The bond issue for Mathesa Investments AB has been successfully completed

The bond issue for Mathesa Investments AB has been successfully completed

The bond issue for Mathesa Investments AB has been successfully completed

SEK 47.7 million Pre-IPO financing in Advanced Soltech Sweden AB successfully completed

Under hösten 2020 emitterade Patriam Invest en senior säkerställd obligation om upp till SEK 400 miljoner för att finansiera bolagets fastighetsutveckling. Därefter har Patriam tagit fram ett grönt obligationsramverk som nu certifierats enligt Climate Bonds Standard. Obligationen är den första som certifieras enligt Climate Bonds Standard i Sverige.

In late 2020, Swedish property developer Patriam Invest initiated a SEK 400 million corporate bond issue to finance its business. Following the issue, Patriam has developed a green bond framework that successfully obtained Certification under the Climate Bonds Standard as of June 15. The bond constitutes the first Swedish bond issue to be Certified green under the Climate Bonds Standard.

The DKK 30m bond issue for Frederiksborg Ejendomme 2 ApS has been successfully completed. JOOL Corporate Finance AB acted as Corporate Finance advisors, Roschier Advokatbyrå acted as legal Corporate Finance advisor and Intertrust (Sweden) AB as trustee.

CPHI-Holding A/S is a holding company that directly and indirectly owns a group of companies with their main operations in businesses concerning airport logistics and airport security. The three main operational companies are BBHS A/S, Exruptive A/S and IntelligentTrackSystems A/S.

Despite the pandemic, the Nordic corporate bond market reached new record levels in 2020 and continues to serve as an attractive source of capital. In 2020 the total outstanding volume reached an unprecedented EUR 106bn by year-end. High yield bonds, the segment that JOOL operates in, make up about half of this volume, according to Nordic Trustee’s Corporate Bond Market Report 2020.

The DKK 40m bond issue for Frederiksborg Ejendomme 2 ApS has been successfully completed. JOOL Corporate Finance AB acted as Corporate Finance advisors, Roschier Advokatbyrå acted as legal Corporate Finance advisor and Intertrust (Sweden) AB as trustee.

JOOL Corporate Finance AB has acted as corporate finance advisor to CapRate in connection to the restructuring of debt issued by Koggbron AB and Malmö Katrinelund 27 AB, totalling a volume of SEK 530 m.

CPHI-Holding A/S is a holding company that directly and indirectly owns a group of companies with their main operations in businesses concerning airport logistics and airport security. The three main operational companies are BBHS A/S, Exruptive A/S and IntelligentTrackSystems A/S.

JOOL-gruppen samarbetar med klassiska Göteborgsrestaurangen Fiskekrogen för att sprida lite välbehövlig julstämning mitt i kampen mot pandemin. Under tisdagen levererades 250 välsmakande jultallrikar till sjukvårdspersonal i Göteborgsområdet, innehållande flertalet julbordsklassisker såsom julskinka, ägghalvor med skagenröra, Fiskekrogens senap och flera sorters sill.

The DKK 90m direct loan for Hawk Investments ApS has been successfully completed. The direct loan was substantially oversubscribed with significant demand from both private investors and family offices, as well as from high-quality institutional investors.

Interest rate: 11 % p.a.

Maturity: 10 months (+6 months)

**********

The bond issue for Frederiksborg Ejendomme 2 ApS has been successfully completed.

Roschier Advokatbyrå AB acted as legal Corporate Finance advisor as to matters of Swedish law and Moalem Weitemeyer Advokatpartnerselskab as to matters of Danish law and due diligence. Intertrust (Sweden) AB act

Issue amount: 140 MSEK

Interest rate: 9,5 % p.a.

Maturity: 36 months

**********

The 140 MSEK bond issue for Patriam Invest AB has been successfully completed.

JOOL Corporate Finance AB acted as Corporate Finance advisors, Roschier Advokatbyrå acted as legal Corporate Finance advisor and Intertrust (Sweden) AB as trustee.

--------------------------------------

Placement of a bond issue for Real Danmark A/S successfully completed.

The SEK 26m bond issue for T. Andréasson Fastighetsaktiebolag (publ) has been successfully completed. The bond issue was oversubscribed with great interest from the investors.

There has been great interest in taking part in Advanced Soltech's offering to subscribe for newly issued preference shares. In total, the subscription is for SEK 131.5 million. The purpose of the issue prior to the planned listing of Advanced Soltech's shares on First North Growth Market is to be able to take advantage of the good business opportunities that the Company now has in China.

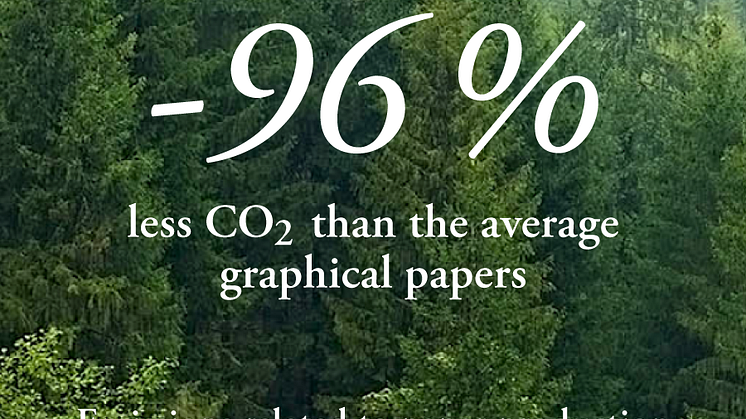

Papers from Lessebo Paper AB emits 96% less CO2 than the average graphical papers, corresponding to only 22 kg per tonne of finished product. This places the company as one of the lowest CO2 emitters in the entire paper industry. On average, a producer of equivalent products emits 616 kg CO2 per metric tonne of finished paper.

The SEK 110m bond issue for T. Andréasson Fastighetsaktiebolag (publ) has been successfully completed. The bond issue was substantially oversubscribed with significant demand from both private investors and family offices, as well as from high-quality institutional investors.

JOOL has raised over SEK 600 million of green bonds! Despite COVID-19, there is still investor demand for climate bonds and the future remains promising for companies looking to finance sustainable projects. What makes a bond green? A corporate bond is a debt instrument and a loan made by an investor to a borrowing company. With a “green” bond, the proceeds have been specifically earmarked...