The contactless revolution ten years on: two-thirds of Brits now tap to pay

Visa releases its annual Digital Payments study to mark the 10 year anniversary of contactless in the UK.

Visa releases its annual Digital Payments study to mark the 10 year anniversary of contactless in the UK.

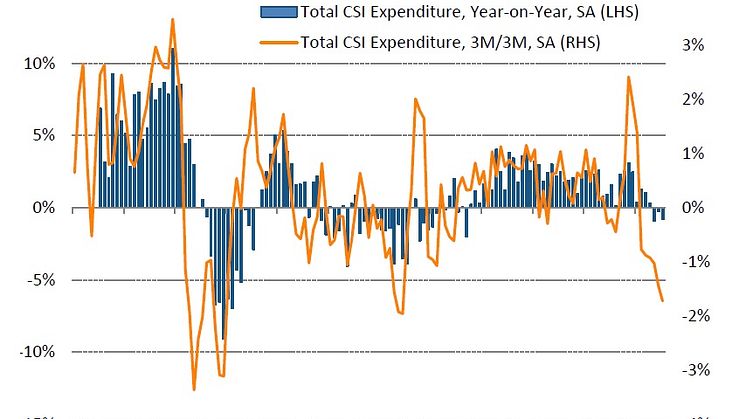

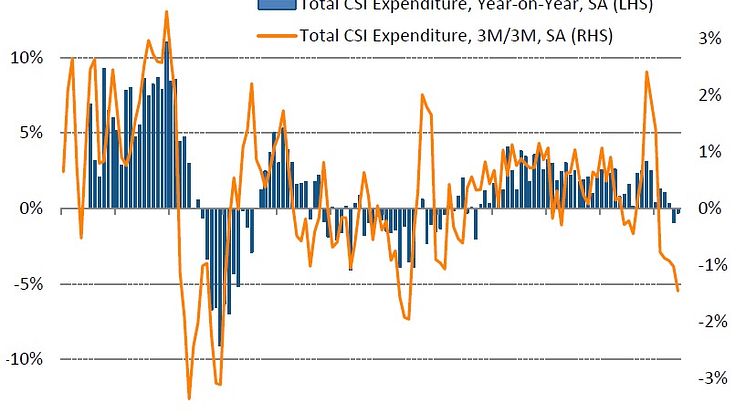

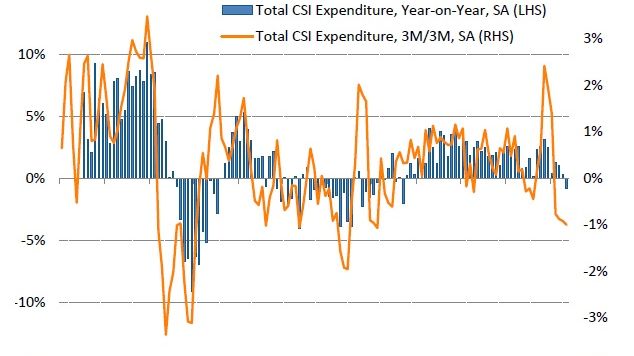

• Consumer spending falls by -0.8% on an annual basis, following declines in May and June • Transport & Communication (-6.1%) and Clothing & Footwear (-5.2%) see most marked reductions in spend • Face-to-Face expenditure falls at quicker pace (-3.7% on the year), while E-commerce spend increases by +3.6%

• The UK is Europe’s largest ecommerce market, with sales exceeding £130bn in 2016[1] • Nine out of 10 millennials have used their mobile phone to make a purchase

New Processing Centers Designed to Meet the Growing Demand for Digital Payments around the World

Visa and PayPal have announced an extension of their strategic partnership to Europe. The two companies are already collaborating in the U.S. and Asia Pacific to accelerate the adoption of secure and convenient online, in-app and in-store payments. This latest step brings the benefits of the partnership to European consumers and businesses.

• Household expenditure declines on an annual basis for second month running (-0.3%) • Spending falls by -0.3% year-on-year on average over Q2, lowest quarterly figure since Q3 2013 • Expenditure decreases through Face-to-face categories (-2.4% on the year), while growth in E-commerce expenditure softens (+2.9%)

Future collaboration will enhance payment experiences for consumers in Europe

• UK start-up won with solution that uses machine learning to support regional commerce experiences • More than 300 entries submitted from start-ups in 19 countries

• First fall in household expenditure since 2013 (-0.8% on the year) • Face-to-face spending declines notably (-5.3%), while e-commerce rebounds (+6.9%) after weak April (-0.3%) • Clothing & Footwear (-5.2%) and Household Goods (-4.1%) among the weakest performing sectors in May

• Visa migrating to the next generation of the 3-D Secure platform, the technology platform originally developed by Visa and underpinning the Verified by Visa service • Upgrade will enhance the security and convenience of mobile online payments globally • Today, three times as many Europeans make online purchases using their mobile device compared to 2015

• Service powered by Visa tokenisation to enable simple and secure mobile payments • 94% of UK 18-24 years olds already use their mobile device for banking and payment services

• Visa Checkout, the easier way to pay online with a single sign-in, is making its debut in the UK, launching on lastminute.com • An exciting range of promotions is kicking off the partnership between Visa and lastminute.com • Enrolled customers have a 51% higher conversion rate when compared to other customers and data shows reduced cart abandonment