News -

£120,000 timeshare victims. Brit couple facing retirement with crippling debts.

Have you ever attended a timeshare sales presentation but didn´t sign up? Perhaps you look back with relief that you didn´t part with, £10,000? £20,000? More?

By resisting the urge to sign up, you probably escaped a far bigger outlay than that...

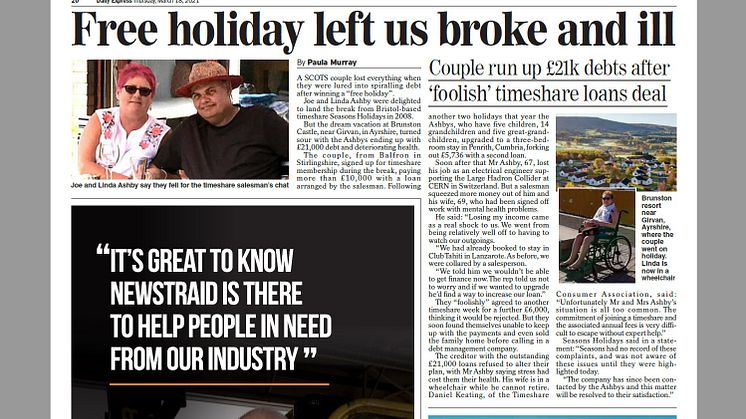

Daniel Keating of the Timeshare Consumer Association explains; "Successful timeshare companies don´t see their victims as a one-off sale. When members join it is only the start of an expensive journey. Owners are targeted systematically every year, on every holiday to upgrade and upsell. The pressure never stops until the day they die, or until the client runs out of money. Sometimes even after the client runs out of money."

Sounds like an exaggeration? The following is a typical timeshare history. From signing up, to exiting in 12 years, and a loss of over £120,000 along the way.

The easy assumption is that the victims are responsible. They should have said "no." Right? At some point they must have realised that they were being duped. The truth is that timeshare companies are continuously evolving more sophisticated and plausible schemes to separate members from their cash. Guests are targeted long before they arrive for their luxury holiday by what is called the ´Inhouse Department.´

"Inhouse sales to existing members make up, on average, 80% of a timeshare company´s revenue," reveals Greg Wilson of ECC, a respected timeshare expert specialising in industry malpractice. "From that statistic you can extrapolate that an average owner will end up spending 5 times more than they initially pay when they first sign on the dotted line."

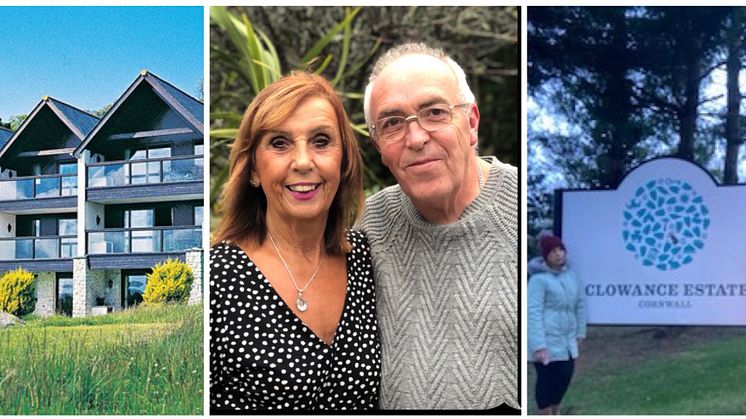

Bristol couple Neil and Kim Bacon are far from unintelligent. They have run their own successful packaging company for the last 20 years, which puts them firmly in the category of "savvy business people."

So how did the Bacons end up in their early 60s with a crushing second mortgage and debts of over £120,000? Neil (62) and Kim (63) have agreed to share their story, in the hope of warning others against the lure of glamorous timeshare holidays. If this can happen to the Bacons, it can happen to anyone.

"It was around 1998 in Tenerife," says Neil. "A young woman knocked on our apartment door and invited us down for breakfast to show us a Sunterra holiday scheme they were selling. Kim and I knew it was probably timeshare, but we´d never done a presentation so we thought we´d see what the fuss was about.

"£2,500 seemed like great value. A holiday every year for life, a wide choice of destinations and guaranteed top quality everywhere we went. We didn´t have to think hard. We signed up, like many others that day.

"The first couple of years were fine. We paid our annual fees (around £300) and took the holidays. We were approached to upgrade but we declined. Then we received an offer for an extra holiday free from a company called Island Residence Club (IRC - Azure) in Malta."

If the Bacons had known what the ´free holiday´ would lead to, they would have ripped up the certificate on the spot. As it was, they saw a chance for a top quality break and jumped on a plane to Malta

The key condition for the holiday promotion was that Neil and Kim attend a mandatory sales presentation, during which they were shown plans for a spectacular development called Golden Sands. Neil and Kim loved what they saw and traded in their existing membership plus a further £19,500 for two weeks in the new resort.

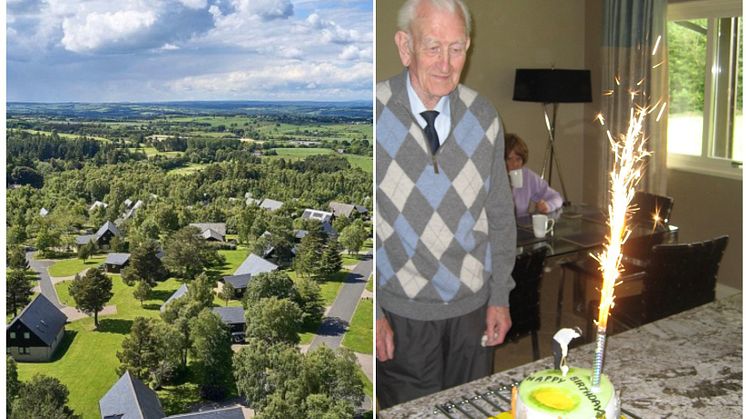

Expensive view. Golden Sands in Malta seen from Kim and Neil´s penthouse balcony

"We were sold on stunning development plans with a championship golf course, and that our investment would rise in value once the resort was finished," continues Neil, ´all of which eventually turned out to be complete fabrication."

What induces canny business people to spend almost £20,000 with strangers in a foreign country? Greg Wilson sheds some light. "Timeshare companies are selling to you during your holiday when you feel happy and content. It is well established psychology that happy people make ´yes´ choices more easily. It´s the same reason why you ask your boss for a raise when he is in a good mood. And the timeshare salesperson has an expertly crafted presentation to demonstrate the value and credibility of the resort."

The Bacons upgraded again a couple of years later to a nicer apartment, at a cost of £18,300, and once more in 2010 for another £22,000. In 2012 they upgraded to the penthouse for a further £14,191.

"This was to be it," says Neil. "We had the best apartment and didn´t need to spend any more. We had laid out nearly £80,000 through all the upgrades to own one week a year in the penthouse. We understand that many people will see our choices as foolish, but the timeshare guys are very shrewd. They get you feeling good, they tell you you deserve it, they arrange easy loans. They are very charming and it feels like the most natural thing in the world. At that stage we still believed that it was an investment in property, and that our money could be recouped."

Even though the Bacons were resolute about not needing any further upgrades, an Azure sales rep called Iggy was to dupe them for an eye watering additional £37,500.

"This was the real criminal activity as far as we are concerned," says Neil. "The rest of it was duplicitous, morally questionable and possibly illegal. This last sale was stealing, pure and simple.

"Iggy had conducted some of our sales before. He was a real charmer, always pleased to see us. We bumped into him on the Golden Sands resort in 2013 and after making clear we would not be upgrading, we had a coffee with him in the pool bar. Iggy told us about a couple of available weeks that were well below market value (due to a family bereavement, or some such story) and that if we bought them we could resell them at a decent profit through the Azure/IRC resale program in 2015. Iggy told us that there were amazing developments planned, like a shopping mall and designer villas, partly funded by stars like Ryan Giggs and Gary Neville.

"Kim and I saw this as Iggy understanding we had overspent on our investments with IRC and him offering us a way to make some of the money back. IRC arranged another loan for us (don´t get me started on the loan procedure, suffice to say they cheated the application process to get us loans we were not qualified for through Barclays) and we bought the two weeks."

The Bacons were soundly rebuffed when they contacted IRC in 2015 to sell their weeks. "There was no resale program," says Neil. "Iggy had flat out lied to us. IRC told us that the weeks were not investments but ´lifestyle products.´ Giggs and Neville were nothing to do with Azure. This was another lie, as were the plans for the impressive development. Maltese friends have since told us that the land in question is sacred and will never get any building permission. We never saw Iggy again.

"We were stuck with huge debts, weeks we couldn´t use, didn´t want and were paying maintenance for. We were drowning and needed help."

Devastatingly, there was still one more trap waiting for Kim and Neil.

"We found what seemed to be a UK solicitor firm who could help us claim our money back," continues Neil. "An advert led us to Sarah Waddington Solicitors, based in Ware. After discussing with them we believed we had found our saviours, and that we had a good chance of getting at least some of our money back. "

After paying several thousand pounds to Sarah Waddington Solicitors, Neil and Kim ended up in an even worse position.

"Sarah Waddington told us to withhold our maintenance payments while they ´sorted things out´ with Azure," says Neil. "This awful advice resulted in us having all of our weeks confiscated for zero compensation. Golden Sands took the weeks back off us, just like that.

"We still owe all the money and have no chance of being compensated for our losses.

"Our debts are nearly £120,000. We have a second mortgage on our house and we are in our 60s. At the time we should be looking forward to retirement, we are saddled with a suffocating second mortgage and no way out."

Greg Wilson comments: "The Bacon´s experiences are more common than people realise. Nowadays, even the more reputable timeshare companies are struggling to stay relevant and people are waking up to the fact that they can stay in the same resorts through booking.com without the need for to pay huge joining fees. This means that timeshare resorts are fighting for survival and concocting ever more inventive ways to harvest revenue from their member base.

"Add to that the fact that it will always be risky spending large amounts of money in a foreign country, without UK consumer protection, and suddenly you have a lot of good reasons not to sign up for a timeshare membership. They just don´t represent good value anymore now that the traditional travel industry has got their act together.

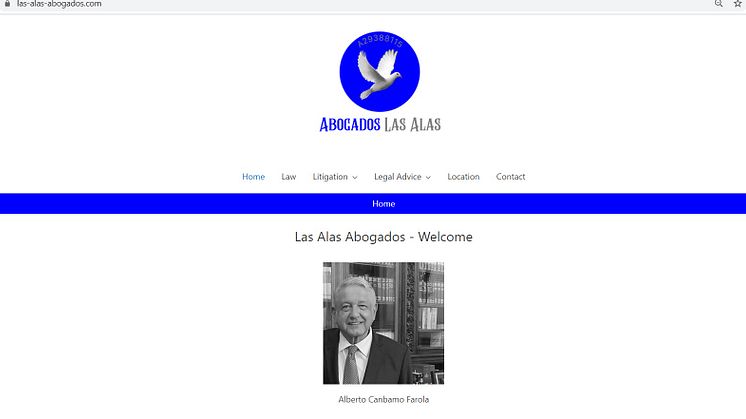

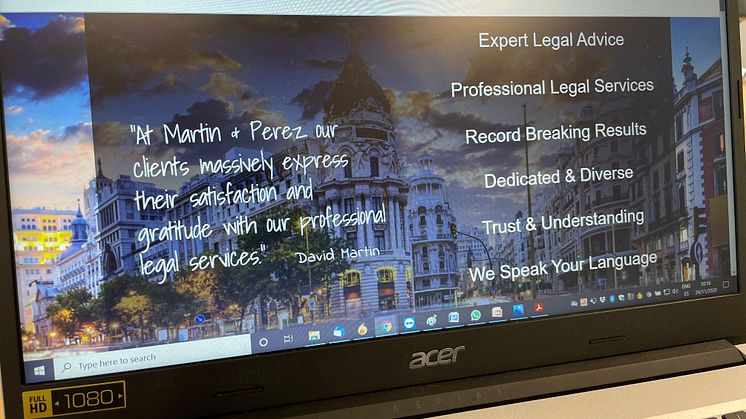

"As for the solicitor, I don´t like to comment on individual firms, but suffice to say a lot of timeshare owners are looking to exit their memberships and seek compensation for being mis-sold. This has given rise to a new industry of law organisations offering to help in this area.

"Unfortunately, while there are competent and successful firms out there, there are also many rogue operators, aiming to cash in on people´s misfortunes. It is a good idea to seek the advice of an independent body like the Timeshare Consumer Association before engaging the services of a law firm to help you with timeshare claims."

________________________

Timeshare Consumer Association. Contact us on: T: +44 2036704588 or +44 2035193808 (ask for Daniel), E: enquiries@timeshareadvice.org (Address to Daniel).

WhatsApp (message only) +447586871055

TCA provides a central resource of consumer information on timeshare matters for the media and other organisations – We work towards encouraging responsible, honest, timeshare operators. We also publicly expose negative consumer practices and organisations which operate in a manner detrimental to timeshare buyers and owners.

An important part of our mission is to lobby UK and European Governments and regulatory bodies for improved consumer protection in the timeshare environment and collect information on frauds and mis-selling, for action by enforcement authorities.

We are staffed by former and current timeshare owners, as well as former timeshare industry staff. We know our way around the timeshare business

We are a proud member of the UK Small Charities Coalition

Related links

- Timeshare sales tactics revealed

- ECC

- Timeshare Consumer Association

- Barclays Partner Finance sues over mis-sold timeshares

- Sarah Waddington Solicitors review

- Value analysis timeshare vs hotel stays

- Is there a future for the timeshare industry?

- Can you safely exit an unwanted timeshare?

- Man duped by 24 fake timeshare law firms in a row

- TCA newsdesk

Topics

Categories

- Azure

- Barclays

- Malta

- Timeshare owners

- Golden Sands

- Tenerife

- Timeshare

- Gary Neville

- ECC

- TCA

- Ryan Giggs

- European Consumer Claims

- ECC Timeshare

- ECC European Consumer Claims

- European Consumer Claims Limited

- European Consumer Claims Reviews

- ECC reviews

- ECC Limited

- Timeshare Consumer Association

- Timeshare reclaims

- Timeshare compensation claims

- Timeshare refund

- Timeshare refund claims

- Greg Wilson

- Sarah Waddington

- Island Resort Club

- Neil Bacon

- Kim Bacon

- Sunterra

- Daniel Keating

- Sarah Waddington Solicitors