Press release -

Asset tokenization will have a significant impact on the financial ecosystem

- The technology could lead to a new financial trading system that is more efficient, transparent and accessible

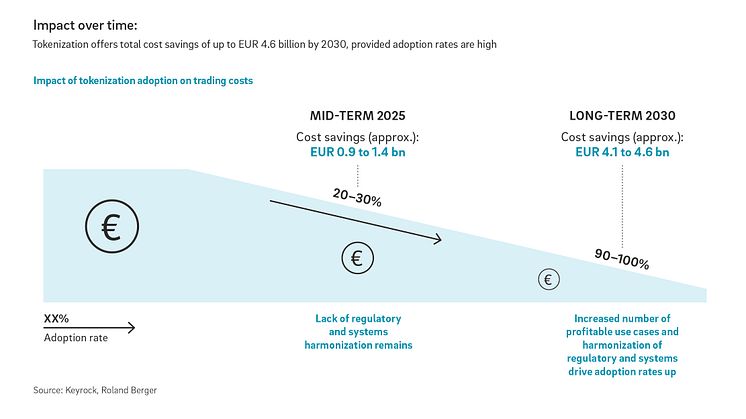

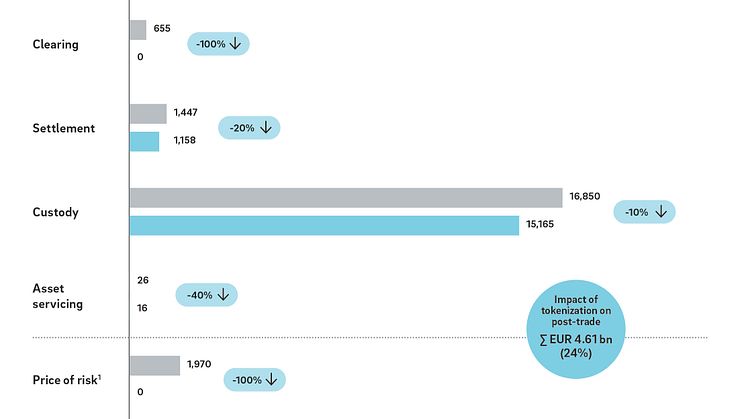

- From 2030 on a total cost reduction of up to EUR 4.6 bn or 24% of the actual cost of trading is expected in equity trading alone per year

- Growing number of use cases will force regulators to define necessary frameworks

Munich, December 2021: Blockchain technology is revolutionizing the financial services industry. One of the most recent – and potentially most disruptive – of blockchain-based innovations is asset tokenization. While large-scale applications of this new technology are not in place yet, promising use cases exist across the globe already. In the long run, tokenization could lead to annual cost savings up to EUR 4.6 bn, from 2030 onwards. These are main findings in Roland Berger's study “The Tokenization of the Economy and its Impact on Capital Markets and Banks”, co-authored with Keyrock (a crypto market-maker based in Belgium).

“Tokenization will have a major disruptive influence on the core activities of the whole financial services industry and will result in irreversible change. To avoid being left behind and potentially going out of business, players such as asset managers, banks, market infrastructure providers and supervisors must urgently address the challenges and opportunities offered,” says Frederick Van Gysegem, Partner at Roland Berger.

Demystifying Tokenization

Tokenization is the process of converting any tangible or intangible asset into a digital token that can subsequently be used, owned and transferred by the holder through the blockchain. This eliminates the need for a third-party intermediary as well as traditional analogue ownership documents.

The authors identified three main advantages of the technology across trading value chains: increased efficiency, relating to costs as well as processes; increased transparency, due to seamless data-sharing via a decentralized network, as well as increased accessibility, thanks to fractionalized assets allowing smaller players to enter the fray.

Equity trading promises to be first field to adopt large-scale tokenization

“We believe equity trading will be the first area where tokenization could have a significant impact, for four main reasons. First, given the progress of blockchain in financial markets and specifically the equity markets, most existing proof-of-concepts can be found there. Further, the high level of technology adoption in equity markets eases the transition into a technology-driven model. Finally, the significant market size indicates that equity trading is a promising candidate to scale up,” explains Van Gysegem.

Currently, the equity post-trade value chain is riddled with complexities and inefficiencies. According to the experts, tokenization could have the potential to alleviate this drastically: “Large parts of the current financial markets’ infrastructure have been developed to enable transfers of value that are as safe, as fast and as definitive as possible. Tokenization enables digital transfers of value that are as seamless and easy as the transfer of information over the internet while improving the current status quo in terms of speed, security and flexibility. This without the need for many of the current intermediaries. This is a shift as profound as the evolution from paper to electronic trading. The disruption is underway already and market participants can decide to adapt and thrive or lag behind and become irrelevant”, explains Kevin de Patoul, CEO and co-founder of Keyrock

Financial- and time-saving appeal to outweigh challenges

While real use cases of the technology in equity trading already exist, the adoption of tokenization across the financial spectrum is unlikely to occur overnight. The most severe challenges being the lack of regulatory frameworks and common industry standards. Scalability as well as setting up proper cyber security measures also represent significant hurdles.

"Some might think the demand for tokenization is still at a level at which it can be safely ignored, at least for a while. But we strongly believe now is the time to act – and avoid becoming a follower. As more and more profitable use cases appear, regulators will be pushed to define the boundaries of the technological and regulatory framework, and users will be drawn to tokenization's financial- and time-saving appeal," says Van Gysegem.

Topics

Categories

Roland Berger is the only management consultancy of European heritage with a strong international footprint. As an independent firm, solely owned by our partners, we operate 50 offices in all major markets. Our 2400 employees offer a unique combination of an analytical approach and an empathic attitude. Driven by our values of entrepreneurship, excellence and empathy, we at Roland Berger are convinced that the world needs a new sustainable paradigm that takes the entire value cycle into account. Working in cross-competence teams across all relevant industries and business functions, we provide the best expertise to meet the profound challenges of today and tomorrow.