Press release -

Change of course under Trump: Opportunities and risks for companies worldwide

- Trump's trade policies could trigger a vicious cycle of protectionism and thwart international division of labor

- Extending the Tax Cuts and Jobs Act (TCJA) would keep the tax burden low but increase US debt by USD 3.4 trillion by 2035

- Possible cutbacks to the Inflation Reduction Act (IRA) could affect incentives for electric vehicles and renewable energies

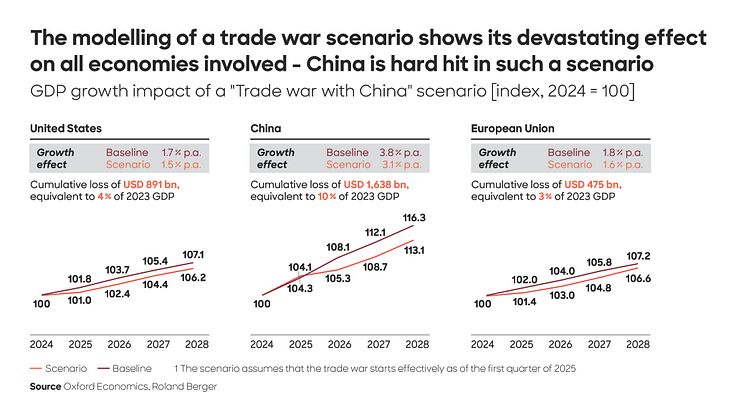

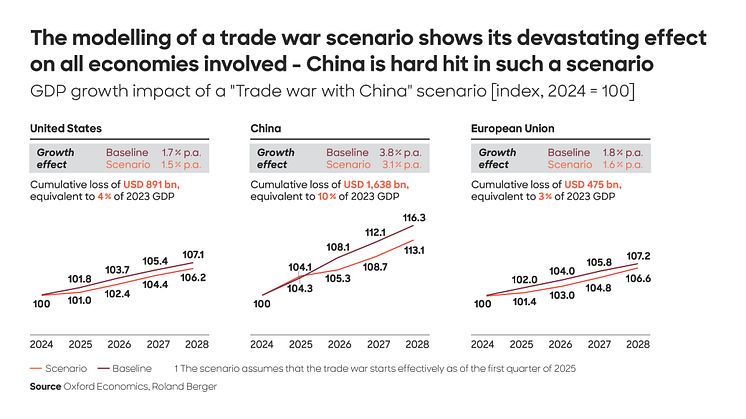

Munich, May 2024: The presidential election in the United States will also set the course for the global economy. What would be the impact on businesses if Donald Trump won a second term in office? If his administration were to pursue a confrontational trade policy again, particularly towards China, the consequences would hit more than just the two conflicting parties. Based on a model from Oxford Economics, the Roland Berger experts forecast that a trade war over the period 2025-2028 would inflict damage on the US economy equivalent to 4% of gross domestic product in 2023 figures (USD 891 billion), while the cumulative loss would amount to 10% of GDP in China (USD 1,638 billion) and 3% in Europe (USD 475 billion). These are among the findings of the study "Trump 2025: Economic policy impact of a potential 2nd Trump term" by Roland Berger. The publication's authors take a particularly close look at the consequences for international trade, the energy sector and mergers and acquisitions (M&A).

"The impact of a second Trump term for businesses worldwide would be enormous. Companies with business in the US should already be proactively engaging in risk analysis and scenario planning in preparation for the upcoming risks, particularly around trade barriers like tariffs," says Marcus Berret, Global Managing Director at Roland Berger.

Protectionism would exacerbate international trade conflicts

Trump's first term in office was characterized by an aggressive trade stance, particularly towards China in the form of higher tariffs and trade barriers. Even though Trump's successor Biden took this policy forward, the Roland Berger experts presume a second Trump tenure to see the policy tightened further. If Trump actually imposes a tariff on Chinese imports as proposed during his election campaign, the impact would be immense. Such a scenario would exacerbate tensions between the world's two largest economies and there could be a further decoupling of US and Chinese tech and manufacturing sectors.

The US M&A market would be reinvigorated

On tax policy, the Roland Berger experts anticipate all tax breaks introduced by Trump in his first term of office under the TCJA to be extended before they expire at the end of 2025 – at least if the Republicans secure a clean sweep. Choosing to continue these expiring measures from the TCJA would tear a USD 3.4 trillion sized hole in the budget by the year 2035. Even though further tax cuts are being debated publicly, they will likely be difficult to implement given the extent of the national debt.

The study authors also expect the prospect of a business-friendly regulatory environment to reinvigorate M&A activity in the US in a second Trump term, as was already happening during Trump's first tenure until the pandemic began. The volume of M&A activity in the US was only USD 13.4 billion in 2016, the year before Trump's presidency, but had grown to USD 21.6 billion by 2019.

Complete reversal of energy policy

In the first weeks of his first presidency, Trump rolled back more than 100 of his predecessors' environmental regulations. Roland Berger expect that Trump will again reverse numerous climate change initiatives if he returns to the White House and instead renew efforts to ramp up the production of fossil fuels. However, the study does not expect Biden's Inflation Reduction Act (IRA) to be completely repealed – after all, many states with Republican governors, such as Georgia (USD 18 billion) and South Carolina (USD 10 billion), also benefit from investments under the IRA. However, if a second Trump administration were to target the IRA – for instance, to fund tax cuts – then subsidies for electric vehicles (EVs), EV charging stations, energy efficiency and the solar industry would likely be most at risk. "The IRA has prompted a great many companies to invest in the US. These decisions have been made with long time horizons, especially in industry. Companies need to prepare for different energy price trends and get ready for individual IRA subsidies to be cut or eliminated completely," says Berret.

Topics

Categories

Roland Berger is one of the world's leading strategy consultancies with a wide-ranging service portfolio for all relevant industries and business functions. Founded in 1967, Roland Berger is headquartered in Munich. Renowned for its expertise in transformation, innovation across all industries and performance improvement, the consultancy has set itself the goal of embedding sustainability in all its projects. Roland Berger revenues stood at more than 1 billion euros in 2023.