Storebrand expands its Nordic Real Estate Team

Storebrand Asset Management continues to expand in the Nordics and strengthens its Real Estate team with the hire of two senior Portfolio Managers and a senior analyst.

Storebrand Asset Management continues to expand in the Nordics and strengthens its Real Estate team with the hire of two senior Portfolio Managers and a senior analyst.

Storebrand Asset Management recognized net revenue of NOK 576 million for the fourth quarter of 2022, including performance revenues realized at year end. During the quarter, we generated net inflows of NOK 8 billion, ending the period with NOK 1020 billion in Assets under Management (AuM), a net decline of NOK 77 billion or 7% in 2022.

Storebrand has had its emissions reduction targets approved by the Science Based Targets initiative as consistent with levels required to meet the goals of the Paris Agreement.

Storebrand has been assessed by the renowned Dow Jones Sustainability Index as one of the world's leading listed companies in work with sustainability.

"More than half of the world’s total GDP is moderately or highly dependent on nature and its services. Yet, the value of nature and “ecosystem services” has been largely unacknowledged by companies and their investors. This is despite the fact that failure to act could result in collapsing food systems, loss of livelihoods and pose a systemic risk to the global economy"

Storebrand Asset Management recognized net revenue of NOK 464 million for the third quarter of 2022. Overall, business in the quarter was impacted by geopolitical tensions, inflation, widening credit spreads and rising interest rates, which together are driving market turmoil and uncertainty.

Storebrand Asset Management is proud to join a group of 318 financial institutions and multinational firms with $37 trillion in assets and spending power in calling on over 1,000 of the world’s highest impact businesses to set emissions goals in line with the Paris agreement’s 1.5°C goal.

Storebrand Asset Management (Storebrand) is delighted to announce that it has launched its Emerging Markets ESG Plus strategy as a Common Contractual Fund (CCF) on the AMX platform. This has been funded by an investment from the Lewisham Pension Fund (LPF).

Cubera Private Equity is pleased to announce that Reidun Tysseland has accepted the position as Managing Partner of Cubera Private Equity.

Storebrand Asset Management generated net revenues of NOK 501 million in the second quarter of 2022, reflecting a solid 10% YOY growth relative to the same period last year, despite the turbulent context so far in 2022. The revenue growth in the quarter was driven by positive developments within our private equity solutions, as well as the effects of the Q3 2021 acquisition of Capital Investment.

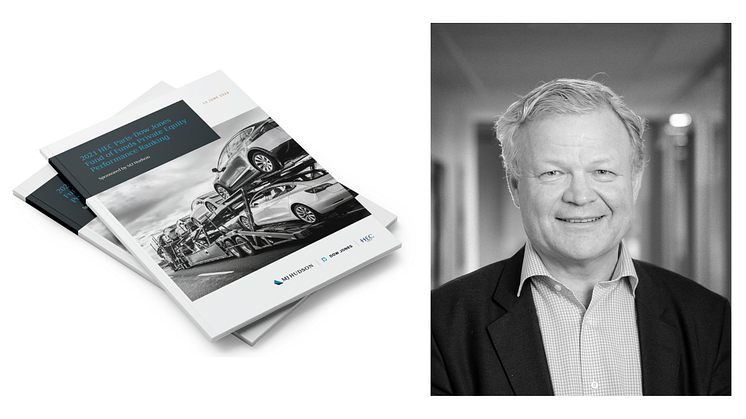

Cubera Private Equity has been recognized as a global leader and the standout European performer at sixth place in the HEC Paris-Dow Jones Performance Ranking of Private Equity Fund-of-Funds.

Jan Erik Saugestad, CEO Storebrand Asset Management: "This pilot project shows how companies can provide meaningful data on their impacts and dependencies on nature. As an investor, this kind of reporting helps us assess risks and opportunities and channel our investments into the most sustainable companies."