Press release -

Are big timeshare companies shielding 'irresponsible' credit providers from damage claims?

Following a £48 million defeat for Barclays Partner Finance (BPF), Diamond Resorts (Europe) Ltd attach clauses in relinquishment contracts forbidding its clients from suing credit providers.

Oh and Diamond also don't want you seeking help or advice from expert claims companies either...

"Irresponsible" credit providers challenged

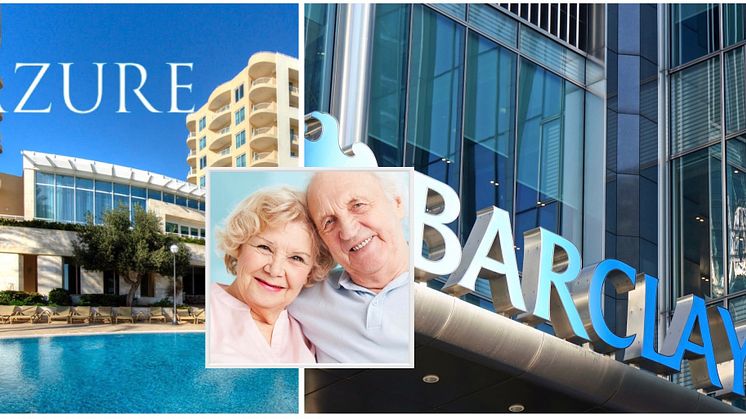

In June 2021, following a 4 year legal campaign by the 'Erin Brockovich of timeshare', Adriana Stoyanova, Barclays Partner Finance agreed to repay £48 million in loans issued via disgraced Maltese, timeshare company Azure.

Azure was accused of allowing unlicensed, commission only sales people to process the loans, and that the salespeople involved 'shoehorned' the loans through by coaching prospects on how to fill in the paperwork to maximise chances of the loan being accepted, for instance by splitting the loan between two different applicants. Barclays Partner Finance was seen by its challengers as having a duty of care to the consumers involved, and sued over their part in the timeshare loans.

In what was seen as a huge climbdown from the financial giant, the thousands of affected customers were told their loans would be cancelled. Payments made so far were to be refunded, with 8% interest. Any notes on the customer's credit file relating to the loan were to be removed.

The remediation programme will start on 15 September and all clients are due to be refunded by April 2022.

Shockwaves throughout the industry

"Criticism has been levied at the major finance houses over their involvement with high pressure timeshare companies for years now," says Jack Dawson, Head of Client Support at European Consumer Claims (ECC). "The relationships often seemed questionable, in terms of the fact that people were being signed up for life changing loans by timeshare sales people. Clients who come to ECC for help tell us openly that they would never have agreed to these loans without the credibility of the finance house's involvement."

"After BFP's surrender, every other credit provider who has worked with unsavoury timeshare companies is keen to protect themselves from legal and financial repercussions."

It appears as though some finance providers may already be leaning on their timeshare co-conspirators for help

Damage claims verboten!

Diamond, who closed down most of their European sales operations at the end of 2017, have added the following clause to a relinquishment contract that ECC has seen recently:

- 'It is a condition of this settlement... that: you have not (and will not at any stage in the future) make a complaint or seek payment of damages against a credit provider where such complaint relates to these DRECL Points purchase(s)

The agreement was merely for a Diamond member who had negotiated a way for himself to escape the burden of his membership and associated annual fees. Diamond were charging a premium to release the member from their points system, and the contract was governing that agreement. It had nothing to do with the loan or the finance company that provided it.

Andrew Cooper, CEO of ECC believes this to be a result of pressure from the finance company on Diamond Resorts. "There is no other reason for this stipulation to be added to a contract about relinquishing a membership. It smacks of the credit providing company demanding help from Diamond to help minimise their exposure to future legal actions.

"This could be interpreted as fear on the part of the credit providers. If they felt that they had acted appropriately, would their timeshare 'partners' be slipping clauses into unrelated contracts forbidding the client from seeking recourse?"

On your own

Another disconcerting clause Diamond slipped into the same relinquishment contract tells the client they must confirm that:

- 'no third party (such as a claims company) is instructed to act on your behalf in this matter'

This condition, if adhered to, would preclude the client from getting expert advice from the people best qualified to give it.

"Imagine you were getting divorced from a very wealthy partner," anologises Cooper, "Now imagine the partner tells you that you can have the divorce, under the exact conditions set by them, but if you must agree not to consult or instruct an expert 3rd party such as a divorce attorney.

"You would rightly conclude it to be an unreasonable demand. You would be putting your faith in the opponent to prioritise your interests, and denying yourself the best available support.

"In this case Diamond, with their expensive, high powered legal team want the client to to agree to forego the expertise and advice of claims firms, and to rely on their own probably more limited understanding of the industry.

"That imbalance of knowledge and experience would leave the client at a clear disadvantage."

Don't take the knee

"All calls to our team are in the strictest confidence and all information treated as privileged," confirms Andrew Cooper. "Just because a big, wealthy corporation doesn't want you seeking help or support, doesn't mean you can't still get yourself in the best possible position.

"Before communicating with your resort, get in touch with one our team for a free, confidential chat.

"Arming yourself with information could save you a lot of money."

Related links

- Tenacious timeshare lawyer Adriana Stoyanova compared to "Erin Brockovich" following Barclays win

- Huge win for consumers 'mis-sold' Barclays Partner Finance loans by disgraced timeshare company

- Anatomy of a timeshare compensation claim

- Barclays/Azure loan cancellations open floodgates for other timeshare loan claims

- Diamond Resorts' U turn on cancer victim's plea to escape suffocating timeshare membership

- Message from Andrew Cooper, CEO of European Consumer Claims (ECC)

- Escaping unwanted timeshare memberships

- ECC timeshare reviews

- Your moral obligation to claim timeshare compensation

- Is ECC legit?

- Time to make your mind up on that timeshare compensation claim

- Can timeshare owners in Spain really claim compensation?

Topics

Categories

- Legal

- Barclays

- Timeshare

- Diamond resorts

- Andrew Cooper

- ECC

- Barclays Partner Finance

- European Consumer Claims

- ECC timeshare

- European Consumer Claims reviews

- ECC reviews

- Timeshare refund

- Maintenance fees

- adriana stoyanova

- Timeshare refunds

- Maintenance fee refund

- Timeshare law firm

- Are ECC legit

- ECC timeshare reviews

- Is ECC legit

- Who are ECC

- Who are ECC timeshare

- ecc uk

- Who are European Consumer Claims

- Diamond resorts europe

- Andrew Cooper ECC

- Andrew Cooper European Consumer Claims

- Adriana stoyanova m1 legal

Regions

ECC provides timeshare claims services, expert advice and help

E: (for media enquiries): mark.jobling@ecc-eu.com

E: (for client enquiries) EUROPE: info@ecc-eu.com USA: info@europeanconsumerclaims.com

T: EUROPE: +44800 6101 512 / +44 203 6704 616. USA: 1-8777 962 010

Monday to Friday: UK timings: 9am-8pm. Saturday/Sunday closed. USA 9am -8pm EST. Sunday closed

Follow European Consumer Claims on Facebook here

Follow European Consumer Claims on Twitter here

Follow European Consumer Claims on LinkedIn here

Follow European Consumer Claims on Medium here

Follow European Consumer Claims on YouTube here

Follow European Consumer Claims on Newsdesk here

Follow Andrew Cooper (CEO of European Consumer Claims) on Twitter here

Andrew Cooper background article can be read here