Press release -

Leading claims firm targets justice for Brits who lost life savings buying retirement community properties

After a decade of bringing financial redress to people mis-sold by holiday ownership companies, leading consumer claims company ECC targets retirement community injustice.

European Consumer Claims (ECC)

European Consumer Claims launched in 2016 to challenge widespread mis-selling, consumer abuse and even fraud in the timeshare industry. It was a natural progression to broaden the corporate mission and tackle similar abuses in the holiday park sector.

Both timeshare and holiday parks have a reputation for employing high pressure sales, misleading potential customers and continuing to treat those customers in a predatory manner post-sale.

Annual costs/fees in both sectors often increase far more than initially promised, contributing to abysmal resale values.

ECC has successfully claimed tens of millions of pounds worth of financial compensation for people who have been unfairly treated by both timeshare and holiday park consumers.

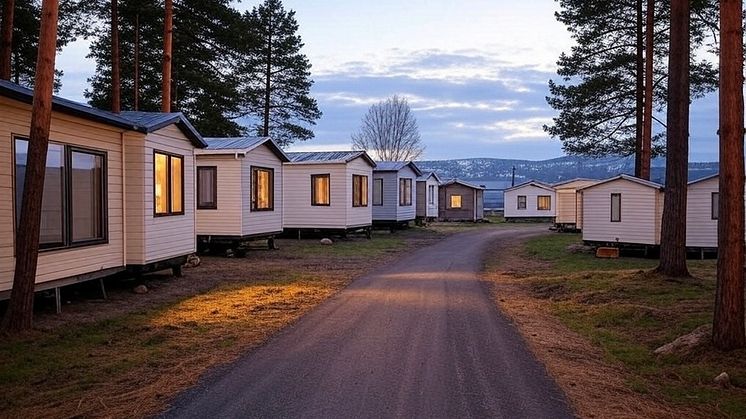

Retirement community property issues

So what made ECC turn its steely gaze to the retirement community property market?

Perhaps surprisingly, several of the issues that plague timeshare and holiday park buyers are also rife in retirement property sales.

Misleading information at the point of sale is a huge issue in timeshare and holiday park operations. This is an even more serious problem with retirement community property sales because it generally involves far larger amounts of money. Ten or twenty times the cost of a timeshare membership (possibly more) and significantly more than even a lodge purchase. The kind of amounts that nobody can afford to lose.

There is zero room for slick, fly-by-night sales patter. There can be no tolerance for being 'economical with the truth'. This is not a matter of someone losing a chunk of money on fake holiday promises, although those situations can be devastating in their own right.

Buying a retirement community property is a graver and more consequential decision. It determines the quality of the final part of an often vulnerable person's life.

It usually involves making the best possible choices with the close family member's life savings, in order to cater to their increased dependence on outside help in the daunting sunset years of life when bodies and minds begin to let their owners down.

The next two issues named are really examples of this one. If prospective buyers had accurate information about the financial implications of buying properties in retirement communities they would often have made different choices.

Annual fees spiralling out of control. It is well documented that timeshare annual fees are uncapped and can rise to levels that mean membership no longer makes fiscal sense. Holiday parks too have been reported to increase costs to unreasonable levels, with the alleged goal of forcing lodge owners to sell - at great financial loss - back to the park.

Often the timeshare companies or holiday parks involved have a less than savoury reputation. On hearing about people losing money because they trusted salespeople in these industries there is sometimes an attitude of complacency. A feeling that, the victim is somehow foolish and possibly even partly to blame for putting their trust in an industry so well known for fraud.

Those of us involved in the claims industry know that nothing could be further from the truth. Timeshare and holiday park victims are no more nor less intelligent than the rest of us. They were just in the wrong place at the wrong time.

With retirement community property mis-selling there are no such misconceptions. It is inconceivable to most of us that anyone would enter into such an important transaction without a seriousness of purpose and after having researched every aspect. The stakes are simply too high.

So when we hear about shocking annual fee increases from well known UK retirement community developments, we understand that it could easily be ourselves in this position. We all have elderly relatives. Some of us ARE elderly relatives.

Linking back to the misleading information problem, annual fees spiralling out of control are only an issue if we were given incorrect information on this possibility before making the purchase. Or if the true information were withheld.

Serious depreciation in value post-sale

Again, these three issues are all interlinked. If the salesperson were upfront about the prospect of losing a lot of money, then very few people would buy. Generally speaking, properties are expected to make money, so why should retirement community properties be any different?

The main reason for this value depreciation is the associated maintenance/service costs increasing to the point where prospective buyers baulk.

Nobody wants to buy a property which has expensive costs, and those costs have no capped increase rate.

This in turn means the market value can drop like a stone and ...*circular argument alert*... nobody wants to buy a property that is expected to lose value.

Expert comment

"These issues reduce down to two things," explains Greg Wilson, CEO of European Consumer Claims (ECC). "Firstly: incorrect information initially given by the sales person, usually driven by a need to earn commission on the sale. They make the proposition look as attractive as possible so they can close the deal, prioritising their own needs over those of their customer.

"The company that they work for are entirely complicit. They set the incentives of the commission structure, and those incentives govern their sales staff's behaviour.

"The second problem is when retirement community property managers become greedy and increase fees to a level that is no longer sustainable to the clients. These clients are a captive market. Very much like timeshare contracts, retirement community contracts legally bind the client to pay whatever fees are demanded of them.

"At ECC we feel strongly that more robust legislation is required to protect vulnerable families being misled (or not fully informed) about the contracts they are signing.

"There are currently avenues open to seek financial redress. However the existing legal framework does generally require expert assistance to navigate.

"With the sizeable sums of money involved in retirement property litigation, always seek expert advice before committing to a course of action."

Related links

- Greg Wilson reflects

- ECC contact page

- European Consumer Claims (ECC)

- How do high pressure timeshare sales actually work?

- Retirement home scandal that wipes out life savings

- Holiday parks vs timeshare ownerships. Two sides of the same coin?

- ECC victories

- Retirement home transfer fee money grab

- ‘No one will buy my mum’s retirement flat despite a £100k price cut’

- Families lose ‘life savings’ on developer’s retirement flats

- Out of control timeshare maintenance fee hikes: A case study interview

- UK households selling £219,000 homes left with just £10k in 'national scandal'

Topics

Categories

Regions

ECC provides claims services, relinquishments expert advice and help

E: (for media enquiries): mark.jobling@ecc-eu.com

T: (for media enquiries): +44 2039962044

E: (for client enquiries) EUROPE: info@ecc-eu.com USA: info@americanconsumerclaims.com

T: EUROPE: +44 203 7699 164.

T: USA: +1-888 207 6456/+1 332 251 7157

Monday to Friday: UK timings: 9am-8pm. Saturday/Sunday closed. USA 9am -8pm EST. Saturday/Sunday closed

Follow European Consumer Claims on Facebook: here. American Consumer Claims: here

Follow European Consumer Claims on Twitter: here. American Consumer Claims: here

Relevant websites for this article

www.holidayparkadvicecentre.co.uk

www.americanconsumerclaims.com

www.timeshareadvicecentre.co.uk

|

Download the ECC App to access these cool features:

|

CLICK HERE to download the ECC app for your smartphone