Press release -

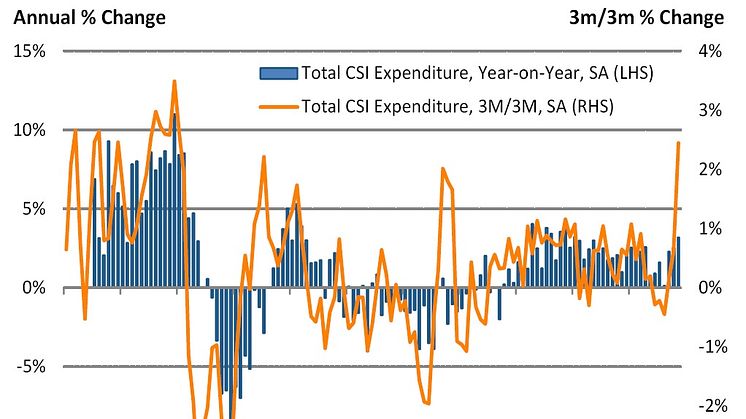

November spending reached 22-month high, driven by e-commerce around Black Friday

Kevin Jenkins, UK & Ireland Managing Director at Visa commented:

“The Christmas shopping season got off to a good start for consumers and retailers alike. Overall spending growth in November accelerated to a 22-month high as consumers made the most of the promotions around Black Friday and Cyber Monday. The shopping season seems to have started earlier this year too, as we saw solid spending growth rates in the weeks leading up to Black Friday.

“As Black Friday shifted further online this year, e-commerce retailers were the clear winners in November. Online spending grew 12.5% over the last year, the highest rate of growth since our records began in 2009. In contrast, spend on the high street was down 1.4%.

“All sectors benefited from an upsurge in growth, with recreation and culture in the lead, as the experience economy continued to power ahead. Household goods saw its highest level of growth since December 2015, as more shoppers took advantage of Black Friday promotions to upgrade their domestic appliances. Clothing and footwear retailers reported an increase in sales too, albeit at a slower rate than in October.”

What UK businesses are saying:

Visa is tracking the sentiment of several small businesses across the UK on a monthly basis, asking about their views on the economy, business conditions and forecasts for the month ahead.

Gayle Haddock, Carry me home (Children’s Clothes), London:

This has been a good month for us, with higher sales volume on our website. We didn’t offer Black Friday related discounts, but do offer general promotions throughout the season to ensure our customers don’t miss out.

The Christmas shopping season is crucial for our business, as many of our customers who have been browsing are now looking at our products with gift recipients in mind. We expect December to be even busier as our customers tend to start their Christmas shopping in earnest once they get their November pay checks.

Josh Beer, The Illustrious Pub Company, Cambridgeshire:

November was a bit quieter than expected, with revenue down from last year. People seemed willing to spend on dining out for special occasions, but overall our customers spent less and not visited as often. That seemed to be also the case for other gastro pubs in our area.

It’s still early to say whether people were saving to buy Christmas presents, or because they were nervous about an uncertain new year. We’re however expecting to have a busier December with people celebrating with friends and family during the festive period.

Tony Bailey, Top Notch Hair & Beauty, Manchester:

We had fewer visits in November, but the customers who came in treated themselves, as the average bill was up 7%.

The slow month may have been caused by increased competition, with more salons in our area, or decreased foot traffic to the high street as people focused on online deals around Black Friday. With online discount sites publicising cheaper beauty practitioners, we’re focusing our efforts on increasing our social media presence, and advertising our quality and expertise.

Topics

Categories

Visa Inc. (NYSE:V) is a global payments technology company that connects consumers, businesses, financial institutions, and governments in more than 200 countries and territories to fast, secure and reliable electronic payments.

We operate one of the world’s most advanced processing networks — VisaNet — that is capable of handling more than 65,000 transaction messages a second, with fraud protection for consumers and assured payment for merchants. Visa is not a bank and does not issue cards, extend credit or set rates and fees for consumers. Visa’s innovations, however, enable its financial institution customers to offer consumers more choices: pay now with debit, pay ahead with prepaid or pay later with credit products. For more information, visit our website (www.visaeurope.com), the Visa Vision blog (www.vision.visaeurope.com), and @VisaEuropeNews.

Visa UK