Smartphones have replaced bank branches for millennials managing money on the go

Visa research shows high adoption of banking and money management apps among young Brits

Visa research shows high adoption of banking and money management apps among young Brits

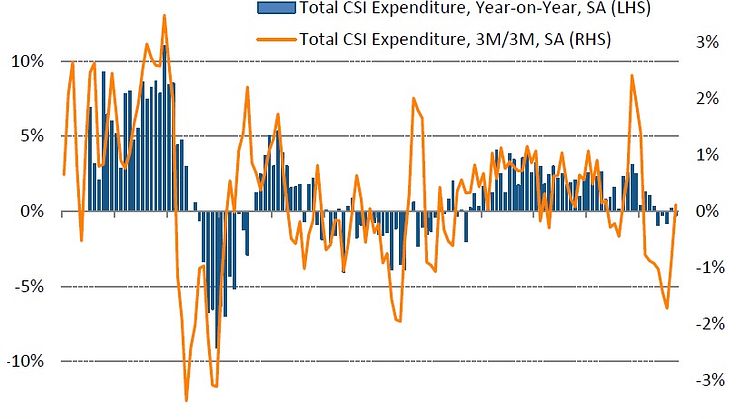

- Household expenditure declines -0.3% on the year, the fourth month in the last five to see a decline - Recreation & Culture (-1.3%) suffers biggest decline since July 2013 - High street continues to suffer as face-to-face spending declines -3.2% - Lower spending across Transport & Communication (-6.4%) and Household Goods (-2.6%)

Visa has today announced its global team Visa roster for the Olympic and Paralympic Winter Games. The roster is comprised of over 40 Olympians and Paralympians from 17 countries, including British snowboarder, Billy Morgan and speed skater, Elise Christie.

- Consumer spending rises for first time since April (+0.3% year-on-year) - Growth driven by higher E-commerce expenditure (+6.5% on the year), as Face-to-Face continues to decline (-2.6%) - With average growth of 0.2% each month this year, consumer spending is on track for its weakest calendar year of growth since 2013

Visa releases its annual Digital Payments study to mark the 10 year anniversary of contactless in the UK.

• Consumer spending falls by -0.8% on an annual basis, following declines in May and June • Transport & Communication (-6.1%) and Clothing & Footwear (-5.2%) see most marked reductions in spend • Face-to-Face expenditure falls at quicker pace (-3.7% on the year), while E-commerce spend increases by +3.6%

• The UK is Europe’s largest ecommerce market, with sales exceeding £130bn in 2016[1] • Nine out of 10 millennials have used their mobile phone to make a purchase

New Processing Centers Designed to Meet the Growing Demand for Digital Payments around the World

Visa and PayPal have announced an extension of their strategic partnership to Europe. The two companies are already collaborating in the U.S. and Asia Pacific to accelerate the adoption of secure and convenient online, in-app and in-store payments. This latest step brings the benefits of the partnership to European consumers and businesses.

• Household expenditure declines on an annual basis for second month running (-0.3%) • Spending falls by -0.3% year-on-year on average over Q2, lowest quarterly figure since Q3 2013 • Expenditure decreases through Face-to-face categories (-2.4% on the year), while growth in E-commerce expenditure softens (+2.9%)

Future collaboration will enhance payment experiences for consumers in Europe

• UK start-up won with solution that uses machine learning to support regional commerce experiences • More than 300 entries submitted from start-ups in 19 countries