Press release -

£27k nightmare of Croydon grandmother "mis-sold timeshare" by Hilton rep who "played on faith in Barclays"

Relationships between timeshare sales operations and credit providers under scrutiny again, following the Barclays Partner Finance/Azure scandal. Veronica Johnson's finances devastated by high pressure sales tactics in Portugal

Enticing holiday

65 year old executive assistant Veronica was offered a £99 holiday by timeshare giant Hilton back in 2011. The Brit knew she would have to do a timeshare presentation as part of the deal but felt safe from any kind of high pressure or trickery, as the offer came from international hotel giant Hilton.

"I wasn't closed minded, but I knew I probably couldn't afford to join any holiday club," says Veronica. "I was divorced by then and bringing up 4 children. Luxuries were few and far between because I put my children first. That's why this cheap holiday seemed like such a godsend. I took a girlfriend with me and she accompanied me on the presentation.

Hours of high pressure

"The woman who showed us around kept us for hours. She really wore us down," recalls Veronica. "We kept telling her we couldn't afford to join the timeshare, but she wouldn't take no for an answer. I have never felt under such pressure.

"We were both determined not to spend money we couldn't afford, especially in a foreign country. But for the whole morning this woman was surrounding us with luxury and telling us we deserved it. She put a lot of energy into convincing us both we could afford it.

"The fact that Barclays was attaching its name to the project as credit providers was really hammered home. The sales woman kept saying: 'If Barclays are involved, you know you can trust the project.' Eventually we agreed we wanted to join but knew we couldn't afford it. Again Barclays was invoked.

"In the end she convinced me I could manage the payments by saying 'if the loan is approved, that means Barclays believe you can afford it.' I allowed myself to be convinced and filled in the application paperwork.

Veronica says the sales rep coached her on how to fill in the paperwork which was approved in minutes. "I never got any loan approved so quickly in my life," recalls Veronica. "My friend applied too, and was turned down for finance. The sales woman was relentless, pushing me to act as guarantor for the second loan. I declined, thank goodness."

Quick decision, a decade of financial misery

Veronica took a loan for around £17,000 over ten years. "It worked out that I paid over £27,000 by the time I finished," she admits. "Paying the payments meant I couldn't afford to use the actual timeshare. I gave one holiday to one daughter, and a holiday to another daughter, but that was it. I've never used it myself. In the end I had to just give it back. I couldn't afford to pay the maintenance fees or flights as well as keeping up the payments."

Veronica paid £27,000 for a timeshare she never even got to use herself. "I had always planned to pay off my mortgage before retirement," the conscientious Surrey homeowner says. "But now I'm 65 and having to work past retirement age, because I still have 7 years mortgage payments left."

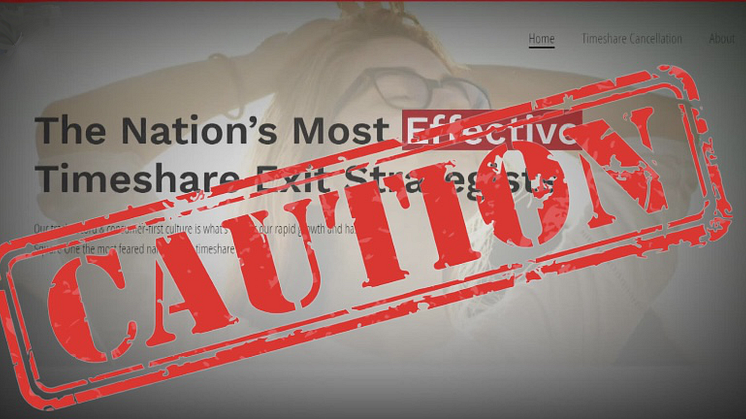

Unholy alliances

"Links between reputable credit providers and high pressure sales operations are coming under more and more scrutiny," says Daniel Keating, Information Officer for the Timeshare Consumer Association (TCA). "The fact is that timeshare has generally had a less than savoury reputation, and people have made life ruining decisions based on presentations made by high pressure, commission only sales people.

"We know that people abroad, and in a 'holiday' frame of mind are more likely to agree to expensive purchases that they would normally be more careful about. Big, well known credit providers helping them to finance these decisions adds credibility to the situation and we are hearing stories like Veronica's all the time.

"Credit providers are rightfully being held responsible for their part in the damage that has been done to people's lives. Already there has been a huge win with Barclays Partner Finance and their involvement with disgraced Maltese timeshare company Azure."

"In the meantime we urge holidaymakers to never sign anything on the day, and to carefully consider your finances before committing to what can be a life altering decision."

"For advice on this, or any other timeshare related issue, please get in touch with our team, for free, confidential, expert advice."

Related links

- Timeshare manipulation tactics. How people are influenced to buy on the day

- Brit couple´s £58k loan nightmare. Barclays under fire over relationship with disgraced Maltese timeshare company

- How to survive a timeshare presentation

- Barclays facing potential loss of £billions over fresh timeshare mis-selling claims

- Why timeshare doesn't work

- What is timeshare?

- Who are the Timeshare Consumer Association

- Stirlingshire couple lose home after being sold £21k Seasons timeshare they only owned for one year

- £120,000 timeshare victims. Brit couple facing retirement with crippling debts

- Why claiming timeshare compensation is the right thing to do

- Timeshare compensation claims. Fact vs fiction

- Tenacious timeshare lawyer Adriana Stoyanova compared to "Erin Brockovich" following Barclays win

Topics

Categories

- Surrey

- Barclays

- croydon

- Timeshare

- hilton

- TCA

- Barclays Partner Finance

- Timeshare Consumer Association

- Timeshare reclaims

- Timeshare compensation claims

- Timeshare refund

- Timeshare refund claims

- Timeshare advice

- Daniel Keating

- Timeshare Advice Centre

- timeshare compensation

- Who are the TCA

- Can tca be trusted?

- can tca be trusted

- timeshare consumer association review

- help with timeshare problems

- Who are TCA

- Who are Timeshare Consumer Association

- Timeshare consumer association reviews

- TCA reviews

- Hilton vacation club

- Hilton grand vacation club

Regions

Timeshare Consumer Association. Contact us on: T: +44 2036704588 or +44 2035193808 (ask for Daniel), E: enquiries@timeshareadvice.org (Address to Daniel).

WhatsApp (message only) +447586871055

TCA provides a central resource of consumer information on timeshare matters for the media and other organisations – We work towards encouraging responsible, honest, timeshare operators. We also publicly expose negative consumer practices and organisations which operate in a manner detrimental to timeshare buyers and owners.

An important part of our mission is to lobby UK and European Governments and regulatory bodies for improved consumer protection in the timeshare environment and collect information on frauds and mis-selling, for action by enforcement authorities.

We are staffed by former and current timeshare owners, as well as former timeshare industry staff. We know our way around the timeshare business

Timeshare Consumer Association Newsdesk here

Timeshare Consumer Association on YouTube here

Timeshare Consumer Association on Facebook here

Timeshare Consumer Association on Medium here

Timeshare Consumer Association on LinkedIn here

Timeshare Consumer Association on Quora here

Timeshare Consumer Association website here

We are a proud member of the UK Small Charities Coalition