Apple Pay Now Available to Visa Cardholders in Switzerland

Visa Inc. announced today that around 1 million Visa cardholders in Switzerland now have access to the newly launched Apple Pay – giving users an easy, secure and private way to pay

Visa Inc. announced today that around 1 million Visa cardholders in Switzerland now have access to the newly launched Apple Pay – giving users an easy, secure and private way to pay

• UK is predicted to become the second highest spenders in Europe, and the fourth globally • Average UK household spend on international travel to reach £9,300 annually by 2025 • Growth in spend by over 65s predicted to be a key driver

Visa Inc. (NYSE: V) announces the completion of its acquisition of Visa Europe Ltd.

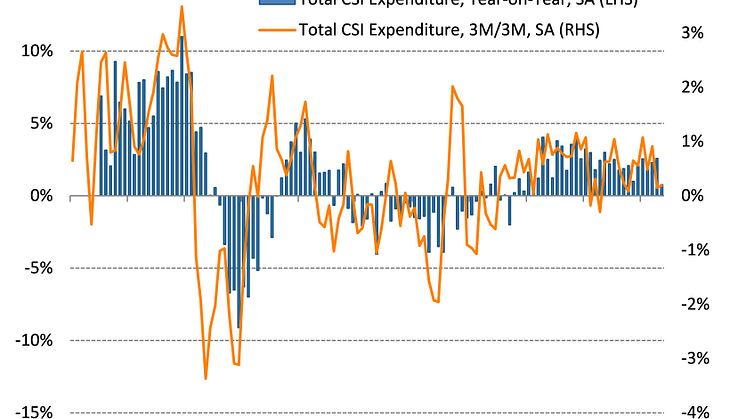

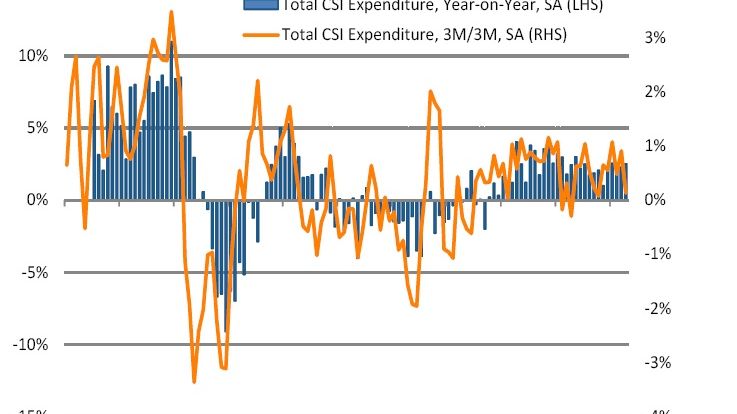

• Slowest increase in consumer spending since February 2014 • Transportation and communications dropped -5.2% year-on-year, driven by slowing growth in car sales • Clothing & Footwear retailers buck the trend, posting +4.2% year-on-year, its first rise in three months • Growth in e-commerce slows to +2.3% year-on-year while face-to-face expenditure falls slightly on an annual basis (-0.8%)

Visa Inc. (NYSE: V) today announced that the European Commission has approved the proposed acquisition of Visa Europe Ltd. by Visa Inc

Connects banks with other mobile wallet providers for instant access, streamlined implementation

• New campaign launches in partnership with the British Olympic Association • Everything Counts platform enables the British public to share the stories of athletes on the road to being part of Team GB • Athletes Adam Gemili, Adam Peaty, Claudia Fragapane and Elinor Barker signed as Team Visa Ambassadors

• 1-in-5 in-person Visa-processed card payments are now contactless • 3 billion contactless transactions made using Visa cards and devices across Europe between 1 May 2015 and 30 April 2016 • 165 million Visa contactless cards and 3.2 million POS terminals are now in active in Europe

Headline findings: • Total consumer spending increases by +2.5% year-on-year in April • E-commerce growth rate of +8.4% year-on-year but face-to-face expenditure is broadly flat (+0.2% year-on-year) • Clothing and footwear sees biggest fall in year-on-year spending since September 2014

• SMEs identify banks as their preferred provider of transaction services, but take-up of newer ways to pay and be paid varies • Key barriers to change highlighted as perceived cost, risk and other priorities being addressed first

Headline findings: • Consumer spending rises by +2.3% year-on-year • Strong increases in expenditure seen in Recreation & Culture (+5.6%) and Hotels, Restaurants & Bars (+5.3%), but spending at Clothing & Footwear retailers declines (-1.8%) • Growth led by higher e-commerce spending (+4.2%), as face-to-face expenditure falls slightly (-0.9%)

• Contactless transactions over £20 grew at more than double the rate of those under £20 following the introduction of new £30 spend limit • Bars and pubs a prime driver of growth for contactless above £20, seeing 30% average weekly growth • Contactless payments now make up 10% of all face-to-face payments between £20 – £30