Press release -

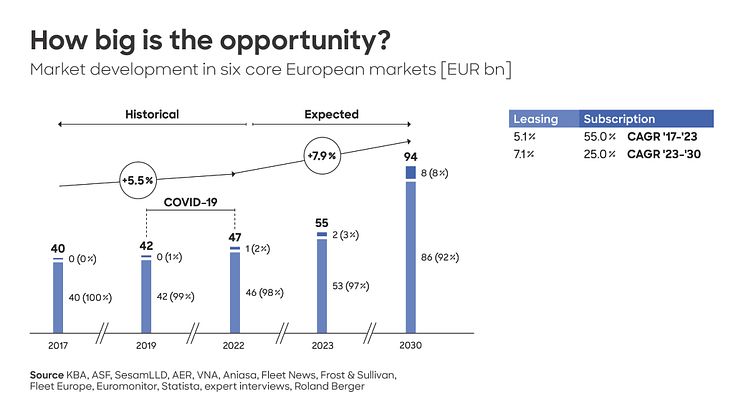

Roland Berger study: European market for vehicle leasing and subscription schemes set to grow to 94 billion euros by 2030

- More than half of consumers are considering flexible vehicle ownership instead of outright vehicle purchase

- The total market is growing by eight percent per year (2023-2030), subscriptions by 25 percent, leasing by seven percent

- The market offers substantial opportunities but also brings challenges, especially around electric vehicle residual values

Munich, July 2025: The market for vehicle leasing and subscription schemes is set to grow by about eight percent per year (2023-2030) in the six core European markets of France, Germany, Italy, Spain, the Netherlands and the United Kingdom, to reach a volume of around 94 billion euros by 2030. Players in the automotive industry, as well as banks and leasing companies, should take advantage of the new opportunities arising out of this trend. But the Car-as-a-Service (CaaS) market also presents challenges: Falling residual values on returned lease or subscription vehicles, especially battery electric vehicles (BEV), are putting providers under financial pressure and creating uncertainty. The market also features a wide variety of different players and no universally successful business model exists as yet. These are the findings of the study Car-as-a-Service – The rise of flexible vehicle ownership, for which the Roland Berger experts analyzed the CaaS market.

"Given current inflation rates and economic uncertainty, growing numbers of Europeans are keen to avoid the high one-off costs of buying a car and the associated risks, notably around resale value – especially in the case of electric vehicles," says Jan-Philipp Hasenberg, Partner at Roland Berger. "Flexible models like the vehicle leasing and subscription schemes that have long been established in the B2B market are therefore becoming increasingly attractive to consumers, too. The idea is familiar from many other areas: Why buy a car when, for a reasonable monthly price, you can lease one or subscribe to a service that gives you access to one whenever you need it? And you don't even need to worry about the residual value."

The flexible ownership market is characterized by a diversity of players. These fall into four major groups, each with their own strengths and areas of expertise: OEM captives, for example, benefit from the brand reputation and distribution network of their OEM. Bank-affiliated leasing companies have access to the financing solutions, capital, broad customer base and distribution network of their parent bank, making them well positioned with regard to business customers. The same applies to independent leasing companies, who also provide a good multi-brand offering, specialized services and excellent know-how in the area of fleet and asset management.

The fourth group consists of pure subscription players. This sector is relatively small, and most players are not yet operating profitably, but it is growing at a much faster rate – 25 percent per year – than the leasing sector (7% p.a.). By 2030, subscriptions are set to account for some eight percent of Europe's CaaS market. Players offer innovative digital solutions, flexible contract lengths and all-inclusive packages. They are brand-agnostic and often have a business-to-consumer (B2C) focus. Besides pure subscription players, others are also increasingly breaking into the subscription services market, including car dealers. Car rental companies, too, already manage large fleets and have a broad network of service stations and partners as well as established sourcing agreements with OEMs. For these players, offering subscription services is a logical expansion of their business.

"Companies need a broad array of carefully coordinated capabilities, particularly to operate in the vehicle subscription market," says Dominik Loeber, Partner at Roland Berger. "These range from sourcing the vehicles to offering insurance, maintenance, damage and claims management and remarketing to providing residual value management and refinancing. Each market player must also identify their unique strengths and leverage them to establish a robust competitive position."

Topics

Categories

Roland Berger is one of the world's leading strategy consultancies with a wide-ranging service portfolio for all relevant industries and business functions. Founded in 1967, Roland Berger is headquartered in Munich. Renowned for its expertise in transformation, innovation across all industries and performance improvement, the consultancy has set itself the goal of embedding sustainability in all its projects. Roland Berger generated revenues of around 1 billion euros in 2024.