10.32%), as well as more than 31 days (11.32%).

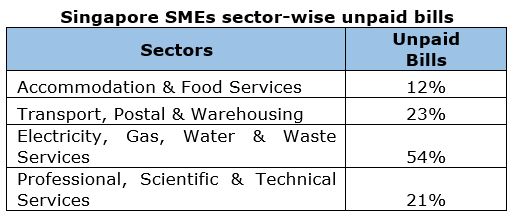

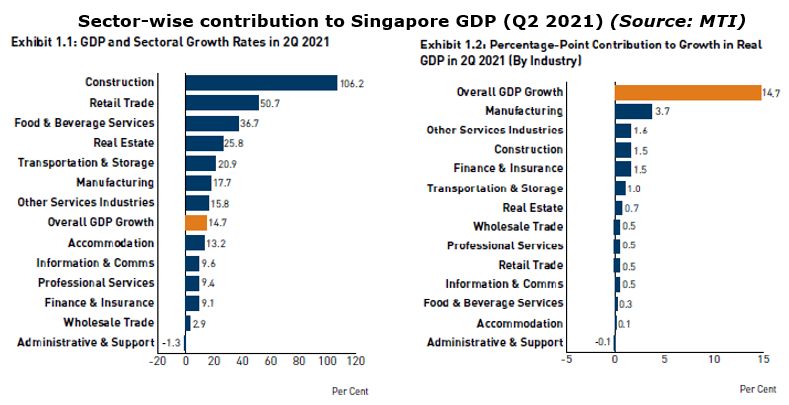

In Singapore, the Agriculture, Forestry & Fishing sector has the highest rate of on-time payments. But this is not a major sector — it contributes less than 1% to the country’s GDP. Meanwhile, sectors which do contribute significantly to the Singapore economy have the highest rate of unpaid invoices.

Late payments can have serious consequences for businesses, including cash flow issues and an inability to raise capital. Past research from Xero has also revealed that late payments to small businesses resulted in backlog of work, reduced productivity and reduced morale of employees and struggles to pay staff. If these small businesses are held back from growing and flourishing, this may have repercussions on a country's economy as well in the long run.

So, what can SMEs do to get paid on time?

RIABU believes in the concept of customer intimacy, which means understanding the needs, wants, and opinions of customers, with the goal of nurturing a long-term relationship. Through close communication, you will be better able to help them get the most out of your products or services. This relationship-building process is a core element of the Virtuous Revenue Cycle, which aims to improve your Days Sales Outstanding metric and ensure that you get paid on time.

Small business owners should think about invoicing and payment terms at the very beginning of the contract and take actions action to reduce late payment volumes by invoicing correctly and on time and adhering to any specific requirements their customers may have. It would be even better if you focus on 20% of your largest customer very early on in the payment cycle. If your relationship is right, you are more likely to get paid on time. And if you apply this method over time, you gradually educate your customer in a gentle loving way that you are not going to leave them alone.

Get more tips on effective cash flow management from our book, Let The Cash Flow. To find out more about how RIABU helps small businesses get paid on time, visit RIABU.com

Topics

- Business enterprise, General

Categories

- xero

- sme

- singapore

- cash flow

- mark laudi

- riabu