Blog post -

Why Days Sales Outstanding (DSO) is an important metric for businesses to track

The main goal of any business or entrepreneur is to sell goods and services, and earn profits from it. But tracking the monetary value of your revenue is not enough. We believe all businesses need to also keep track of another important metric — Days Sales Outstanding (DSO). This refers to the number of days it takes your business to collect its payments due from customers for completed orders, based on an average days sale.

Why is DSO critical?

A growing business which sells on credit will see the value of its receivables increase, even if all customers pay to the agreed credit terms.

So the total monetary value of receivables is not an accurate guide to how effective you are at collecting the money due to you. DSO, a measure normalised for sales, is the metric you need.

Imagine you have started a new business that makes furniture. You receive an order worth $5,000 from a company to deliver 20 chairs. As you are a new vendor for the company, it does not provide you with any upfront payment. However, you honour the order and transport the chairs to the company a few days later. But you won’t receive your payment upon delivery.

This is because the company ordering the chairs follows certain policies and procedures for making payments to its vendors. So it will take 15 days for the company to finalise the payment to any vendor.

As a result, your order becomes a sale on credit. Since the full order was on credit, the whole amount also becomes receivables (payments owed to you and not yet received).

Let's assume you don’t take any new orders from any new customers until the payment from the first order is received. That is, you wait for 15 days to receive $5,000. This waiting period is called Days Sales Outstanding (DSO).

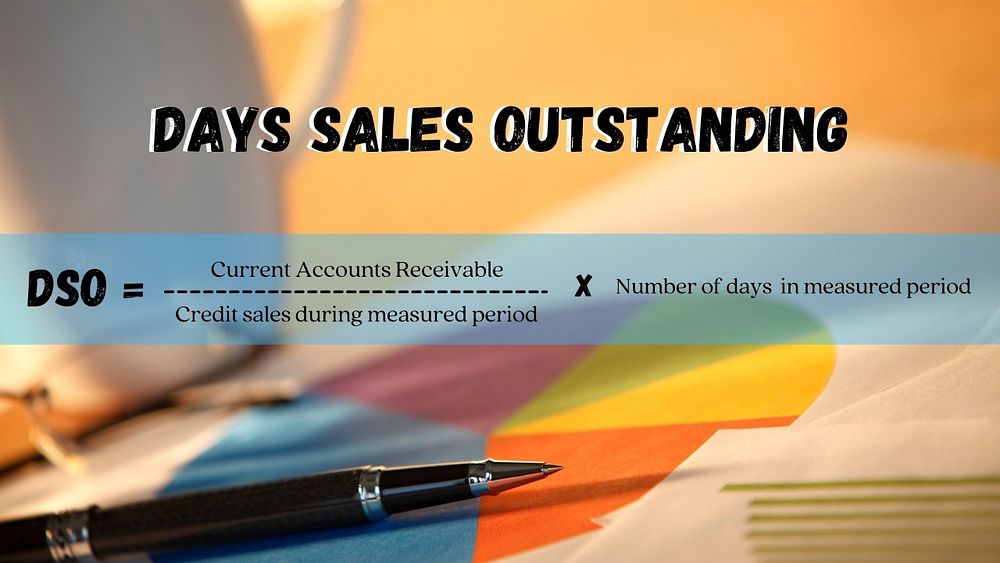

Here's how you calculate DSO:

(It is important to note that only credit sales are considered while calculating the DSO, as payments for cash sales are received upon delivery and thus don’t involve a waiting period.)

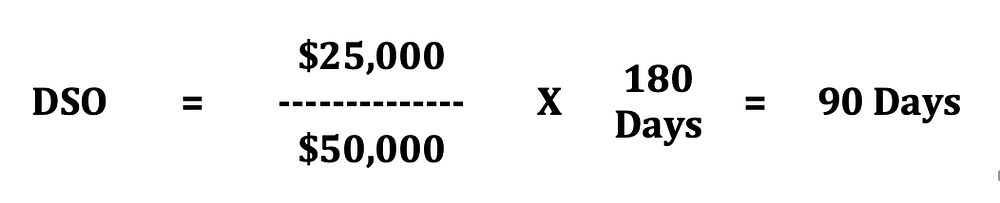

Now, let’s say you made $50,000 worth of credit sales in the last six months and you have $25,000 worth of receivables outstanding. Your DSO turns out to be 90 days.

Tracking the monetary value of sales alone does not give a business a good idea of how well it manages its cash flow from accounts receivable. DSO does. As a business owner, your aim should be to have the lowest possible DSO in order to improve your liquidity position.

Topics

- Business enterprise, General

Categories

- accounts receivable

- days sales outstanding