Press release -

Simple interest awarded on a timeshare claim? Congratulations, it can be a lot of money

People sold illegal timeshare contracts are being awarded compensation in record numbers as legal obstacles are being systematically removed. Often, as well as the award itself, simple interest is also granted. But what does that mean?

Compensation claims

Timeshare companies in Spain (and sometimes elsewhere) are being comprehensively punished by the courts for over a decade of issuing illegal contracts.

It's common knowledge that timeshare owners from all over the UK are receiving compensation awards individually worth tens of thousands of pounds, provided they fit the qualifications that enable them to claim (whether in Spain, or victims of the Azure company in Malta who were sold Barclays loans)

Extra awards

On top of the claims however the judge often awards costs and/or "simple interest" to the client.

"Costs" is easy to understand. You are awarded an amount of money to mitigate the legal fees you spent to bring the case to conclusion.

Simple interest is an innocuous sounding phrase that many people pay scant attention to. But in reality it can be a very welcome surprise

What is simple interest?

Unlike compound interest, simple interest always applies to the principal amount, and therefore does not increase at the same rate as compound interest (which applies to the latest total of principal plus all added interest).

However, simple interest still can make a lot of difference especially if you have been paying your loan for several years.

Recent example

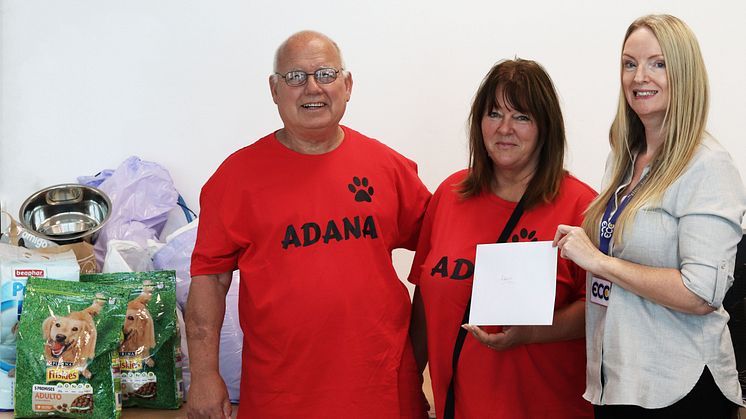

Sounds complicated? Ok here is a true life example: Mr/Mrs X were recently had their Barclays loan cancelled, thanks to legal hotshot Adriana Stoyanova. The "Erin Brockovich of timeshare" achieved a watershed victory for 1400 consumers, against all the odds, due to the banking giant's involvement with disgraced Maltese timeshare company Azure.

Mr Mrs X were awarded the £35,000 they had already paid. They were also awarded simple interest at 8%.

The simple interest was another £14,250.

"I nearly fell off my chair," says Mr X. "We knew we were getting simple interest, and we thought a few hundred pounds, maybe a thousand. But this changed £35,000 into nearly £50,000.

"What a fantastic surprise."

Claims and advice

Unhappy timeshare owners can often escape their contracts with expert help, provided they fit certain conditions.

The success of Adriana Stoyanova (who collaborates with M1 Legal) against banking giant Barclays has sent shockwaves around the world of timeshare, potentially opening the door for claimants who were sold loans with other credit providers who collaborated with high pressure timeshare resorts.

"Watch this space," says Andrew Cooper, CEO of European Consumer Claims. "A lot of claims industry professionals are working very hard behind the scenes to bring more credit providers to justice for supporting rogue timeshare sales operations.

"For updates on whether you may be able to claim, or for a free, confidential chat about your options, get in touch with our team at ECC. Business hours, Monday to Friday."

Related links

- Tenacious timeshare lawyer Adriana Stoyanova compared to "Erin Brockovich" following Barclays win

- Azure owners' joy as Barclays begin timeshare loan repayments

- Can timeshare owners in Spain really claim compensation?

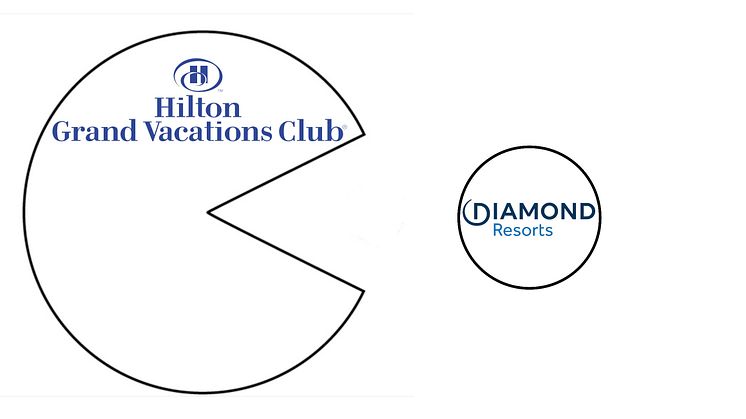

- Barclays/Azure loan cancellations open floodgates for other timeshare loan claims

- Huge win for consumers 'mis-sold' Barclays Partner Finance loans by disgraced timeshare company

- Do you qualify for timeshare compensation? A quick guide:

- M1 Legal offers help to distressed former Club La Costa employees after confrontation at padel game

- £120k timeshare nightmare leaves Bristol couple facing debt ridden retirement

- Leading timeshare claims firm targets £billions in refunds over "unfair" 2020s maintenance fees

- Is timeshare good value?

- Why are genuine timeshare claims firms so rare?

- European Consumer Claims (ECC). Heroes or villains?

Topics

Categories

- Legal

- Timeshare

- Andrew Cooper

- ECC

- European Consumer Claims

- ECC timeshare

- European Consumer Claims reviews

- ECC reviews

- M1 Legal

- Timeshare refund

- Maintenance fees

- Timeshare refunds

- Maintenance fee refund

- Timeshare law firm

- Are ECC legit

- ECC timeshare reviews

- Is ECC legit

- Who are ECC

- Who are ECC timeshare

- ecc uk

- is m1 legal a legitimate company

- ecc europe

- m1 legal ecc

- Who are European Consumer Claims

- ecc review

- Andrew Cooper ECC

- Adriana stoyanova m1 legal

Regions

ECC provides timeshare claims services, expert advice and help

E: (for media enquiries): mark.jobling@ecc-eu.com

E: (for client enquiries) EUROPE: info@ecc-eu.com USA: info@europeanconsumerclaims.com

T: EUROPE: +44800 6101 512 / +44 203 6704 616. USA: 1-8777 962 010

Monday to Friday: UK timings: 9am-8pm. Saturday/Sunday closed. USA 9am -8pm EST. Sunday closed

Follow European Consumer Claims on Facebook here

Follow European Consumer Claims on Twitter here

Follow European Consumer Claims on LinkedIn here

Follow European Consumer Claims on Medium here

Follow European Consumer Claims on YouTube here

Follow European Consumer Claims on Newsdesk here

Follow Andrew Cooper (CEO of European Consumer Claims) on Twitter here

Andrew Cooper background article can be read here