Visa Europe Announces New Digital Enablement Programme with Launch Partners to Include Google’s Android Pay and Leading UK Banks

Connects banks with other mobile wallet providers for instant access, streamlined implementation

Connects banks with other mobile wallet providers for instant access, streamlined implementation

• 1-in-5 in-person Visa-processed card payments are now contactless • 3 billion contactless transactions made using Visa cards and devices across Europe between 1 May 2015 and 30 April 2016 • 165 million Visa contactless cards and 3.2 million POS terminals are now in active in Europe

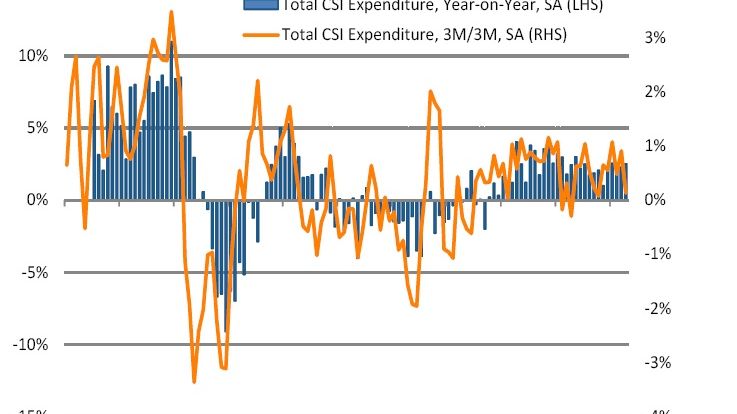

Headline findings: • Total consumer spending increases by +2.5% year-on-year in April • E-commerce growth rate of +8.4% year-on-year but face-to-face expenditure is broadly flat (+0.2% year-on-year) • Clothing and footwear sees biggest fall in year-on-year spending since September 2014

• SMEs identify banks as their preferred provider of transaction services, but take-up of newer ways to pay and be paid varies • Key barriers to change highlighted as perceived cost, risk and other priorities being addressed first

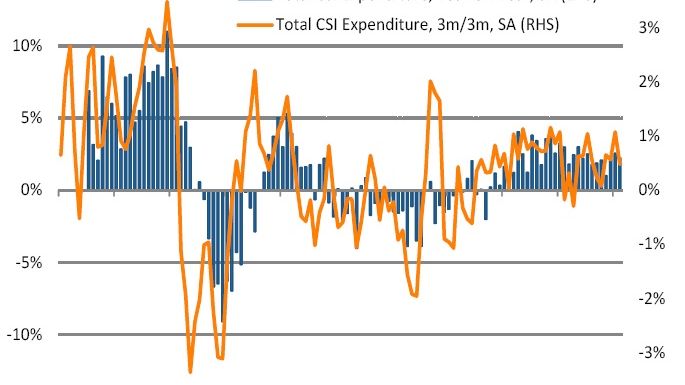

Headline findings: • Consumer spending rises by +2.3% year-on-year • Strong increases in expenditure seen in Recreation & Culture (+5.6%) and Hotels, Restaurants & Bars (+5.3%), but spending at Clothing & Footwear retailers declines (-1.8%) • Growth led by higher e-commerce spending (+4.2%), as face-to-face expenditure falls slightly (-0.9%)

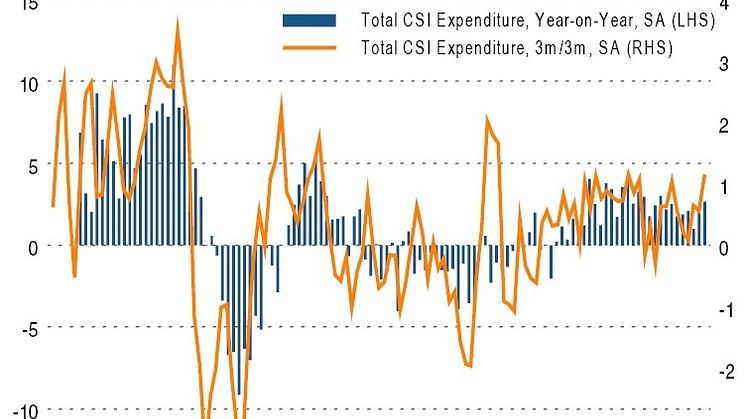

• Household spending increases +2.2% year-on-year in February • Sharp rise in spending on Hotels, Restaurants & Bars (+13.6%) and Recreation & Culture (+9.7%), while expenditure growth reaches 13-month high across Food & Drink (+4.8%) retailers • E-commerce on upward trajectory as growth improves to +6.3% on an annual basis

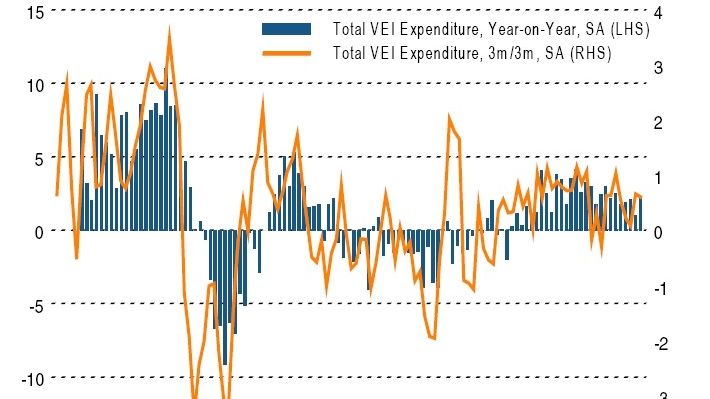

Headline findings: • Consumer spending rose +2.7% on an annual basis in January, the highest growth rate since May 2014 • Clothing & Footwear surged +5.0% from a dip in December, thanks to cold weather and January sales • High Street spending bounced back to an eight-month high

• Consumer spending increases solidly in December (+2.3% year-on-year), rounding off 2015 as the second strongest year since 2008 • Sharp rise in e-commerce spending (+7.4%), but face-to-face spending is broadly flat (-0.1%) • Growth led by Hotels, Restaurants & Bars (+8.1%), Household Goods (+4.9%) and Recreation & Culture (+4.8%)

Headline Findings •Modest increase in consumer spending in November (+1.1% on the year) •Expenditure continues to rise solidly in e-commerce (+4.1%), but declines on the high street (-1.5%) •Hotels, Restaurants & Bars, Recreation & Culture and Clothing & Footwear see strongest increases in spending during November

Headline findings

Consumer spending continues to rise at a steady rate of +1.8% year-on-yearSolid increases seen across a broad range of categories, with the Recreation & Culture and Clothing & Footwear sectors among the best performersStrong growth for e-commerce of +5.8% year-on-year, though high street spending remains flat

One third of British travellers caught in airport ‘Squanderlust’ spending

Analysis of spending on Visa cards in the UK shows clear growth in Sunday trading versus other days of the week:

Average Sunday Average Saturday Average Day Increase in face-to-face spend from 2011 to 2015 35.2% 28.2% 27.9% Increase in online spend from 2011 to 2015 68.9% 56.7% 47.5%

Commenting on spending growth in Sunday trading, Kevin Jenkins,

1.1 billion contactless transactions made by Visa cardholders across Europe in the last 12 months More than €12.6 billion spent in total More than 130 million Visa contactless cards are now in circulation in Europe Visa’s contactless infrastructure is ready for the next generation of digital payments

Research suggests 18-24 year olds use their cards less when overseas due to perceived higher costs, despite research proving otherwise

Visa Europe will offer Visa debit, credit and reloadable prepaid cardholders access to Apple Pay "Supported by Visa’s extensive contactless infrastructure, Apple Pay in the UK offers an easy, secure and private way to pay, catapulting mobile payments into the mainstream" Jeremy Nicholds, Visa Europe

Smart devices on track to replace cash and cards as UK mobile payments projected to hit over £1.2bn a week by 2020 -UK mobile payments predicted to grow three-fold in the next five years as shoppers embrace new options and spend more on mobile -One in four estimate spending more than £50 a week on mobile by 2020

Three-quarters of 16-24 year olds would feel comfortable using biometric security 69% believe it will be faster and easier than passwords and PINs Half of young people foresee the death of passwords by 2020