Secret tobacco factory dismantled

One of Northern Ireland’s biggest ever illegal tobacco factories has been dismantled after a raid in Newry.

One of Northern Ireland’s biggest ever illegal tobacco factories has been dismantled after a raid in Newry.

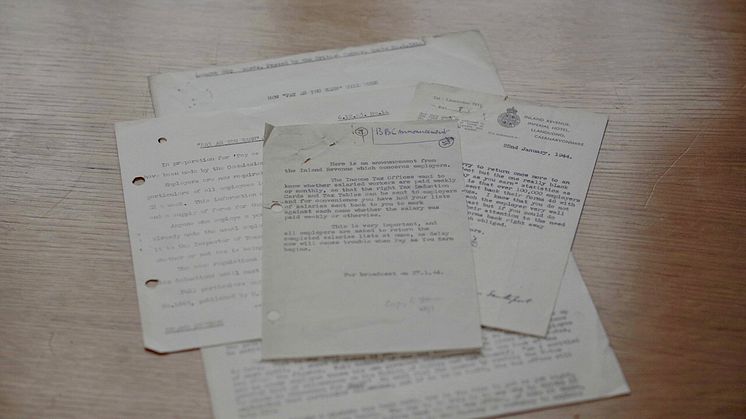

History Alice visits HMRC to find out more about the introduction of Pay As You Earn, 80 years ago.

Here are some top tips for tax agents ahead of the Self Assessment (SA) deadline on 31 January 2025.

During National Apprenticeship Week HM Revenue and Customs (HMRC) is encouraging apprentices to claim the money that is rightfully theirs. Whether that’s making sure you’re being paid the correct hourly rate to claiming the savings in your Child Trust Fund, this is how to do it.

Know your worth

You’ve started an apprenticeship, you’re bringing home a wage, but are you getting paid correct

HMRC is beginning to write to selected Eat Out to Help Out (EOTHO) claimants to ask them to check their claims.

The EOTHO scheme saw more than 84,000 food and drink establishments take part and offer a 50% discount on eligible purchases on Mondays, Tuesdays and Wednesdays during August 2020.

HMRC worked quickly to set up a system to pay restaurants within five working days. Controls were bui

HM Revenue and Customs (HMRC) has confirmed today that it has decided not to extend its existing contract with Concentrix, a company it employs to check tax credits entitlement.

A taskforce tackling wealthy tax cheats who are living beyond their means in Northern Ireland was launched today by HM Revenue and Customs (HMRC).

A diesel laundering plant and illegal filling station, capable of evading £14.5 million in duty a year, have been dismantled by HM Revenue and Customs (HMRC) in the Darwen area of Lancashire.

A Fermanagh farmer, who was jailed for stealing nearly £500,000 in fraudulent VAT repayments, has been ordered to repay £60,000 or serve a further two years in prison.

The largest ever toxic waste dump linked to diesel laundering in the UK has been uncovered at a farm in Co Armagh this morning by HM Revenue and Customs (HMRC).

A Co Tyrone farmer who tried to steal over £1.3 million in a VAT fraud has been jailed for 16 months after an investigation by HM Revenue and Customs (HMRC).