Press release -

Global Automotive Supplier Study: Average industry profit margin drops to just 4.7%

- Chinese suppliers lead with 5.7%, while Europe (3.6%) and South Korea (3.4%) lag behind

- Stagnant volumes, the delayed transition to electric vehicles, and geopolitical uncertainties identified as key challenges

- Margins expected to remain lower; strategic business model adjustments necessary for continued success

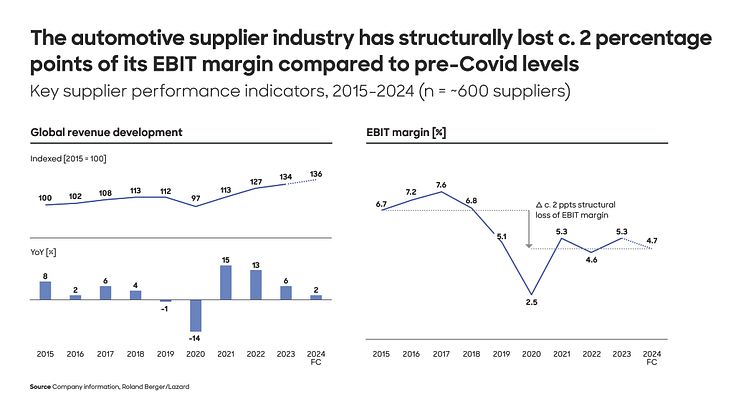

Munich, May 2025: The global automotive supplier industry continues to face challenging market conditions: stagnant production volumes, geopolitical uncertainty, increasing competition, and rising cost pressures are expected to drive average profitability down to just 4.7% EBIT margin in 2024. This marks a further decline from 2023, when profitability temporarily stabilized at 5.3%, which was still one-quarter down, being two percentage points lower than pre-COVID levels. Against this backdrop, Chinese suppliers are still performing relatively well with an EBIT margin of 5.7%, while European (3.6%) and South Korean (3.4%) suppliers remain below the industry average. Weak demand in the second half of 2024 and challenging price negotiations with OEMs are placing additional strain on suppliers. While OEM profitability is still higher, it has also declined, putting sustained pressure on supplier margins in the coming years. These findings come from the latest edition of the Global Automotive Supplier Study, conducted by Roland Berger and Lazard, which analyzed 600 automotive suppliers worldwide.

“What we are currently observing in the European and North American automotive supplier industry can best be described as a phase of ‘stagformation’,” says Felix Mogge, Partner at Roland Berger. “On the one hand, suppliers are facing stagnant volume growth, while on the other, they are undergoing a fundamental transformation that requires them to urgently reshape their business models.” As a result, the industry has underperformed compared to other sectors in recent years. “While suppliers have slowly regained revenue growth since the COVID-19 pandemic, their profitability has structurally declined. A significant portion of revenue growth has been driven by inflation, which has also increased costs.”

Five key trends driving market challenges

The study identifies five major trends that are currently shaping the automotive supplier industry:

- Stagnant global production volumes: Overcapacity is putting pressure on the market, especially in Europe. In contrast, China and South Asia are the primary drivers of modest global automotive growth.

- Slower-than-expected transition to electric vehicles (EVs): EV adoption in Europe and North America is lagging behind expectations, preventing the realization of anticipated economies of scale.

- The rise of software-defined vehicles: Increasing demand for advanced assistance and connectivity features presents opportunities, but not for all suppliers equally, and leads to growing software costs.

- Intensifying global competition among OEMs: The EV market is attracting new players, increasing competitive pressure and cost challenges for suppliers.

- Geopolitical uncertainty and changing trade dynamics: Tariffs and subsidies are altering global trade flows and supply chains.

The challenging profitability outlook has implications beyond just earnings. “More than 40% of the 25 largest automotive suppliers are now rated non-investment grade – a significantly higher proportion than in other industries. Less than 5% of companies in the medical technology or industrial sectors hold such a low rating,” says Dr. Christian Kames, Co-Head of Investment Banking for the DACH region at Lazard. “This rating downgrade leads to higher financing costs at a time when the industry requires substantial capital to drive innovation and manage the transformation towards electromobility, software-defined vehicles, and, in the longer term, autonomous driving.”

The era of continuous market growth is over – complete refocus required

Looking ahead, market conditions are not expected to improve significantly. “We believe that the era of steady market growth is over and that a more volatile environment will continue to put pressure on earnings and profits,” says Florian Daniel, Partner at Roland Berger and one of the study’s authors. However, suppliers can still succeed by implementing consistent efficiency improvement programs, forming partnerships to optimize and scale their portfolios, streamlining their product offering, and focusing on strategic technologies.

“In stagnating markets, achieving economies of scale often requires consolidation through M&A activities or partnerships, demanding more active portfolio management than in the past,” says Christof Söndermann, Managing Director at Lazard and co-author of the study. Suppliers must refocus on product segments and technologies where they can maintain sustainable competitiveness, while exiting areas where they lack a clear right to win. “Some market players may need to completely reposition themselves to survive.”

Topics

Categories

About Roland Berger

Roland Berger is one of the world's leading strategy consultancies with a wide-ranging service portfolio for all relevant industries and business functions. Founded in 1967, Roland Berger is headquartered in Munich. Renowned for its expertise in transformation, innovation across all industries and performance improvement, the consultancy has set itself the goal of embedding sustainability in all its projects. Roland Berger revenues stood at more than 1 billion euros in 2023.

About Lazard

Founded in 1848, Lazard is the preeminent financial advisory and asset management firm, with operations in North and South America, Europe, the Middle East, Asia, and Australia. Lazard provides advice on mergers and acquisitions, capital markets and capital solutions, restructuring and liability management, geopolitics, and other strategic matters, as well as asset management and investment solutions to institutions, corporations, governments, partnerships, family offices, and high net worth individuals. For more information, please visit Lazard.com and follow Lazard on LinkedIn.