Visa to Launch First Everywhere Initiative in Europe

Live competition at Mobile World Congress challenges five start-ups to bring payments to the Internet of Things

Live competition at Mobile World Congress challenges five start-ups to bring payments to the Internet of Things

• At just over 1,000 square meters, new Innovation Center is Visa’s largest to date • Space will host partners and clients from across Europe to collaborate on new ways to pay • Center features live demonstrations including Internet of Things applications, virtual reality and biometrics • Mayor of London’s office welcomes the investment in the London fintech community

• Visa Token Service, which enables secure and convenient mobile payments, is live in five European markets, with seven more in the pipeline • European consumers currently spending an average of €9 in face-to-face transactions when they use their mobile device to pay • More than 1.2 million European merchants offer contactless point-of-sale, driving uptake in mobile payments

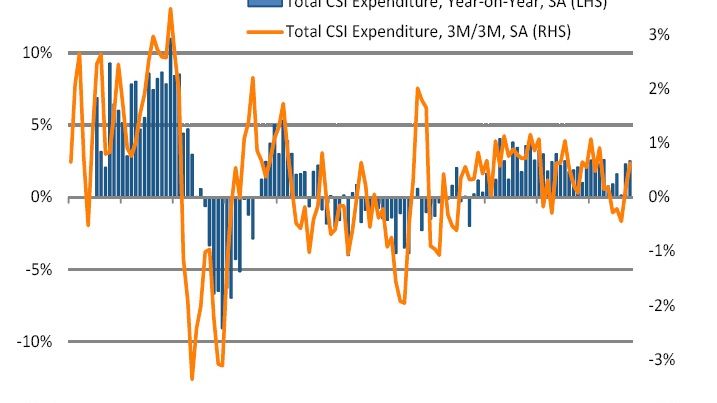

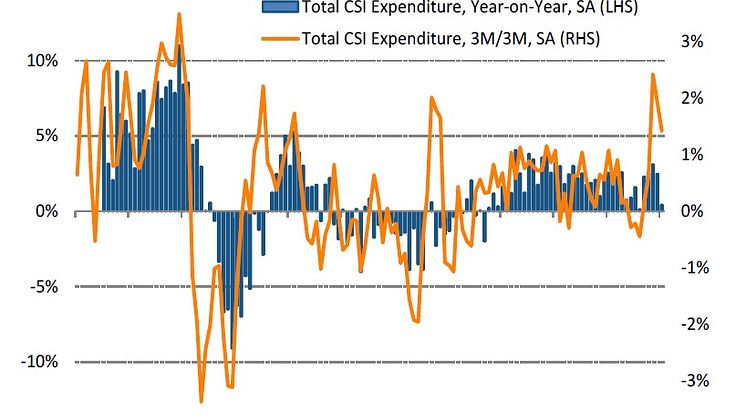

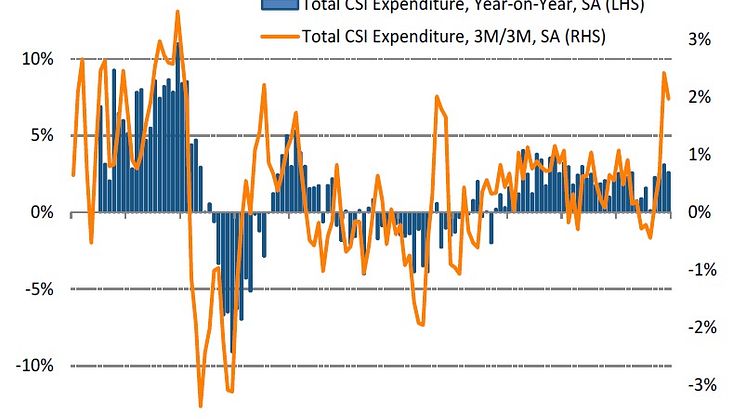

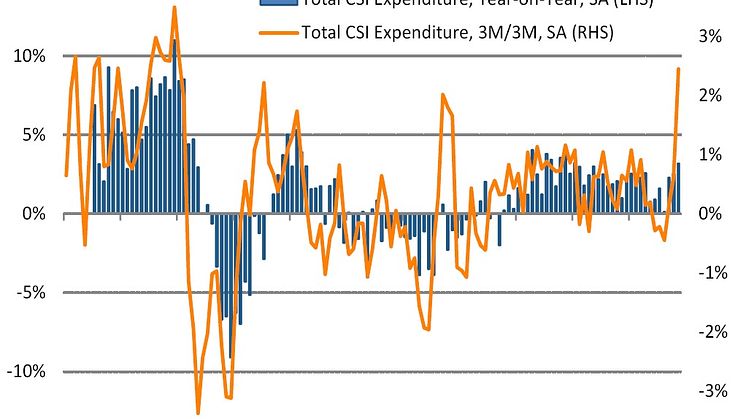

Consumer expenditure growth weakens to +0.4% year-on-year in January, from +2.5% in December Face-to-face spending declines at quickest rate in four years (-3.1%), while e-commerce continues to rise (+4.1%) Hotels, Restaurants & Bars (+5.7%) and Recreation & Culture (+3.1%) are top performing sectors Clothing & Footwear sees biggest drop in spend since April 2012 (-3.8%)

Headline findings · Consumer spending up +2.6% on the year in December · Spending growth remains solid in e-commerce categories (+5.5% year-on-year), but rises only slightly in face-to-face categories (+0.7%) · Hotels, Restaurants & Bars (+7.3%) and Recreation & Culture (+6.4%) see strongest increases in expenditure

• Visa join forces with European eSports giants, SK Gaming • Sponsorship will support the team as it expands • SK Gamers will be part of Visa’s content strategy

- Cryptocurrency regulator, 3D printing technician and gig economy manager are predictions for future jobs - 52% of millennials expect to switch careers multiple times during their lifetimes - 62% will prioritise a career that aligns with their passions and interests

Consumer spending increases +3.2% year-on-year, the highest rate since January 2015 Record increase in e-commerce expenditure (+12.5%), but face-to-face spending declines slightly (-1.4%) All broad spending categories see higher spending, led by Recreation & Culture (+9.3%)

• More than £2bn spent on Visa cards during Black Friday • Online Visa spend in week leading up to Black Friday up 13% year-on-year with almost £1bn spent on Black Friday, alone • Contactless and mobile technology are driving new shopping habits in the run-up to Christmas

Graham Carroll, 26, will join nine other eSports gamers to compete for $1m prize pool in Las Vegas Professional Formula E racers and their teams will be competing for the prize in January

• Plans requiring additional checkout steps means more declined transactions and longer and more complicated checkout experiences • 52% of UK shoppers say increased online checkout steps will cause them to abandon purchases • Changes mean no more express checkouts or quick in-app payments from mobiles, reduced access to non-European online shopping sites, and longer queues

• Consumer spending rises +2.5% on the year in October, up from +2.3% in September • E-commerce spending increases solidly (+4.3%), face-to-face expenditure expands for 1st time in 3 months (+1.8%) • Growth led by Hotels, Restaurants & Bars(+9.0%) and Recreation & Culture(+7.4%) • Spending on Clothing & Footwear rose at quickest rate since September 2015(+4.7%)