Press release -

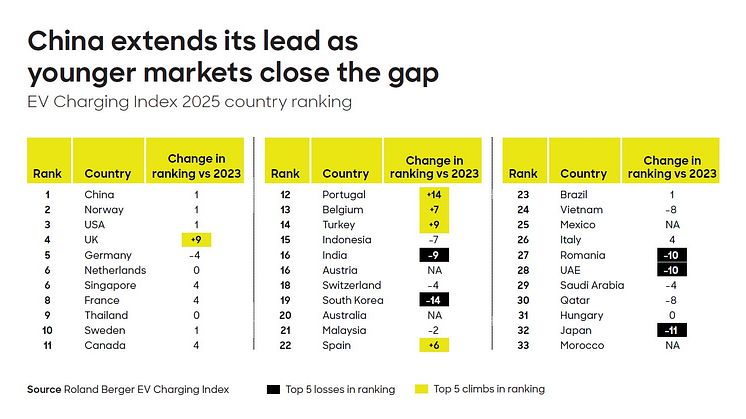

EV Charging Index 2025: China dominates with impressive e-mobility progress; Norway rises to second, with the USA third, while younger markets close the gap.

- The share of electric cars in new vehicle sales rose from 20% to 25%, though some major markets saw little if any growth in this metric

- Public charging sufficiency stays consistent, but the ratio of (faster) DC charge points increased, supporting higher user satisfaction with the overall charging experience

Munich, July 2025: Amid a backdrop of political and macroeconomic uncertainty, global electric vehicle use has shown steady growth over the last two years, although this varies strongly across regions. Roland Berger’s EV Charging Index 2025, which comprises primary research and a survey of 12,000 respondents in 33 markets, ranks China, Norway, and the United States as the top three market leaders. The Index is based on metrics including EV sales, charging infrastructure, industry innovation, and customer satisfaction. While Germany’s fall in EV sales has seen it slip down the rankings over the last two years, other nations have risen swiftly. The UK is now fourth, thanks to strong growth in EV sales and charging infrastructure, while Portugal and Turkey have each jumped into the top half of the Index. South Korea remains a strong player in the EV market, but its overall ranking is declining, largely due to low customer satisfaction with the country’s charging network. Romania’s ranking has also fallen as EV sales growth has stalled.

“Global e-mobility growth progressed steadily, albeit with considerable regional variation. Cost headwinds, battery supply chain issues, and public policy changes led to modest EV sales growth in much of Europe, while political uncertainty is slowing progress in the United States,” says Adam Healy, Principal at Roland Berger. “By contrast, China continues to prioritize electrification and younger markets in both the Middle East and Southeast Asia saw substantial growth in EV adoption rates.”

China again leads the way in e-mobility

China tops our EV Charging Index as it continues to expand its sizeable EV parc while excelling in charging provision. Meanwhile, first mover countries such as Norway and the Netherlands retain their places high up in our index, and other early follower markets such as France and the UK have gained ground, while younger markets in Southeast Asia (including Thailand and Indonesia) have taken great strides over the last two years.. It’s a similar story in the Middle East and emerging markets like Brazil and India, suggesting that what these nations may lack in EV sales penetration, they make up for in improvements in charging provision, technology, and user satisfaction.

EVs increasingly used as everyday vehicles

Environmental protection remains the leading driver of EV adoption, but it now sits alongside the perception that EVs offer lower operating costs than ICE vehicles. In Asia-Pacific and North America, operating costs have overtaken the green case for using an EV.

In support of this, more than three quarters of EV users (80%) report driving 10,000 kilometers or more each year, while 73% use their EVs at least four days a week. This paints a clear picture: Electric cars are increasingly becoming everyday vehicles.

As EVs become more widespread, user profiles continue to diversify. Use of home charging shows a minor decrease, falling from 87% in our 2024 Index to 85% of respondents this time. This is consistent with the gradual shift away from the archetypal early EV adopters with a private charging on their own property. On a global level, EV drivers conduct around half their charging away from home.

“All charging types and use cases remain important parts of the charging mix and fundamental components of user-friendly charging provision across the globe,” says Martin Weissbart, Partner at Roland Berger. “Charge point operators need to keep this in mind while addressing users’ wishes for more, higher-power infrastructure.”

Topics

Categories

Roland Berger is one of the world's leading strategy consultancies with a wide-ranging service portfolio for all relevant industries and business functions. Founded in 1967, Roland Berger is headquartered in Munich. Renowned for its expertise in transformation, innovation across all industries and performance improvement, the consultancy has set itself the goal of embedding sustainability in all its projects. Roland Berger generated revenues of around 1 billion euros in 2024.