Press release -

Visa Upgrades Verified by Visa Technology to Enhance Security and Simplify Online Payments

London, UK – 30 May 2017 – Visa (NYSE:V) today announced upcoming enhancements to its Verified by Visa service, a global solution designed to make online purchases more secure by helping ensure payments are made by the rightful owner of the Visa account. The upgrade will deliver rich data to financial institutions and merchants to better authenticate consumers and reduce fraud on transactions made via a mobile or desktop browser, app, or connected device. As part of the upgrade, Visa is enhancing its systems to support 3-D Secure 2.0, the next generation of a security platform that was pioneered by Visa and is underpinning the Verified bv Visa Service.

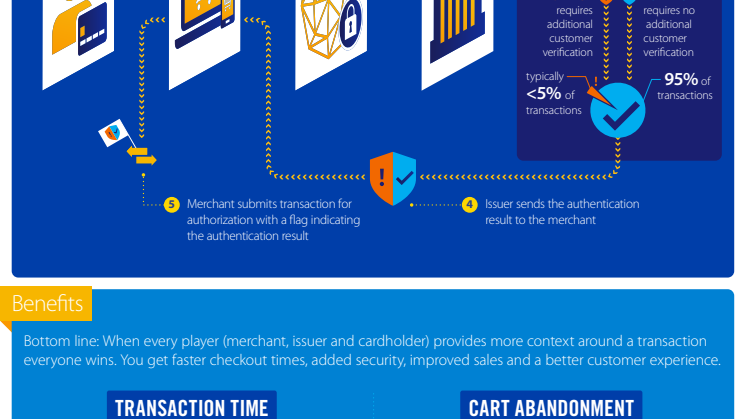

The updated technology behind 3-D Secure 2.0 provides more tools for issuers and merchants to customize the authentication process and ensure the consumer experience is easy and fast. By building a real-time, collaborative, information-sharing pipeline, Visa has enhanced the data transfer between merchants and issuers to use an unprecedented number of transaction attributes (e.g. device type, shipping address). This allows merchants and financial institutions to authenticate customers more accurately in real-time. Studies show checkout time can be reduced by 85 percent and, in turn, cart abandonment is anticipated to decline by as much as 70 percent. Click here for more information.

“Authentication technology has come a long way since the days of magnetic stripes and signatures. As the way we make payments has changed, so, too, has the need for innovation to keep transactions secure. The vast majority of Europeans have used a mobile device to make payments, but fraud and security concerns remain the number one deterrent,” said Mike Lemberger, Senior Vice President , Product Solutions Europe, Visa.

“By helping to lead the development of 3DS 2.0, we are able to offer an enhanced authentication service that makes these payments both faster and more secure. For European retailers, this helps address the ongoing challenge of reducing cart abandonment in an e-commerce market. This update also provides all the necessary tools to ensure PSD2 compliance for card payments – a major benefit which should not be underestimated.”

To ensure issuers and merchants have time to test, pilot, refine and fully roll out solutions, current Visa rules for merchant-attempted transactions using 3-D Secure will extend to the updated version beginning April 2019. Merchants and issuers are already working on their implementations and Visa expects early adoption to begin in the latter half of 2017. Visa will continue to work with clients and partners globally to support the new 3-D Secure 2.0 solutions, with a focus on continuing to improve payments security and increasing authorizations, to ensure seamless digital payment experiences.

Enhanced multi-device capability will help to protect consumers wherever and however they choose to pay. Visa’s 2016 Digital Payments Study of over 36,000 European consumers revealed three times as many pay regularly using a mobile device compared to 2015 (54 percent vs 18 percent). The improvements will also help enable the future integration of payments technologies into the Internet of Things, as over 20.8 billion connected devices are forecast by Gartner to be in use by 2020. Enhanced risk-based authentication will cut down points of friction by reducing instances requiring step-up verification, such as a static password or PIN, when making a purchase across any device.

* The April 2019 date applies to all global regions. The existing protection for fraud solutions based on 3-D Secure 1.0 will remain in place.

About the Visa Digital Payments Study 2016:

Visa commissioned the Digital Payments research with Populus. The research was conducted between August and September 2016 in 19 European countries: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Israel, Italy, Netherlands, Norway, Poland, Romania, Slovenia, Spain, Sweden, Switzerland, Turkey and the UK. The total sample size was 36,843 consumers, with approximately 2,000 respondents per country.

Additional sources of data:

Gartner, February 2017 - http://www.gartner.com/newsroom/id/3598917

European B2C e-commerce report 2016 – European B2C e-commerce was worth an estimated €509.9bn, with rate of growth slowing from 18.4% in 2011 to 13.3% in 2015, down to an estimated 12% in 2016

Topics

Categories

About Visa Inc. Visa Inc. (NYSE: V) is a global payments technology company that connects consumers, businesses, financial institutions and governments in more than 200 countries and territories to fast, secure and reliable electronic payments. We operate one of the world's most advanced processing networks — VisaNet — that is capable of handling more than 65,000 transaction messages a second, with fraud protection for consumers and assured payment for merchants. Visa is not a bank and does not issue cards, extend credit or set rates and fees for consumers. Visa's innovations, however, enable its financial institution customers to offer consumers more choices: pay now with debit, pay ahead of time with prepaid or pay later with credit products. For more information, visit usa.visa.com/about-visa.html, visacorporate.tumblr.com and @VisaNews.

Visa UK