Press release -

Stirlingshire couple lose home after being sold £21k Seasons timeshare they only owned for one year

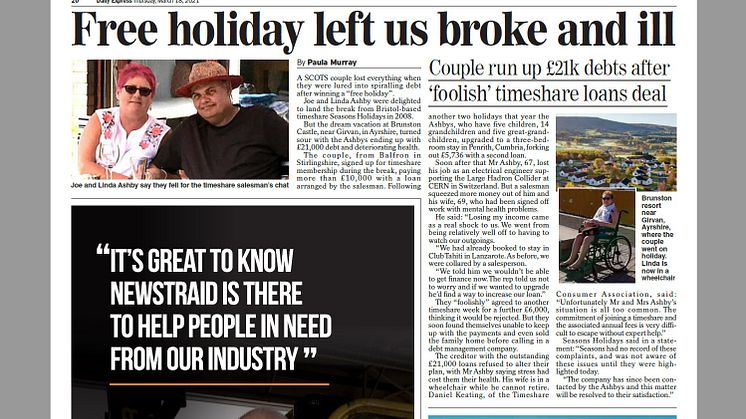

In 2008 Joe and Linda Ashby won a free holiday from Bristol based timeshare company Seasons Holidays. Little did they know that within two years they would lose not only the timeshare they bought but even their family home, whilst being left with a debt of £21,000.

Free Holiday

Joe, 67 and Linda, 69 from Balfron in Stirlingshire, won a 'free holiday' from Seasons Holidays in 2008.

During the week at luxury West Scotland resort Brunston Castle, Joe and Linda signed up, paying £10,675 for a 51 year membership. The loan was arranged by the timeshare salesman via GE Money.

"It was real high pressure sales," says Joe. "It was very slick. Linda and I were both working then and it seemed like we could afford it.

Upgrade

The Ashbys, who have 5 children, 14 grand children and 5 great grandchildren, had two more holidays that year. They upgraded their membership from a 2 bedroom to to a 3 bedroom during their next stay at Whitbarrow Village in Penrith for a further £5736. Also with a GE Money loan. "We thought that would be it" says Joe. "I got made redundant shortly after, so money was a lot tighter."

Joe was an electrical engineer working as support for the Large Hadron Collider at CERN before getting the bombshell news that he was getting laid off. "Losing my income came as a real shock to us. We went from being relatively well off to having to watch our outgoings, at least until I got another job." However Linda and Joe had another encounter with a Seasons Holiday salesman a couple of months later.

Second upgrade

"We had already booked to stay in Club Tahiti in Lanzarote," says Joe. "As before, we were collared by a salesperson. We told him we wouldn't be able to get finance now as I was not working. The rep told us not to worry and if we wanted to upgrade he'd find a way to increase our loan.

"After the presentation we allowed ourselves to be talked into buying an extra one bedroom week for a further £6000 if the rep could arrange finance.

"The rep applied in Linda's name because he said I wouldn't be able to get more credit myself. Although Linda was working officially she was signed off with mental health problems, which we told the sales rep.

The salesman applied anyway and somehow got us the loan with Barclays Partner Finance. BPF consolidated all our outstanding debt. We now owed £21,000

"We felt like we were talked into a corner. We had said we loved it and would buy if we could get finance (thinking we never could because of my redundancy and Linda's mental health problems). Then suddenly we were in the position of having to go ahead. Foolishly we did. The rep convinced us that I would soon be back at work and able to easily afford the payments. Linda and I allowed ourselves to believe that if Barclays were agreeing to the loan, they must believe we were in a good position to pay it. I know its abdicating responsibility, but with the pressure sales, Linda's mental health issues, and the approval of Barclays, we made the regrettable choice to go ahead."

Membership revoked

The couple tried to cancel shortly afterwards, but Barclays Partner Finance told them they were past the 14 day cooling off period. "I couldn't get another job at the time, and the payments were suffocating," says Joe. "Things got really bad. We felt like we were drowning."

Joe and Linda became so strapped for cash that they couldn't afford to pay the annual £390 annual maintenance, and Seasons revoked their membership in 2009.

"So now we were left with a huge debt, and didn't even own the timeshare any more," continues Joe. "Our lives were turned upside down."

Lost their home

After a couple of years valiantly trying to meet debt payments, the Ashbys were forced to sell their home. "We went to a debt management company and they restructured our loans." Joe continues. "We're not the kind of people to shirk our responsibilities, we just needed some help and flexibility. Selling our family home was painful, but there was no way around it."

Surprisingly, Barclays Partner Finance were the only creditor who refused point blank to restructure their loan. "They were our major creditor," says Joe. "They were also the ones who we feel were least responsible in the way they issued us the loan. They allowed the timeshare salesperson who made the sale to be in charge of the loan application process. We feel like the guy was incentivised to cut corners to get his commission. He certainly allowed a woman with mental health issues to sign for a life changing loan.

"The stress was horrendous. Both of our health deteriorated dramatically."

Health problems

Linda, a retired childminder, refugee charity worker and foster mum was already suffering with depression and anxiety. After losing their savings and family home she was further diagnosed with COPD, Fibromyalgia and type 2 diabetes. "Linda has always been a woman who loves life," says Joe. "Since signing up with Seasons and Barclays Partner Finance the stress has devastated her. She is in a wheelchair most of the time."

Joe himself has had 2 hip replacement operations and finds it difficult to get around. He has managed to find a job as a research technician at Glasgow University. "I'm 67, but there is no prospect of retiring. We couldn't afford rent if I did. Linda can't work obviously. I'm going to have to work as long as I can," says the great grandfather.

Linda Ashby. Wheelchair bound

Despite the hardship, Joe and Linda have worked hard at bringing down the debt. As of March 2021 they have £9000 left to pay.

Buyer beware

"Unfortunately Mr and Mrs Ashby's situation is all too common," explains Daniel Keating from the Timeshare Consumer Association. "The commitment of joining a timeshare and the associated annual fees is very difficult to escape without expert help, and for those clients who accepted a bank loan arranged by the resort there is often no way out.

"There is arguably no longer any benefit to paying for membership of a timeshare scheme, because in most cases it is easy to stay in those same resorts through booking.com without paying any joining fee at all.

"For those people that are looking at buying a timeshare, we urge you to take full advantage of the 14 day cooling off period to weigh up the financial commitment, and never sign anything on the day of the presentation.

"Our staff at the TCA are always available to give free, independent advice on this or any other timeshare related issue. Please contact us before handing over any money."

*Media interested in this story please contact Daniel Keating on the contact details below

Related links

- Seasons Holidays accused of pushing out members

- Timeshare sales tactics revealed

- Barclays Partner Finance under fire

- Timeshare Consumer Association

- Cost analysis: Timeshare vs regular booking

- £80k to join "exclusive" timeshare, now available through booking.com

- TCA Linkedin

- TCA Twitter

- TCA Facebook

- TCA on Medium

- TCA on YouTube

Topics

Categories

- mental health

- scotland

- Timeshare

- TCA

- Glasgow university

- Timeshare Consumer Association

- Timeshare reclaims

- Timeshare compensation claims

- Timeshare refund

- Timeshare refund claims

- Seasons Holidays

- Who are the TCA

- Who are TCA

- Who are Timeshare Consumer Association

- Timeshare consumer association reviews

- Stirlingshire

Regions

Timeshare Consumer Association. Contact us on: T: +44 2036704588 or +44 2035193808 (ask for Daniel), E: enquiries@timeshareadvice.org (Address to Daniel).

WhatsApp (message only) +447586871055

TCA provides a central resource of consumer information on timeshare matters for the media and other organisations – We work towards encouraging responsible, honest, timeshare operators. We also publicly expose negative consumer practices and organisations which operate in a manner detrimental to timeshare buyers and owners.

An important part of our mission is to lobby UK and European Governments and regulatory bodies for improved consumer protection in the timeshare environment and collect information on frauds and mis-selling, for action by enforcement authorities.

We are staffed by former and current timeshare owners, as well as former timeshare industry staff. We know our way around the timeshare business

We are a proud member of the UK Small Charities Coalition