Press release -

Consolidated Business Results Summary - First Half of Fiscal Year Ending December 31, 2022 -

Consolidated Business Results

IWATA, August 5, 2022 - Yamaha Motor Co., Ltd. (Tokyo: 7272) announces its consolidated business results for the first half of fiscal 2022.

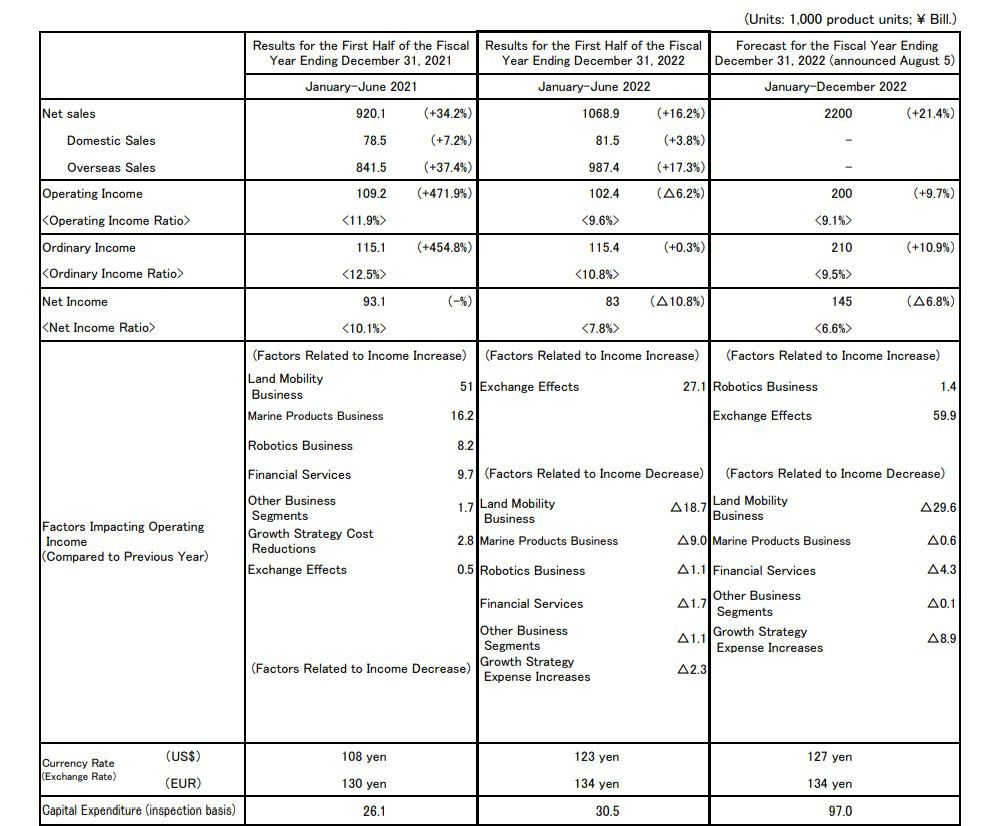

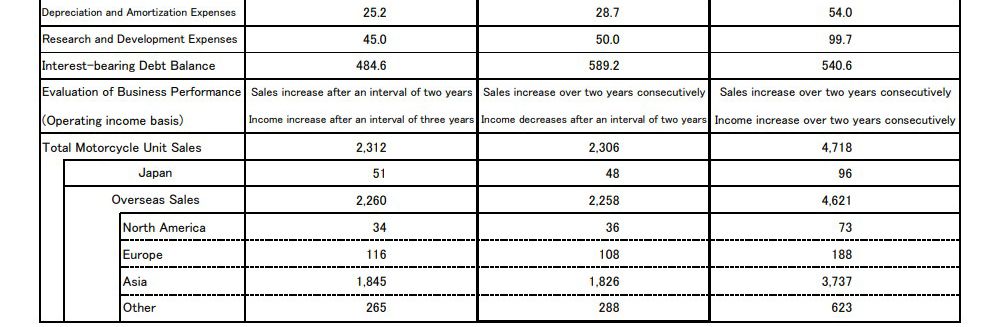

Net sales for the consolidated accounting period for the first six months of the fiscal year ending December 31, 2022 were 1,068.9 billion yen (an increase of 148.9 billion yen or 16.2% compared with the same period of the previous fiscal year) and operating income was 102.4 billion yen (a decrease of 6.7 billion yen or 6.2%). Ordinary income was 115.4 billion yen (an increase of 0.4 billion yen or 0.3%) and net income attributable to owners of parent was 83.0 billion yen (a decrease of 10.1 billion yen or 10.8%).

The Company set a new record for the first half of a fiscal year with over 1,000 billion yen in net sales. This was thanks to robust sales of outboard motors in developed markets, strong sales of motorcycles in Indonesia and other emerging markets, and in part due to the weakened yen, all despite the effects of lockdowns imposed due to the COVID-19 pandemic and procurement difficulties for semiconductors and other electronic components. For operating income, the Company responded to the impacts of soaring costs for raw materials like aluminum and steel, the rising shipping expenses stemming from the shortage of shipping containers bound for the U.S., and other factors by implementing cost reductions or otherwise passing on costs. While the weakened yen brought positive effects, expenses for personnel, logistics, and the like mounted, and the rise in product inventory due to the stagnation of logistics in the U.S. caused unrealized profits to swell, resulting in lower profits overall.

For the first half-year consolidated accounting period, the U.S. dollar traded at 123 yen (a depreciation of 15 yen from the same period of the previous fiscal year) and the euro at 134 yen (a depreciation of 4 yen).

Results by Business Segment

Land Mobility Business

Net sales were 688.7 billion yen (an increase of 92.8 billion yen or 15.6% compared with the same period of the previous fiscal year) and operating income was 36.7 billion yen (a decrease of 8.1 billion yen or 18.0%).

For the motorcycle business, demand is trending towards recovery thanks to measures to stem COVID-19 infections and the easing of restrictions seen in each country. Higher unit sales in Indonesia, India, Brazil, and other markets led to higher net sales for the business. For operating income, factors that negatively impacted numbers include the soaring costs for raw materials and an insufficient supply of premium segment models, which adversely affected the model mix. These could not be fully absorbed by the effects of foreign exchange rates and the passing on of costs, and as a result, operating income declined.

With recreational vehicles (all-terrain vehicles, ROVs, and snowmobiles), despite the supply shortages seen market-wide, unit sales of the Wolverine RMAX Series—a priority model line for the Company—rose, helping increase net sales. On the other hand, operating income decreased due to an increase in costs at our U.S. production bases, rising raw material prices, and spiking labor expenses.

For electrically power-assisted bicycles, part procurement has become challenging due to the Shanghai lockdown. The effects of production delays for e-Kits destined for overseas markets were significant and unit sales fell. Moreover, provisions for product warranties were recorded due to a battery recall in the first quarter of the consolidated accounting period, and as a result, the business posted lower sales and profits overall.

Marine Products Business

Net sales were 255.9 billion yen (an increase of 50.0 billion yen or 24.3% compared with the same period of the previous fiscal year) and operating income was 49.6 billion yen (an increase of 5.6 billion yen or 12.6%).

In the outboard motor market, the boom for outdoor recreation has continued and demand remains quite strong across all horsepower ranges mainly in developed countries. Shipping improvements expedited shipments from Japan to the U.S. and this helped increase unit sales. For personal watercraft, the Company has been experiencing production delays from the beginning of the year due to a shortage of parts and other supplies, so while a certain degree of recovery was achieved in the second quarter of the consolidated accounting period, both production volume and unit sales decreased. Still, sales and profits both rose for the Marine Products business as a whole due to the effects of the weakened yen.

Robotics Business

Net sales were 57.8 billion yen (a decrease of 1.4 billion yen or 2.3% compared with the same period of the previous fiscal year) and operating income was 8.1 billion yen (a decrease of 0.9 billion yen or 10.0%).

Demand in China for surface mounters decreased due to the Shanghai lockdown and also fell in Japan from the effects of the electronic component’s shortage. Despite having orders backlogged from the previous year, sales declined because of the same shortage of electronic components. The semiconductor equipment market has experienced a lull in demand when compared to the significant growth seen the previous year, but sales still increased year on year. Yamaha Robotics Holdings Co., Ltd. continued to improve, recording both higher sales and profits. However, operating income for the Robotics business as a whole declined not only due to the decrease in net sales but also from an increase in labor expenses and other SG&A expenditures, and mounting costs for materials.

Financial Services Business

Net sales were 28.0 billion yen (an increase of 4.4 billion yen or 18.8% compared with the same period of the previous fiscal year) and operating income was 9.3 billion yen (a decrease of 0.6 billion yen or 5.8%).

Receivables increased in the U.S. and Brazil, which drove up sales, but operating income fell due to the decrease in the one-time allowance for doubtful accounts the previous year.

Other Products Business

Net sales were 38.5 billion yen (an increase of 3.1 billion yen or 8.7% compared with the same period of the previous fiscal year) with an operating loss of 1.4 billion yen (compared to an operating income of 1.4 billion yen the same period of the previous fiscal year).

Sales rose thanks to an increase in premium-priced golf car unit sales, but operating income declined year on year partly due to rising raw material costs and fixed costs.

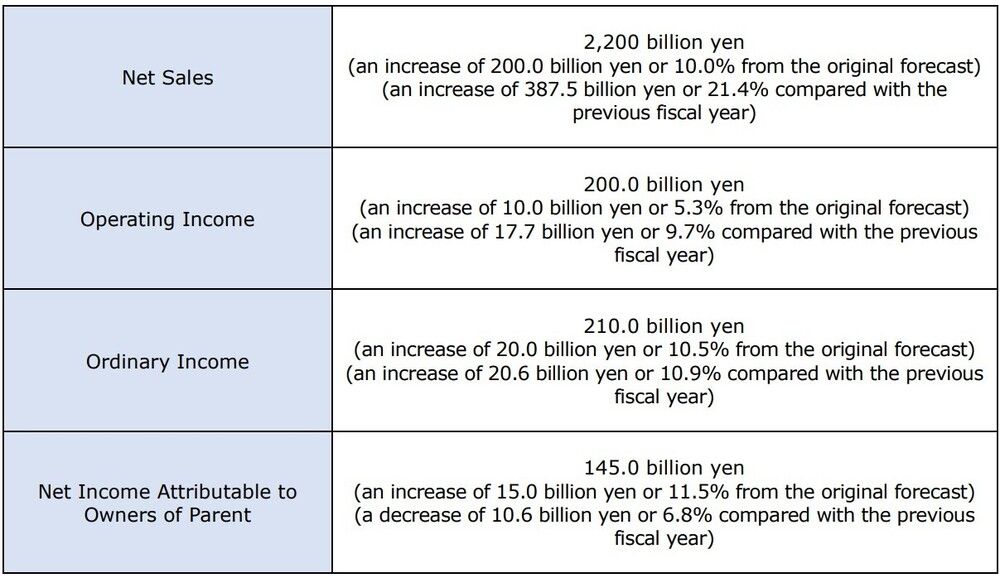

Forecast of Consolidated Business Results

For the remainder of the fiscal year ending December 31, 2022, a favorable business environment is expected to continue, despite supply issues such as the shortage of semiconductors and other parts and the impacts of soaring raw material prices.

In light of continued cost reductions and the depreciating trend of the yen, the Company has revised its forecasts for net sales and various incomes as follows.

These forecast figures are based on the U.S. dollar trading at 127 yen during the fiscal year (a depreciation of 14 yen from the previous forecast and a year-on-year depreciation of 17 yen) and the euro at 134 yen (a depreciation of 6 yen from the previous forecast and a year-on-year depreciation of 4 yen).

Basic Policy Concerning Profit Distribution and Dividends for the Current Fiscal Year

For shareholder returns, the Company’s basic policy is to emphasize making consistent and ongoing dividend payments while taking into consideration the outlook for business performance and investments for future growth, distributing returns to shareholders in a flexible way based on the scale of our cash flows with the total payout ratio set at the 40% range for the cumulative total of the Medium-Term Management Plan’s three-year period.

In terms of dividends for this fiscal year, though the business forecast has been revised, the Company has decided to maintain the full-year dividend forecast of 115 yen per share with an interim dividend of 57.5 yen per share due to the acquisition of 20.0 billion yen of treasury stock during the second quarter of the consolidated accounting period.

Topics

Categories

*This is a dedicated e-mail providing Yamaha Motor PR materials for viewing by media journalists.

We request that you refrain from using the materials and photographs on this e-mail for purposes other than media reporting.